I’ve been watching Super Micro Computer (SMCI) closely for a while now, and despite the significant ~11% price plunge after its preliminary Q3 report this week, I’m still bullish on the stock. Sure, the numbers were not as good as expected, but I don’t think this indicates any major change in the long-term trend. The firm’s official earnings call next week has become a make-or-break moment.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Short-term volatility can provide a value opportunity for those with an insightful eye. Super Micro remains at the heart of AI infrastructure provision, and it’s not an accident that it partnered with NVIDIA (NVDA) and other key tech companies. Good technology, solid financial standing, and what appears to be deferred (not lost) revenue all point toward substantial growth potential over the medium-long term.

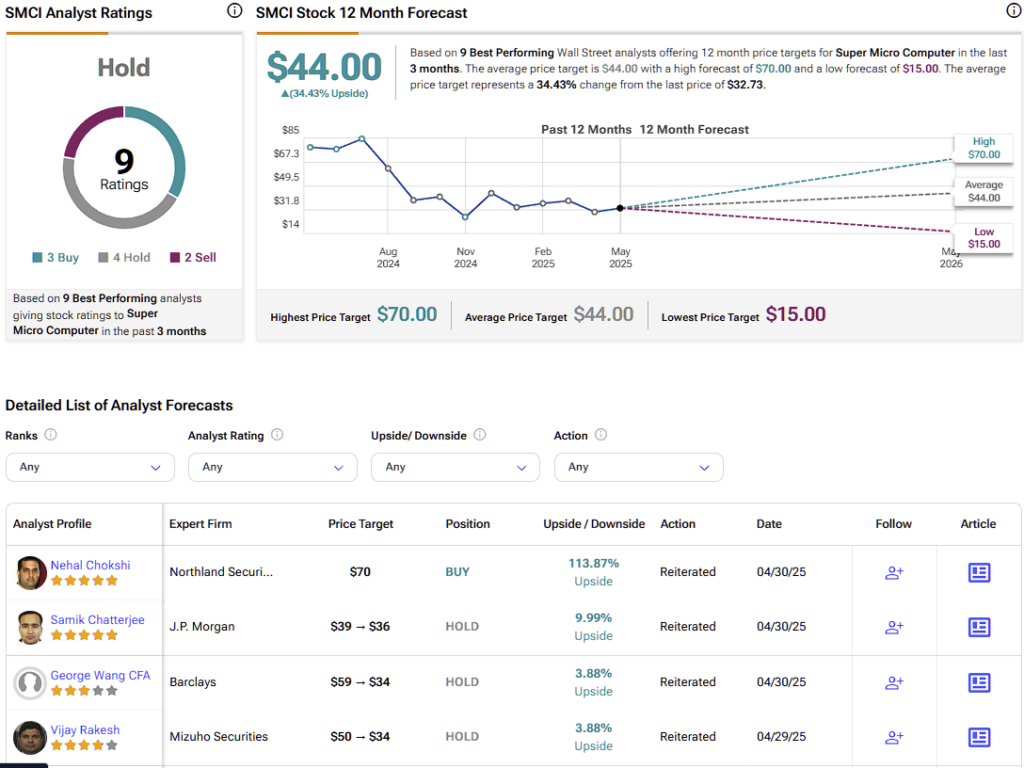

Earlier this week, Nehal Chokshi from Northland Securities reiterated a Buy rating on Super Micro Computer, with a price target of $70, as SMCI stock lingers around $36 per share. Northland first initiated its coverage of SMCI in February this year, citing “significant differentiation” as the reason for its bullish price target of $57. The rationale is that given that SMCI’s niche market has long-term growth ideas, the company has several unique selling points that diversify it from its peers, while adding a premium to boot.

To emphasize the long-term opportunity, despite all the noise in financial markets and recent sell-offs in the U.S.-China-sensitive tech landscape since the firm initiated coverage, Chokshio sees SMCI stock heading towards $70 per share.

The Q3 Miss: What Actually Happened

Let’s begin with what the market was worried about. Management initially guided Q3 revenue between $5 and $6 billion. Now, though, they think the ultimate number will be between $4.5 billion and $4.6 billion—a shortfall of about 10% from the low end of their range.

Non-GAAP earnings per share are now anticipated to range from $0.29 to $0.31, a significant decline from the previous forecast of $0.46 to $0.62. Gross margins also declined by approximately 2.2% from the prior quarter.

So, why the disappointment? Super Micro attributed the shortfall to two factors: customer platform choice delays and margin pressure due to losses on aged inventory and additional expenses associated with new product introductions.

At first glance, those numbers and characterizations might seem to be reason to worry. Admittedly, the stock fell roughly 16 percent on the announcement. But after going through the details, I think this is more of a question of deferred revenue and timing than a foundational problem affecting its long-term stock returns.

Don’t Mistake Delays for Cancellations

Management, led by CEO Charles Liang, indicates the slowdowns were not caused by lost business but by postponed customer decisions. That’s an important distinction. These aren’t canceled orders—they’re delayed ones. Super Micro believes many of the paused deals will close in Q4, and that suggests a potential rebound to follow.

Why the wait? Probably because clients are waiting to see what will happen with NVIDIA and AMD’s (AMD) latest chips. Many server builds relating to these upgrades were put on hold while customers reviewed their hardware needs and waited for chips, especially NVIDIA’s Blackwell GPUs, to be available.

J.P. Morgan and Barclays analysts clarified that the company’s revenue outlook was driven by certain customers’ decisions and product transitions, more so than by a broad slowdown in AI demand. J.P. Morgan emphasized that the miss was driven by timing shifts in customer platform choices. Barclays pointed out that the company’s earlier guidance may have been too optimistic amid uncertainties in AI server builds and limited visibility throughout 2025.

SMCI Takes One Step Back and Two Steps Forward

This is a short-term slump instead of a trend reversal for several reasons. First, if management is right, then Q4 will represent a solid recovery. Deferred revenue would usually follow not far behind, especially when coupled with product changeover. The company also announced big design wins for its newer platforms. That’s evidence of a strong, long-term trajectory, not foundational faltering.

Second, AI server demand is not going away. Major corporations may be reworking their budgets, but the long-term growth story remains. Major names like Amazon (AMZN) and Google (GOOGL) still have ambitious plans for AI spending. Super Micro is well-placed since it delivers fast customization and has very close ties to NVIDIA, so it’s among the most nimble suppliers in this market.

Third, Super Micro is already delivering systems based on NVIDIA’s Blackwell GPUs, which was before the rest of the industry. It’s also leading in cooling technology, using direct liquid cooling—a real advantage as power demands in data centers keep increasing. These major technical breakthroughs count when customers choose suppliers for high-performance applications.

Post-pullback, the stock trades at a reasonable valuation and is potentially undervalued given secular AI tailwinds that appear inevitable to continue, especially in the context of its projected medium-term top-line growth. In my view, the market overreacted.

What I’m Watching for Next

I’m aware of the risks, and I’m not in denial. Executing is more important now than ever. This was a big knock, and if Q4 guidance is weak or delivery slows, investors will lose confidence fast. Super Micro has had issues with trust in the past, particularly around accounting concerns, and it needs to build trust by consistently hitting its targets.

I’m also noticing how much they rely on a few major clients. CoreWeave (CRWV) and xAI are bringing in much money. If only one of them changes its plans or moves to another vendor like Dell (DELL) or a company in Asia, it will be detrimental to Super Micro.

Lastly, macro risks are still present. Supply chains, NVIDIA’s allocation strategy, geopolitics, and tariffs might disrupt the company’s roadmap.

Is Super Micro a Good Stock to Buy?

Super Micro currently has a consensus Hold rating on Wall Street, with three Buys, four Holds, and two Sells. The average SMCI price target of $44 indicates a ~34% upside potential over the next 12 months, reaffirming my bullish stance.

A Steady Long-Term Outlook Trumps Near-Term Noise

I’m still bullish on SMCI’s long-term trend. The Q3 letdown seems like a minor issue, not a major one. Super Micro is in one of the highest-growth areas of tech today, and it’s not simply along for the ride—it’s among the leaders.

The fundamentals remain solid despite the Trumpian hiccups, and demand is not letting up. But execution matters, and I’ll watch for the firm’s Q4 figures set for next week. If the delayed deals close as expected by management, I think this sell-off may be a buying opportunity in hindsight. I’m not all in, but I’m bullish enough to forecast strong stock price appreciation in the medium term.