Silk Laser Australia (ASX:SLA) shares rose more than 7% to AU$2.40 in trading on September 15. The stock’s spike follows recent share purchases by two of its senior company leaders.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Silk Laser Australia operates specialty clinics that offer a range of personal care services, including skincare and hair treatment.

Silk Laser directors buy up stock

There have been two purchases of Silk Laser Australia stock by company directors over the past two weeks. The transactions include a purchase of 8,200 shares, worth about AU$22,100, by the company’s director Sinead Ryan. The purchase increased Ryan’s holding in the company to over 86,600 shares. Fellow director, Jacinta Caithness also bought up, recently purchasing 3,773 shares in a transaction valued at more than AU$9,800.

Silk Laser Australia share price forecast

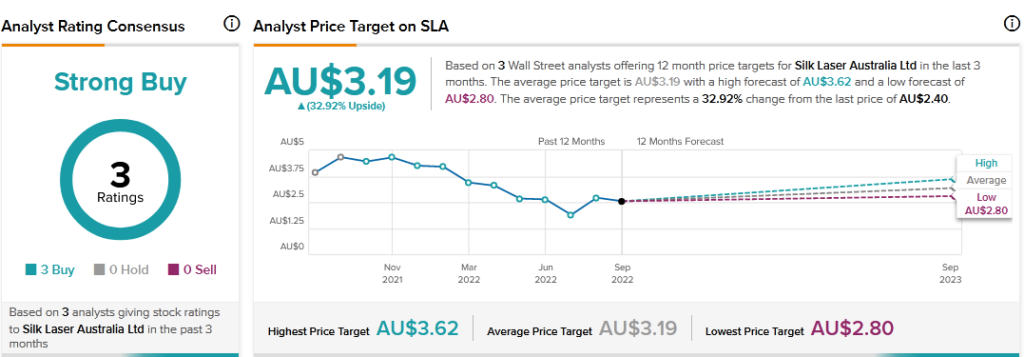

Silk Laser Australia shares are still down about 45% since the start of the year. However, analysts remain bullish on the stock. According to TipRanks’ analyst rating consensus, Silk Laser Australia stock is a Strong Buy. The average Silk Laser Australia share price forecast of AU$3.19 implies over 32% upside potential.

Silk Laser Australia stock scores an eight out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has potential to outperform market expectations.

Moreover, the stock is seeing favorable mentions on financial blogs. TipRanks data shows that financial blogger opinions are 100% Bullish on SLA, compared to a sector average of 69%.

Final thoughts

It’s a good sign for investors to see company leaders back their own stock and buy up, as two Silk Laser directors have just done. Moreover, analysts and bloggers have a favourable view of the stock, indicating that it could be a good long-term investment.