Silver (SLV) has surged so much this year that it is now approaching chipmaker Nvidia (NVDA) in total market value. As of late December 2025, silver’s estimated market capitalization stood at about $4.22 trillion, putting it just below Nvidia’s roughly $4.64 trillion valuation. As a result, silver could soon become the second-most valuable asset in the world if current trends continue.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Indeed, spot silver has climbed to above $79 per ounce on Friday, while futures prices in India have also reached record highs. The surge is due to a mix of strong industrial demand, along with expectations of U.S. interest-rate cuts, and a weaker U.S. dollar. At the same time, tight physical supply and unusual price gaps between major global exchanges suggest that large institutional players are becoming more active in the market.

Looking ahead, analysts believe that the broader setup for precious metals remains supportive. Although Gold (GLD) still dominates global asset rankings as the most valuable at nearly $31.6 trillion, silver’s dual role as both an industrial metal and a store of value is becoming more important in the current macro environment. When putting all these factors together, it is easy to understand why analysts are bullish.

What Is a Good Price for NVDA?

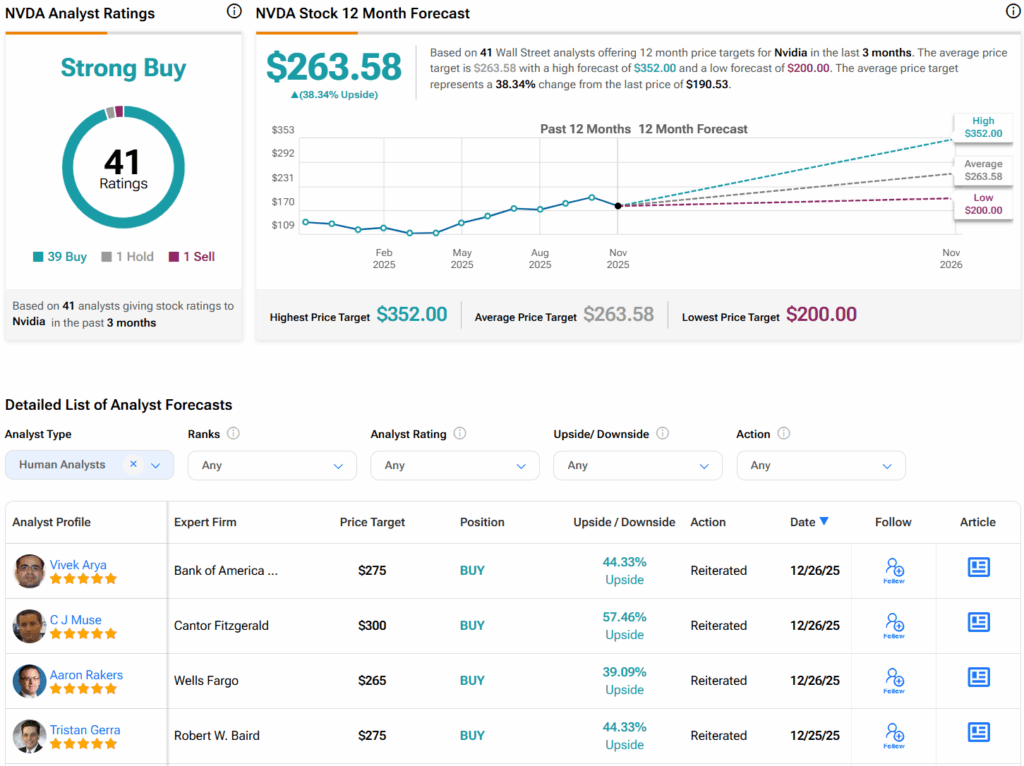

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 39 Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVDA price target of $263.58 per share implies 38.3% upside potential.