Similarweb (SMWB) stock soared on Thursday after the data analytics company announced a deal with financial publication company Bloomberg. This agreement added Similarweb’s web traffic data to Bloomberg Terminal via {ALTD<GO>}.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With this addition, users will see web traffic information with a seven-day lag and five-year history for roughly 3,000 companies on Bloomberg. This data can be compared with other company statistics, such as foot traffic, allowing for a better breakdown of a company’s performance in the digital age.

Similarweb Co-Founder and CEO Or Offer said, “In today’s digital-first economy, a company’s online footprint often reveals shifts in performance long before traditional indicators.” With the information Similarweb provides, Offer stated that Bloomberg Terminal users will get “a powerful edge—enabling them to spot emerging trends, benchmark competitive activity and make even more confident decisions.”

Similarweb Stock Movement Today

SMWB investors appear pleased with the Bloomberg deal, as the company’s shares have rallied 4.89% in pre-market trading following a 2.02% increase yesterday. However, the stock was still down 46.65% year-to-date, but only 1.95% over the last 12 months.

Is Similarweb Stock a Buy, Sell, or Hold?

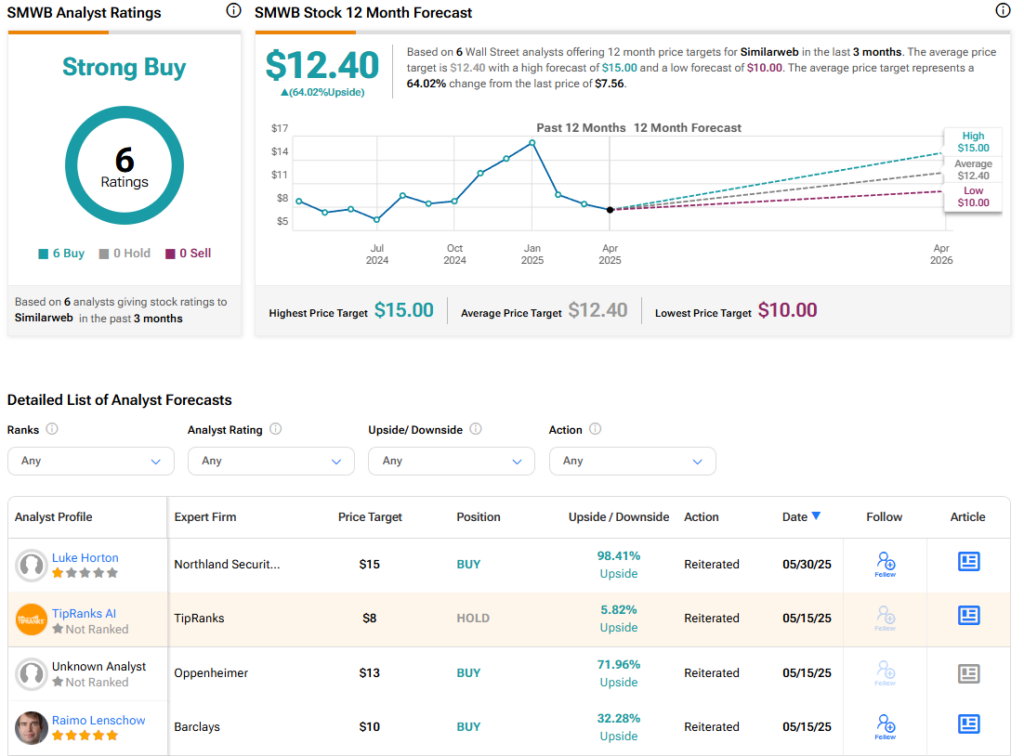

Turning to Wall Street, the analysts’ consensus rating for Similarweb is Strong Buy, based on six Buy ratings over the past three months. With that comes an average SMWB stock price target of $12.40, representing a potential 64.02% upside for the shares.