A group of major technology companies, including Snowflake (SNOW), Salesforce (CRM), and dbt Labs, have launched the Open Semantic Interchange (OSI), an open-source initiative to create a common language for data. This would make it easier for firms to share information across different platforms and enhance the capabilities of AI systems.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Other key partners include BlackRock (BLK), Mistral AI, RelationalAI, and Tableau. The group plans to create a shared data framework, likely using YAML, that will be managed by an independent organization.

Here’s Why Standardization Matters

Basically, different tools and platforms often interpret the same business metrics and metadata in their own ways. This inconsistency can cause confusion, slow down the adoption of new technologies, and impact trust in AI-driven insights.

The OSI will solve this by creating a single standard for business and industry terms, making data easier to share and reliable across AI and business intelligence (BI) tools.

According to Christian Kleinerman, EVP of Product at Snowflake, this isn’t about competition but about building essential, industry-wide infrastructure. He stated, “We are proud to be leading the charge alongside our partners to solve a foundational challenge for AI—the lack of a common semantic standard.”

BlackRock has already stated that the OSI framework will be integrated with its Aladdin platform to unify the investment management process with a common data language.

It must be noted that the success of the OSI depends heavily on the adoption of the standard by major cloud and analytics providers beyond the initial founding group.

Which Is the Best AI Stock to Buy?

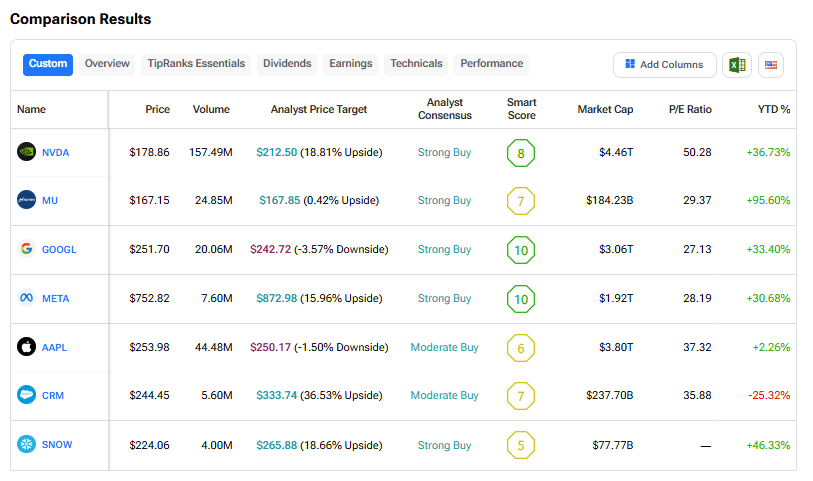

We used the TipRanks Stock Comparison Tool to determine which AI stock is most favored by analysts. Investors should conduct thorough research before choosing to invest in any of these stocks.

Currently, Meta (META), Alphabet (GOOGL), Micron (MU), Nvidia (NVDA), and Snowflake have earned Wall Street’s Strong Buy consensus rating, with NVDA offering the highest upside potential among them.