Clean water is something many of us have the luxury of taking for granted. Yet, the water system is critically important, and access to it is central to the population and most sectors of the economy. Due to climate change, population growth, urbanization, and aging infrastructure, the demand for water utility services will only become more acute.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

However, the recent increase in interest rates has caused SJW Group’s (NYSE:SJW) stock prices to drop more than 25% in the past year. Though, the recent decline in price may be creating a value opportunity for long-term investors interested in owning an income-generating, low-volatility stock in a solidly managed utility at a reasonable price.

How SJW Meets a Growing Demand for Water

SJW is a utility company primarily focused on water and wastewater management, serving around 1.5 million people across four states: California, Connecticut, Maine, and Texas.

Most states regulate these utilities’ rates, so it’s no surprise that 95% of the company’s total net income stems from regulated business activities. In California, where 57% of SJW’s net income is generated, rates are calculated based on a sales forecast and a revenue requirement approved by the California Public Utilities Commission (CPUC), so revenue is stable and predictable.

Recent Financial Results for SJW

The financial results reported for Q1 2024 showed mixed results. Revenue of $149.4 million beat consensus expectations for $140.5 million and marked a 9% increase over results in Q1 2023. This can be attributed to rate increases, especially in the California and Connecticut operations, where revenue protection mechanisms are in place.

However, EPS of $0.36 fell short of expectations for $0.38 and slightly decreased from $0.37 in the same quarter last year. This was attributed to a rise in water production expenses, which saw a 10% increase, mainly driven by higher production costs, higher customer usage, and rate increases from the water wholesaler in California.

At the close of the first quarter, the company had utilized $211 million from its $350 million bank lines of credit, leaving a balance of $139 million available for short-term financing of utility plant additions and operating activities. Also noteworthy, SJW declared a $0.40/share quarterly dividend, maintaining an amount in line with previous declarations and continuing the company’s record of 56 years of consecutive annual dividend payments.

Is SJW Stock a Buy?

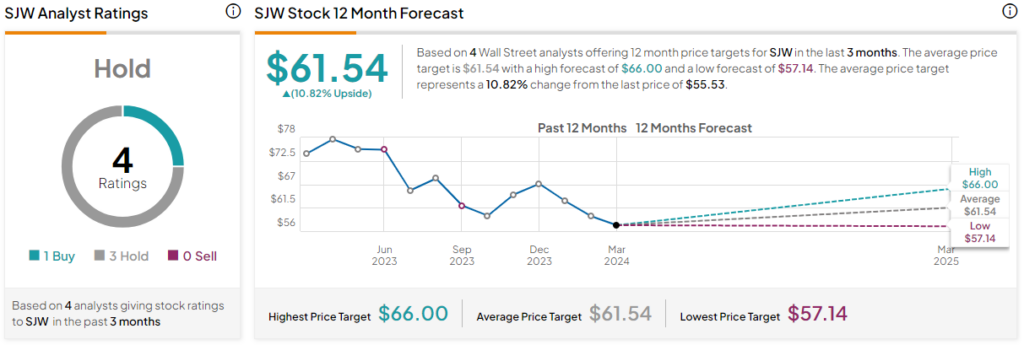

SJW is rated a Hold, based on the cautious stance recommended by three of four Wall Street analysts who issued recommendations in the past three months. Based on their range of 12-month price targets, the SJW stock average price target is $61.54, representing a 10.82% upside from current levels.

Also, the stock demonstrates negative momentum, trading at the lower end of its 52-week price range of $51.36-$77.83 and below the 20-day (56.72) and 50-day (58.32) moving averages. However, the price decline has pushed the stock into relative value territory, with a P/E ratio of 20.88x, comparing favorably to the Regulated Water Utilities industry average of 23.98x.

SJW in Summary

Utility stocks, in general, have suffered from a decline in investor interest as higher-yielding options driven by rising interest rates have been more attractive. Yet, the expanding demand for water has pointed to a growing market over time, and SJW is well-positioned to grow with it.

As mentioned above, SJW is rated a Hold, so investors may want to wait for the downward price momentum to subside and turn positive before considering establishing a position.