Shares of SLB (SLB) gained in trading after the company reported strong Q4 results and boosted its dividend and stock buyback. The oilfield services company’s adjusted earnings increased by 7% year-over-year to $0.92 per share, above consensus estimates of $0.9 per share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

SLB’s International Operations Driving Its Revenues

Furthermore, the company’s revenues increased by 3% year-over-year to $9.28 billion in the fourth quarter. This surpassed Street estimates of $9.18 billion.

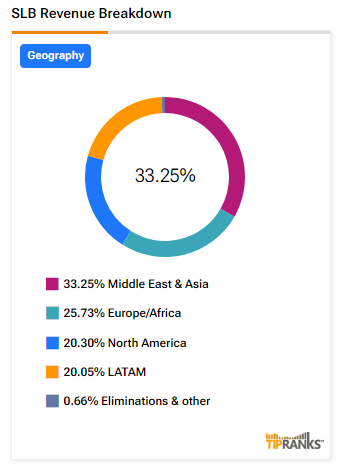

SLB is increasingly focusing on its international business to counter slowing North American growth, and reported a 3% rise in international revenue, its slowest since Q1 2021. Furthermore, the company’s international operations accounted for 80% of SLB’s total revenue.

However, the company’s Latin American revenue dropped 5% year-over-year due to reduced drilling in Mexico, but this was offset by 7% growth in the Middle East and Asia, driven by strong activity in the UAE, Iraq, Kuwait, East Asia, and China.

Meanwhile, North American revenue grew 7%, the highest since Q2 2023, fueled by increased digital sales and offshore activity in the Gulf of Mexico, despite lower U.S. land drilling.

SLB Increases Total Return to Shareholders

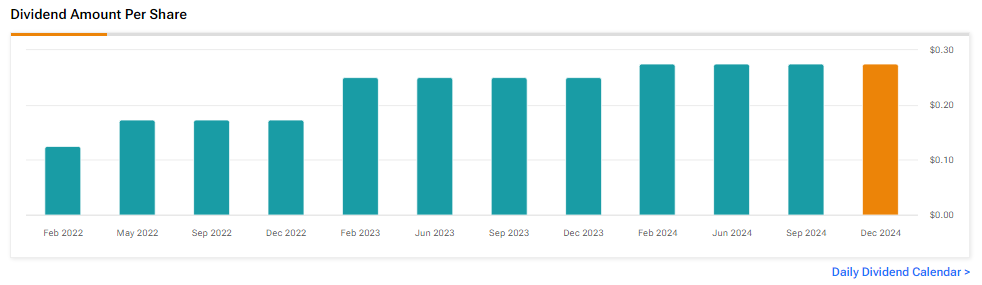

SLB’s Board of Directors raised its quarterly dividend by 3.6% to $0.285 per share beginning with the dividend payable on April 3 to shareholders of record on February 5, 2025. Additionally, the company has entered into accelerated stock buyback transactions to buyback stock worth $2.3 billion. This has increased its total return to shareholders to a minimum of $4 billion in 2025.

SLB’s Management Comments on the Outlook for the Oil Industry

SLB’s CEO Olivier Le Peuch commented, “While upstream investment growth will remain subdued in the short term due to global oversupply, we anticipate the oil supply imbalance will gradually abate. Global economic growth and a heightened focus on energy security, coupled with rising energy demand from AI and data centers will support the investment outlook for the oil and gas industry throughout the rest of the decade.”

Is SLB Stock a Good Buy?

Analysts remain cautiously optimistic about SLB stock, with a Moderate Buy consensus rating based on 13 Buys and five Holds. Over the past year, SLB has declined by more than 10%, and the average SLB price target of $52.42 implies an upside potential of 27.6% from current levels. These analyst ratings are likely to change following SLB’s results today.