Snap stock (SNAP) sank 14% to $7.83 in premarket trading on Wednesday. This was after the company pulled its second-quarter forecast, despite beating earnings estimates in Q1. The move shocked investors already worried about macroeconomic pressures and trade policy whiplash.

SNAP’s Q1 EPS Beats but Forecast Vanishes

Snap managed to beat expectations on paper. The company posted a loss of 8 cents per share on revenue of $1.36 billion. That’s narrower than the 13-cent loss Wall Street expected. Daily active users hit 460 million, slightly above consensus. But the real headline? No forecast.

In its letter to shareholders, Snap said it would not issue second-quarter guidance “given the uncertainty with respect to how macroeconomic conditions may evolve in the months ahead.” That was enough to send shares spiraling in premarket.

Snap’s Tariff Troubles and Ad Spending Fears Weigh Heavy

A big chunk of Snap’s revenue comes from advertising, and that’s exactly where the storm clouds are gathering. With Trump’s tariffs sending ripples through the economy, advertisers are treading carefully.

Cantor analyst Deepak Mathivanan cut his price target on Snap to $7, warning in a note that “Snap’s advertising business is highly sensitive to macro themes, and small changes in economic conditions could bring meaningful volatility to revenue growth.” That volatility has investors nervous about what the second half of 2025 might look like.

Competition From Meta Turns Up the Heat

Snap isn’t just dealing with macroeconomic fog. It’s also fighting for air in a room that Meta dominates. When budgets shrink, advertisers often consolidate spend with the biggest players. That puts pressure on smaller platforms like Snap.

Still, the company is trying to sound confident. In its letter, Snap said, “We remain optimistic because of the progress we have made with our ad platform to improve performance for our advertising partners.” But optimism alone won’t win the budget wars.

Snap Stock Faces Downward Pressure

After the huge drop over the last few months, Snap shares are hovering around $9.00. That’s a far cry from their highs and shows just how spooked Wall Street is. With no guidance and a shaky economic backdrop, it’s hard to make a bullish case here—at least for now.

Snap might’ve cleared the Q1 bar, but without a map for Q2, it’s flying blind. And in this kind of weather, that rarely ends well.

Is Snap Stock a Good Buy?

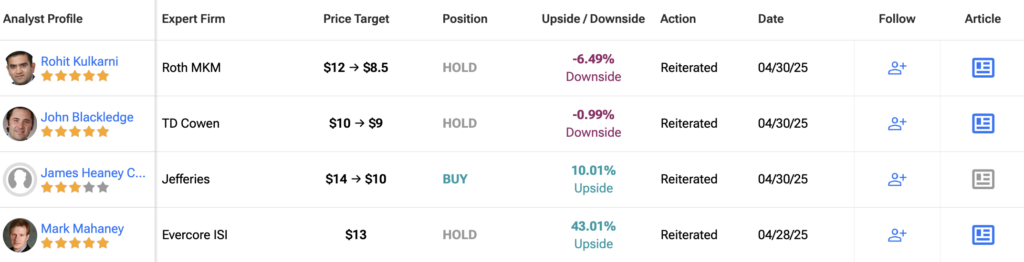

Amid the ongoing pressures and intense competition, Wall Street is largely staying sidelined. Snap stock holds a consensus rating of Hold, based on six Buys, 25 Holds, and one Sell recommendation, according to TipRanks. The average Snap price target stands at $11.22, implying a potential 23.4% upside from current levels. But with macro worries clouding visibility, analysts seem reluctant to jump in just yet.