BigBear.ai Holdings (BBAI) is set to release its Q3 2025 financial results on November 10. The stock has surged 36% year-to-date, supported by optimism around the company’s data analytics and AI-driven solutions. With a growing contract backlog and strong momentum tied to government demand, BigBear.ai appears to be gaining ground. However, ongoing operating losses continue to weigh on investor confidence. Overall, analysts remain moderately bullish on the stock ahead of the earnings report.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What to Expect from BBAI’s Q3 Earnings

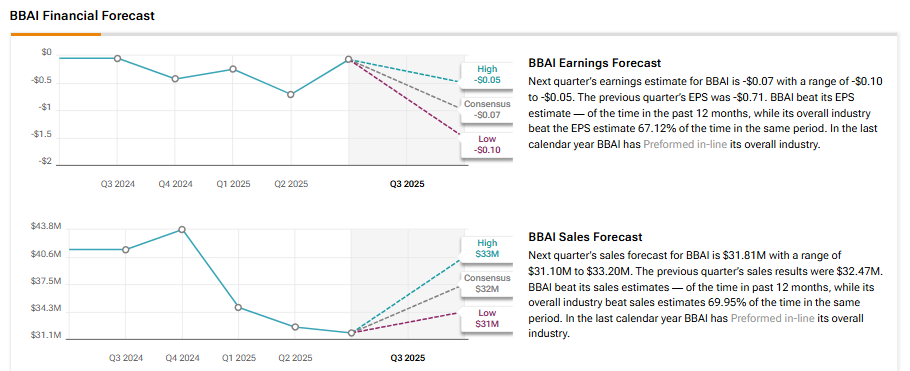

Wall Street analysts expect BBAI to report a loss per share of $0.07 for Q3 compared to a loss of $0.05 in the same quarter last year. Meanwhile, revenue is expected to decline 23% year-over-year to $31.8 million.

It’s important to mention that the company reported a challenging second quarter, with revenue down 18% year-over-year and a sharp increase in net loss. Also, the AI software firm missed analysts’ estimates by a wide margin. In addition, BBAI pulled back its full-year adjusted EBITDA guidance and lowered its revenue outlook, citing disruptions in federal contracts.

Heading into Q3, investors will be watching whether BigBear.ai can show signs of recovery in its government contracts and stabilize revenue trends. Any improvement in margins or new contract wins could help rebuild confidence, while another weak quarter may deepen concerns about the company’s path to profitability.

Options Traders Anticipate a Large Move

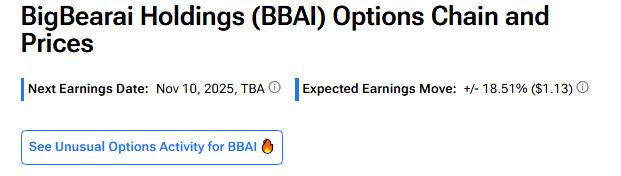

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry; the Options tool does this for you.

Based on options pricing, traders are expecting a 19.13% move in either direction after results, which is much higher than BBAI’s average post-earnings move (in absolute terms) of 11.6% over the past four quarters.

Is BBAI Stock a Good Buy?

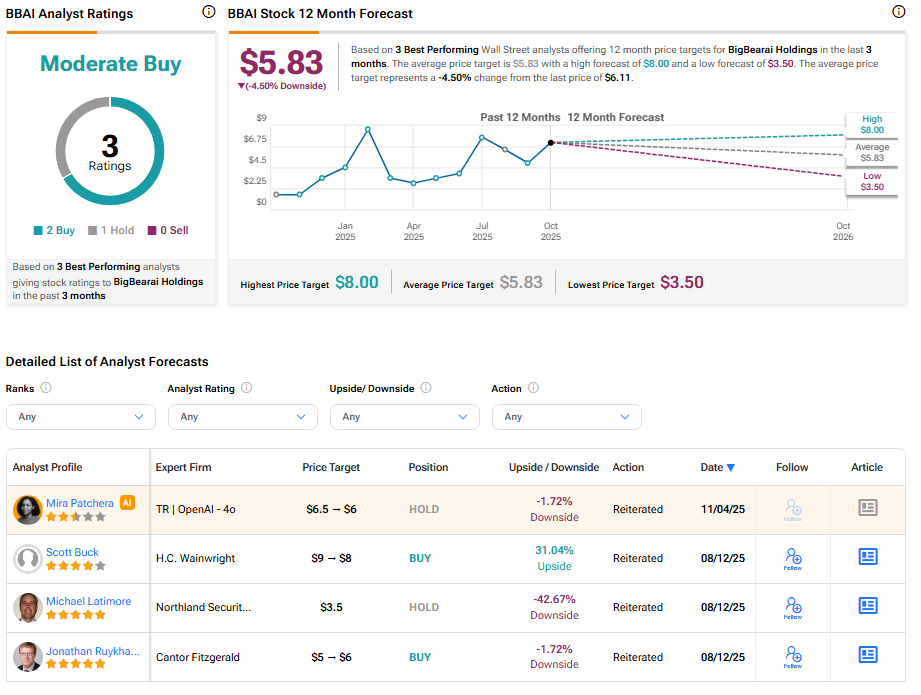

Overall, BigBear.ai Holdings stock scores a Moderate Buy consensus rating based on two Buy and one Hold recommendations. The average BBAI stock price target of $5.83 indicates a downside risk of 3.95%.