Silver has long been a puzzling investment; its historical value in relation to gold has been a controversy in and of itself. But considering the comparisons now, it’s even worse. Silver made a bit of a surge today, hitting a year-to-date high of $26.03 per ounce. As a result, the recovery of silver has done great things for silver exchange-traded funds (ETFs).

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

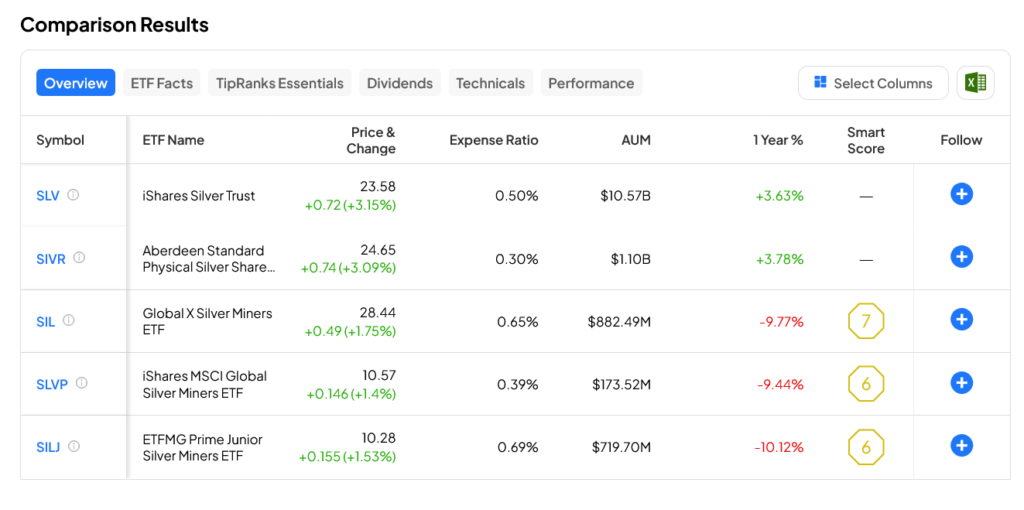

Five of them are up in varying amounts, with the iShares MSCI Global Silver Miners ETF (NYSEARCA:SLVP) gaining modestly, the ETFMG Prime Junior Silver Miners ETF (NYSEARCA:SILI) up 1.5%, the Global X Silver Miners ETF (NYSEARCA:SIL) rising 1.75%, the Aberdeen Standard Physical Silver Shares ETF (NYSEARCA:SIVR) up just over 3%, and the best of all, the iShares Silver Trust (NYSEARCA:SLV) up 3.15% in Tuesday afternoon’s trading.

Silver’s latest push represents a high for 2024 and a level not seen since December 2023. In fact, silver is up 12.9% since the beginning of March alone. It’s also up 7.5% for the year as a whole, which is an admirable gain. Many analysts in the field recognize that silver has fared poorly against gold for quite some time now but may be looking at the beginning of a bullish phase. One analyst, Anna Sokolidiou, noted in a recent article that “$140 Silver is Not Crazy.” Indeed, by some standards, it’s anything but.

A Brief History of Silver (in Relation to Gold)

Right now, an ounce of silver trades for about $26 an ounce. An ounce of gold, meanwhile, is running just over $2,250. So, basically, you’ll need just over 86.5 ounces of silver to buy an ounce of gold. Historically, the value of silver was closer to 15 ounces for one ounce of gold. The Roman Empire set the ratio at 12:1, and in 1792, the U.S. government’s Coinage Act declared it 15:1.

Geologically, there are about 19 ounces of silver for every one ounce of gold, though we only mine about nine of those ounces for every one ounce of gold. So why is silver such a huge bargain against gold right now? There are several explanations, ranging from the mild to the full-blown conspiracy theorist. But for now, all we really need to know is that it is, and the new rise is potentially a big opportunity for those who mine silver.

Which Silver ETFs Are a Good Buy Right Now?

Turning to Wall Street, the current leader of those ETFs mentioned is SIVR. It may only have the second-highest of today’s gains, but for the year so far, it edged out SLV with a 3.78% return. Meanwhile, the laggard in the sector is SILI, which showed a negative return over the year with a 10.12% loss.