Skechers (SKX) stock gained about 2% in yesterday’s extended trading session despite reporting mixed second-quarter results. The upside can be attributed to the company’s $1 billion share buyback announcement and upward revision of its full-year earnings outlook.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SKX develops athletic and comfortable footwear for men, women, and children. For a thorough assessment of Skechers stock, go to TipRanks’ Stock Analysis page.

SKX: Q2 Snapshot

Skechers reported adjusted earnings of $0.97 per share, flat year-over-year and above the consensus estimate of $0.95. Meanwhile, the company’s revenue increased 7.2% year-over-year to $2.16 billion but came below the consensus estimate of $2.24 billion.

In terms of segments, sales at the Wholesale unit increased 5.5%, driven by strong growth in the Americas and Europe, partially offset by weakness in the Asia-Pacific region. Further, the Direct-to-Consumer segment’s sales rose 9.2%, backed by strong performances across all regions.

Upbeat Outlook

Interestingly, Skechers raised full-year guidance owing to a strong second-half order flow. The company now expects earnings per share between $4.08 and $4.18 on revenue of $8.875 billion to $8.975 billion. This surpasses previous estimates of $3.95 to $4.10 in earnings and $8.725 to $8.875 billion in revenues.

Further, SKX forecasts that third-quarter sales will come between $2.30 and $2.35 billion. EPS is expected to fall in the range of $1.10 to $1.15.

Is SKX a Good Stock to Buy?

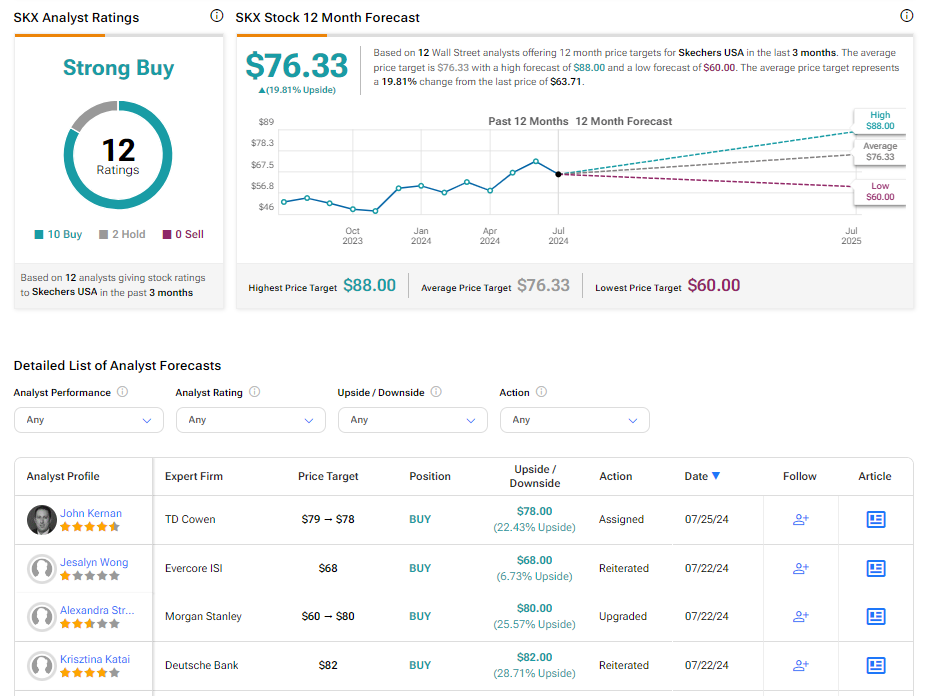

Currently, SKX has a Strong Buy consensus rating based on 10 Buy and two Hold recommendations. After a year-to-date rally of over 2%, the analysts’ average price target on Skechers stock of $76.33 per share implies a 19.81% upside potential.

However, it’s worth noting that the company’s Q2 earnings report may cause analysts to change their ratings.