Sims Ltd. (ASX:SGM) shares rose as much as 1.6% at midday, bucking the broad market selloff. There was no immediate catalyst driving the stock, although the company is preparing to distribute dividends next week.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The global metal recycling company plans to distribute its semi-annual dividend of AU$0.25 per share on 19 October. Sims has a long dividend history, with its stock currently offering an above-average dividend yield of 6.51% at a conservative payout ratio of 17%.

Rising alongside Sims shares were Fortescue Metals Group Ltd (ASX:FMG), Iluka Resources Limited (ASX:ILU), and Beach Energy Limited (ASX:BPT) stocks.

Sims share price prediction

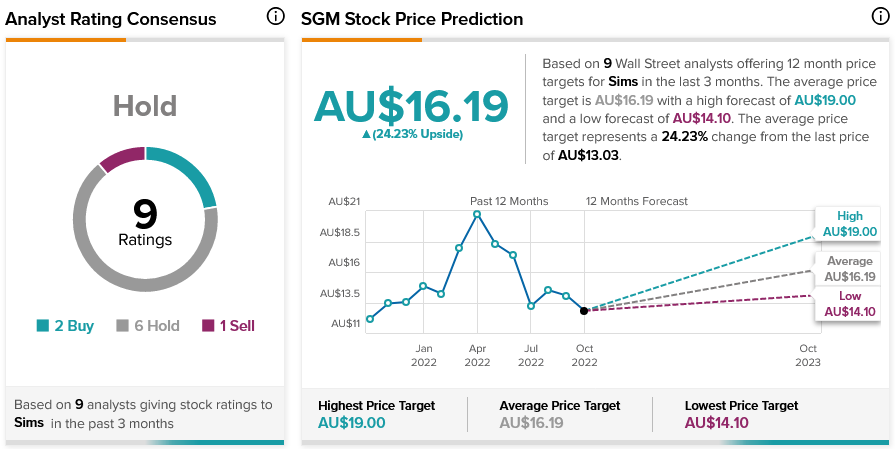

According to TipRanks’ analyst rating consensus, Sims stock is a Hold based on two Buys, six Holds, and one Sell. The average Sims share price prediction of AU$16.19 indicates over 24% upside potential.

Concluding remarks

For investors seeking a high-yield dividend stock that also offers large stock price upside potential, Sims stock is worth considering.