Oilfield services provider SLB (NYSE:SLB) remains a “Strong Buy” rated stock following its upbeat Q1 2024 results, backed by bullish views from Goldman Sachs and other research firms. On April 19, SLB exceeded Q1 FY24 consensus estimates on both the top and bottom lines, winning favorable reviews from analysts. Several analysts stuck to their Buy rating on the stock while a few cut their price targets marginally.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

SLB, formerly known as Schlumberger, offers advanced technology that helps drillers and exploration companies with new and effective drilling services in oil and gas. SLB shares have lost 5.5% so far in 2024.

In particular, 5-star analyst Neil Mehta from Goldman Sachs reiterated a Buy rating with $62 (26.3% upside) price target on SLB. The stock is also on Goldman Sachs’ Conviction List, making it worth considering.

Mehta’s Take on SLB’s Future Potential

Mehta believes that SLB stock is currently undervalued and offers a good opportunity to own a good stock at a reasonable price. Importantly, Mehta expects SLB to earn $5 in earnings per share (EPS) by 2027. To put this in context, SLB generated EPS of $2.91 in Fiscal 2023.

The analyst maintained his EBITDA (earnings before interest, tax, depreciation, and amortization) assumptions despite the company reporting weaker EBITDA margins in Q1. His optimism stems from the expectation of improving seasonal and secular trends.

Moreover, Mehta is encouraged by SLB’s solid pipeline of projects from international markets despite the cancellation of the Saudi pipeline. Mehta added that a shift in activity mix from oil to gas in the Saudi projects will help SLB to add rigs.

For Q2 FY24, Mehta projects revenue of $9.1 billion (up 5%), mainly from a 6% jump in international revenue and a 3% rise in revenue from North America. Mehta has not included the possibility of the ChampionX Corp (NASDAQ:CHX) acquisition for $8 billion in his estimates, while management has provided a rosy picture for the same.

Mehta also sees high potential for SLB’s Digital & Integration business segment. He estimates a 15% year-over-year growth potential in Q2 revenue.

The five-star analyst ranks 167 out of more than 8,700 analysts ranked on TipRanks. He also boasts an attractive 12.4% average return per rating in the past year, with a success rate of 67%.

Will SLB Stock Go Up?

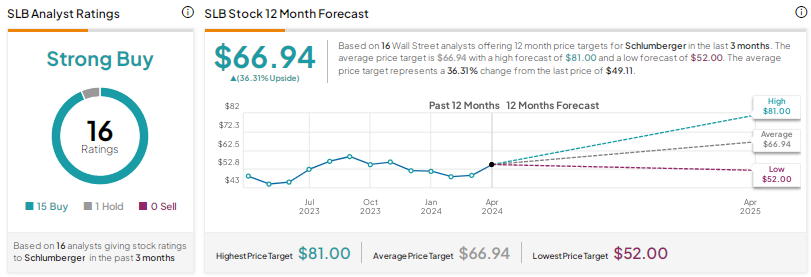

Aside from Mehta, nine other analysts reiterated a Buy rating on SLB stock following the Q1 results. The analysts’ average SLB stock price target of $66.94 implies 36.3% upside potential in the next twelve months. Also, SLB stock has a Strong Buy consensus rating, backed by 15 Buys and one Hold rating.

Ending Thoughts

Goldman Sachs’ analyst is highly optimistic about SLB’s growth prospects based on its strong pipeline and the possibility of higher earnings. Oilfield services providers such as SLB are expected to benefit from the demand for their services from traditional energy companies and the accelerated transformation toward renewable energy solutions.