After hitting all-time highs earlier this summer, Silver experienced a slight pullback through early August but is now showing promising signs of challenging previous highs. Expected rate cuts bolster this upward trend and are likely to further heighten Silver’s investment appeal. This has created a favorable environment for entities like the Canadian mining company MAG Silver (MAG), which offers investors sparkling silver exposure.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Despite the company’s stock already experiencing a double-digit rally this year, up roughly 25%, industry analysts still rate it as “Strong Buy” and predict another 25% upside potential to its average price target. The company recently beat earnings expectations for Q2, and with its newly operational Juanicipio mine demonstrating strong operational performance, the company anticipates growing financial results in the years to come. Investors interested in exposure to silver or quality mining stocks might find this an appealing option.

MAG’s Maximizing Mine Exploration

MAG Silver Corp. is a Canadian precious metals mining company that possesses a 44% stake in the Juanicipio Mine, in the Fresnillo silver trend near Zacatecas, Mexico – one of the world’s largest and most productive silver-mining resources that is estimated to have produced more than 10% of global silver production historically.

MAG is focused on expanding through its interest in a mine operated by Fresnillo (FNLPF), which holds the remaining 56% ownership. Throughout the second quarter of 2024, 10,699 meters were drilled underground, while surface drilling amounted to 4,546 meters, focusing on advancing deeper zones. The company’s annual drilling goal for Juanicipio is 50,000 meters.

Additionally, MAG is managing exploration programs at its wholly-owned Deer Trail Project in Utah and the Larder Project in the Abitibi region of Canada, even though these exploration assets hold marginal values currently. Exploration at the Deer Trail Project in Utah has moved into Phase 4, with 1,610 meters drilled in Q2 2024. Operations on this project were temporarily halted due to a wildfire but have now resumed. In Ontario’s Larder Project, drilling at various targets totaled 10,776 meters in the second quarter of 2024, with significant progress in some zones.

MAG’s Recent Financial Results

The company recently reported financial performance for Q2 2024. The net income was $21.6 million, driven by Juanicipio’s strong performance, which produced 5 million ounces of silver. The company reduced cash and all-in-sustaining costs, generating an operating cash flow of $92.7 million and a free cash flow of $88.6 million. Earnings per share (EPS) of $0.21 surpassed analysts’ expectations of $0.14.

As of the quarter’s end, the company reported a liquidity position of $97.3 million with no long-term debt.

Following last quarter’s results, management has raised full-year guidance based on operational performance in the first half of 2024. The silver head grade at Juanicipio is forecasted to be between 420g/t and 460g/t, up from the previous estimate of 380g/t to 420g/t (above 350 grams per tonne is considered “high grade”).

Production is also projected to increase, ranging from 16.3 to 17.3 million silver ounces versus the previous 14.3 to 15.8 million. This surge is projected to lead to 14.5 to 15.4 million silver ounces sold, compared to 13.2 to 14.6 million. The all-in sustaining costs per silver ounce sold will also reduce, falling from between $9.50 and $10.50 to a new range of $8.50 to $9.25.

What Is the Price Target for MAG Stock?

The stock has been on an upward trend for the past year, climbing 20.35%. It trades at the high end of its 52-week price range of $8.20 – $14.30 and demonstrates positive price momentum, trading above its 20-day (12.63) and 50-day (12.64) moving averages. With a P/B of 2.45x, the shares trade at a bit of a premium compared to the Silver industry average of 1.9x.

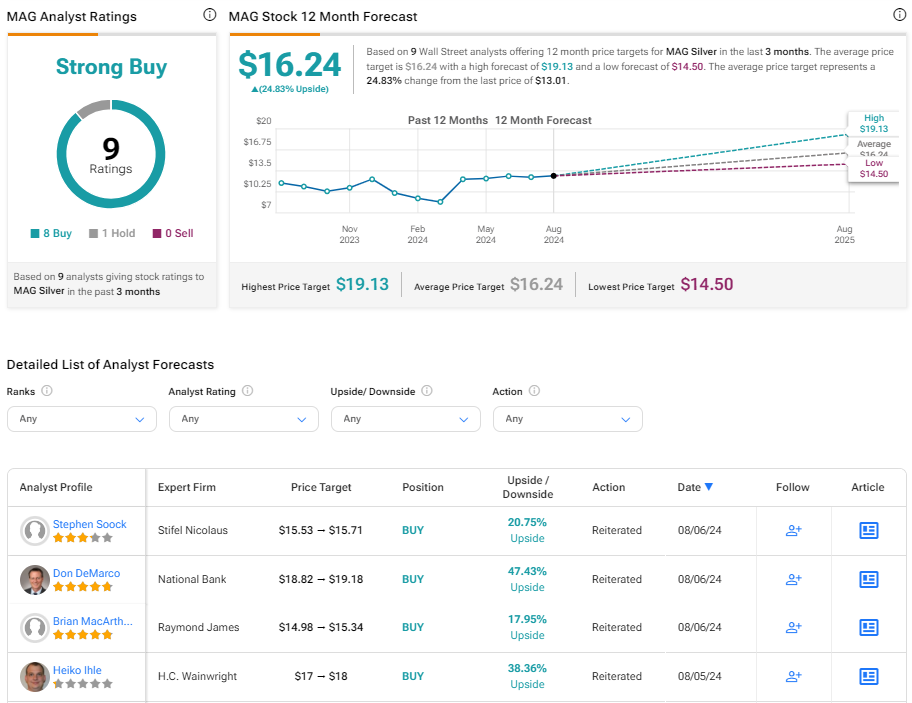

Analysts covering the firm have been bullish on its stock. Nine analysts have issued recommendations and price targets, and MAG Silver is rated a Strong Buy. The average price target for MAG stock is $16.24, representing a potential 24.83% upside from current levels.

MAG Silver in Summary

The lure of silver continues to shine, and MAG is riding this wave with recent solid financial results and upward revised guidance for the full year. Owning a significant stake in one of the world’s most promising silver-mining resources, the company has strategically placed exploration at the heart of its expansion plans. This approach, combined with its strong cash flow and lack of long-term debt, paints a promising picture for the company’s future. For investors considering injecting some precious metals into their portfolio, MAG may be the opportunity you’ve been searching for.