Shares of Snap (SNAP) jumped in after-hours trading after the social media giant reported a fourth-quarter adjusted profit of $0.16 per share on revenue of $1.56 billion. This beat analysts’ EPS and revenue estimates. These results are an improvement from the same quarter of last year, which can be attributed to growing advertising sales and an expanding user base on its Snapchat platform.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Furthermore, Snap’s advertising platform saw the number of active advertisers more than double year-over-year, while daily active users (DAUs) reached 453 million, up 9% from last year. The company has also been successful in diversifying its income streams, as its other revenue segment, which is mostly made up of Snapchat+ subscription revenue, increased by 131% year-over-year with an annualized revenue run-rate of more than $500 million.

Although Snap did not provide guidance in its press release, management will discuss its Q1 2025 and FY 2025 outlook during its Q4 2024 Earnings Call at 5:00 p.m. Eastern today.

Is SNAP a Buy or Hold?

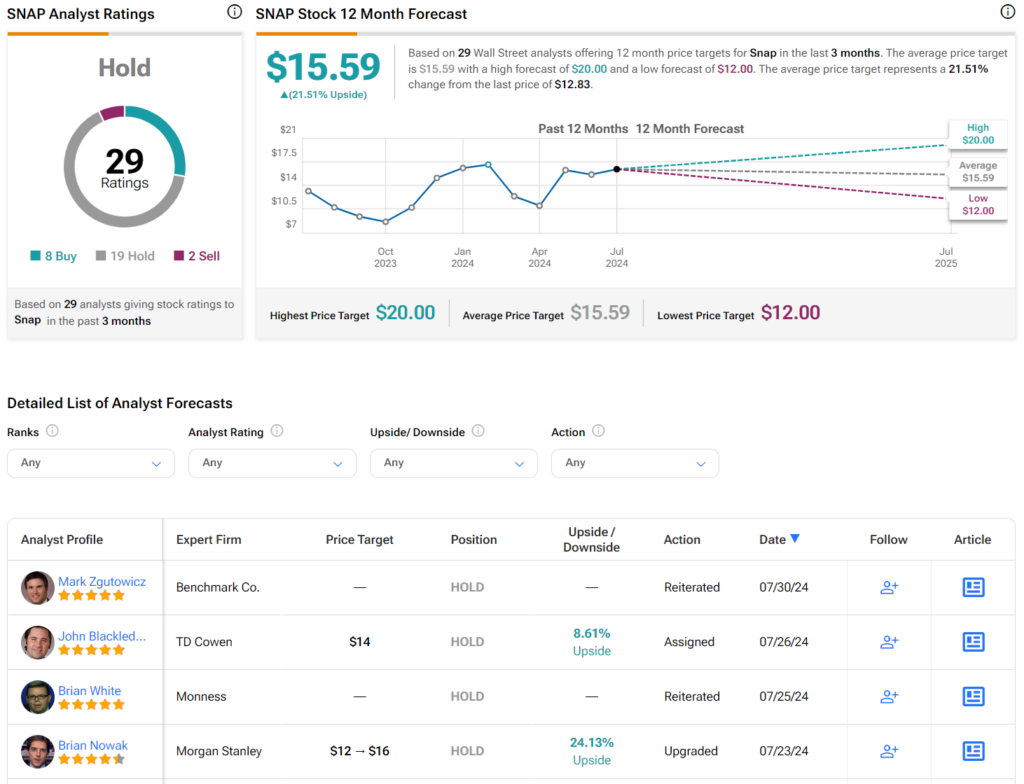

Turning to Wall Street, analysts have a Hold consensus rating on SNAP stock based on eight Buys, 19 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 17% rally in its share price over the past year, the average SNAP price target of $15.59 per share implies 21.51% upside potential. However, it’s worth noting that estimates will change following today’s earnings report.