IonQ Inc. (IONQ) is set to release its third-quarter 2025 earnings this week on November 5. Quantum computing stocks have seen big swings in recent weeks, sparking huge excitement among investors. Notably, IONQ stock is up about 50% year to date, though it has slipped over 10% in the last month. Ahead of the Q3 release, analysts remain bullish as quantum momentum builds, categorizing the stock as a Strong Buy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, IonQ’s forward EV/Sales ratio of 231.7 is dramatically higher than the sector average of 3.66, highlighting its rich valuation. This suggests investors are pricing in exceptionally high future growth expectations, which also increases downside risk if the company fails to deliver. Investors may want to wait for a more attractive entry point before buying IONQ stock.

What to Expect from IonQ’s Q3 Earnings

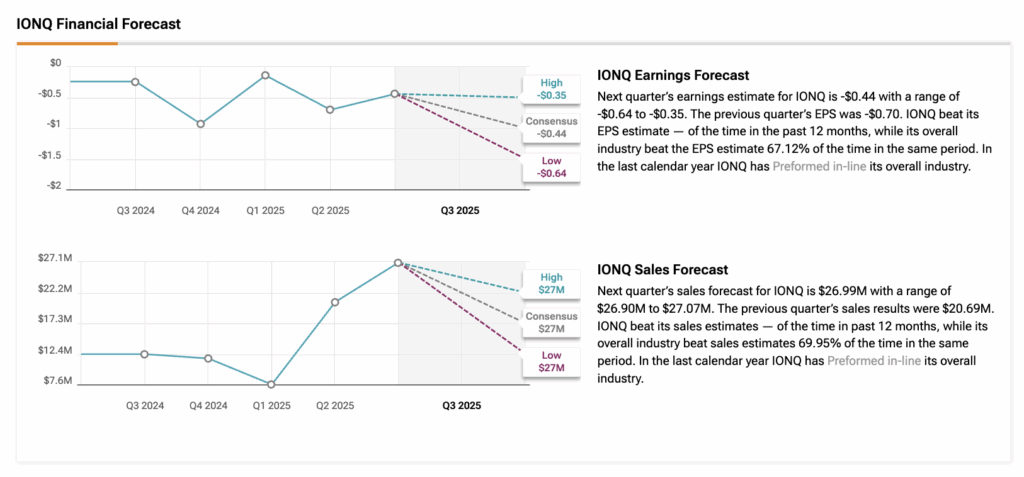

Wall Street analysts expect IonQ to report negative EPS (earnings per share) of $0.44 for Q3, compared to negative EPS of $0.24 in the same quarter last year. On the other hand, analysts project Q3 revenues to grow over 100% year-over-year to $26.9 million, according to the IONQ’s TipRanks Analyst Forecasts Page.

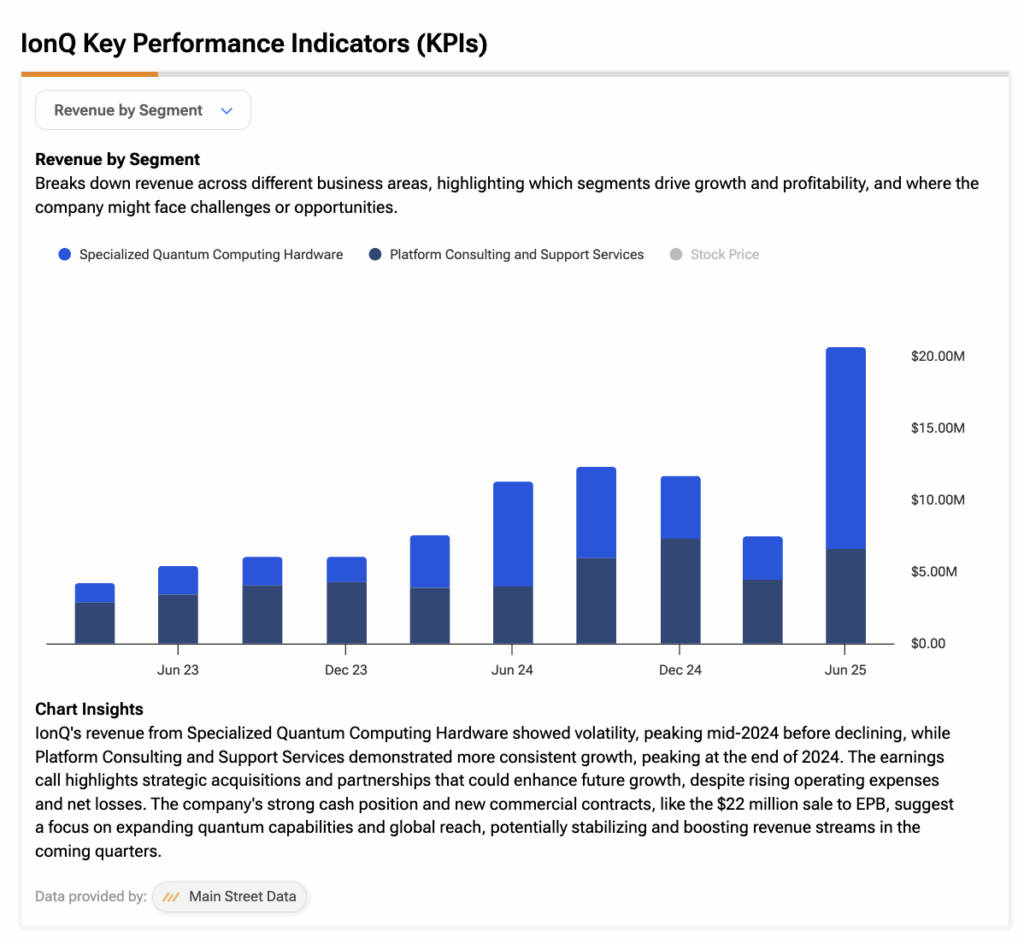

Meanwhile, the company expects its Q3 revenue to range between $25 million and $29 million. Below is a screenshot showing the company’s revenue performance over the years.

For the full year 2025, the company expects revenue between $82 million and $100 million, representing a strong growth range of roughly 80% to 130% compared to 2024.

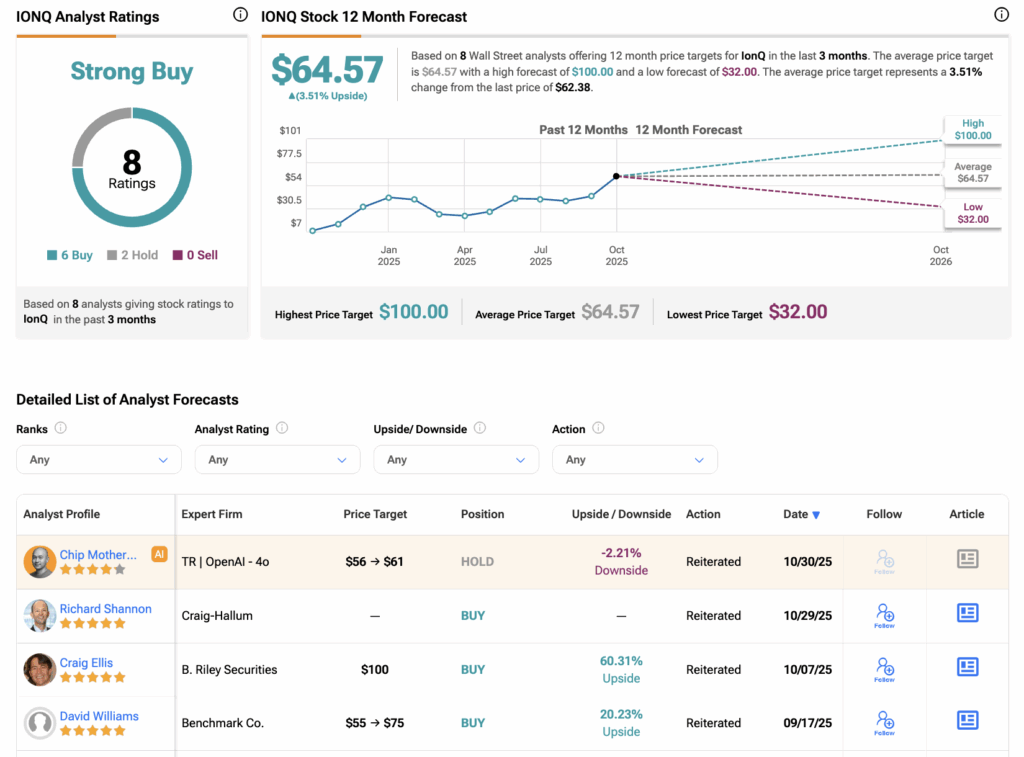

Wall Street Remains Bullish on IONQ

Among analysts, five-star-rated analyst Craig Ellis at B. Riley Securities holds the Street-high price target of $100 on IONQ.

Ellis highlighted that IonQ leads the sector in revenue growth, achieving three straight years of 100% year-over-year gains. He also pointed to a strong and advancing pipeline. Notably, IonQ achieved a new world record for two-qubit gate fidelity at 99.99% in October, representing a major milestone in advancing quantum computing performance. The company stated that this breakthrough will power its next-generation 256-qubit systems, scheduled for launch in 2026.

Before this, Benchmark’s five-star-rated analyst, David Williams, reaffirmed his Buy rating on IONQ stock in September. He also raised his price target on IONQ from $55 to $75. Williams believes IonQ’s steady execution, growing commercial traction, and leadership in gate-based quantum systems position the company strongly for sustained long-term growth.

What Is the Price Target for IONQ?

Turning to Wall Street, analysts have a Strong Buy consensus rating on IONQ stock based on six Buys and two Holds assigned in the last three months. The average IONQ price target of $64.57 implies a 3.5% upside potential from the current level.