How is SMH stock faring? The VanEck Semiconductor ETF has lost 3% over the past five trading sessions but has earned about 35% year-to-date.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Fund Flows and Sentiment

The SMH ETF tracks the performance of the MVIS US Listed Semiconductor 25 index. Recently, it has drawn considerable attention due to high-profile deals being conducted in the AI sector.

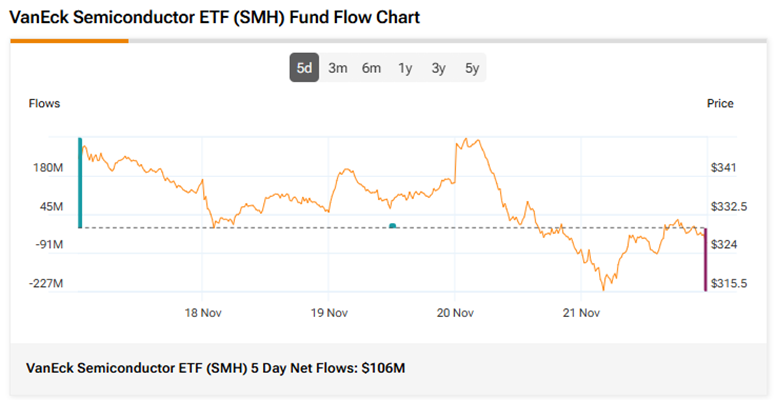

Over the past five days, the SMH ETF has witnessed net inflows of roughly $106 million, while over the past three months, it has reported net inflows of about $4 billion.

Today’s SMH ETF Performance

According to TipRanks’ unique ETF analyst consensus, which is based on a weighted average of analyst ratings on its holdings, SMH is a Moderate Buy. The Street’s average price target of $407.06 implies an upside of nearly 22%.

Currently, SMH’s five holdings with the highest upside potential are:

- Universal Display (OLED)

- STMicroelectronics (STM)

- Synopsys (SNPS)

- Nvidia (NVDA)

- Microchip Technology (MCHP)

Revealingly, SMH’s ETF Smart Score is Seven, implying that this ETF is likely to perform in-line with market expectations.

Power up your ETF investing with TipRanks. Discover the Best AI ETFs, carefully curated based on TipRanks’ analysis.