Currently, multiple exchange-traded funds—including Unusual Whales Subversive Democratic Trading (NANC) and Unusual Whales Subversive Republican Trading (KRUZ)–track the stock purchases of Senators and Representatives in a bid to profit where our lawmakers profit. But these ETFs may not have much longer to exist if a new law passes. A bipartisan measure, led by Sen. Kirsten Gillibrand (D-New York) and Josh Hawley (R-Missouri), will not only bar Senators and Representatives from owning stock in private companies but also will extend that bar clear up to the executive branch.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It won’t be a complete ban; all those individuals will be allowed to buy in on mutual funds, ETFs, and the like, but specific single stocks will be forbidden, even if a blind trust is used. Though some rules are already in place to forbid purchases of companies connected to fields those lawmakers oversee, the rules contain several loopholes that can be worked around.

Indeed, the bill also seems to do little about family members—even husbands like Paul Pelosi—from making those stock purchases. Thus, its actual impact may be little more than cosmetic. Indeed, there are no fewer than six other measures with similar effects already at play in the House of Representatives. But with a growing amount of public support, such a bill may ultimately pass.

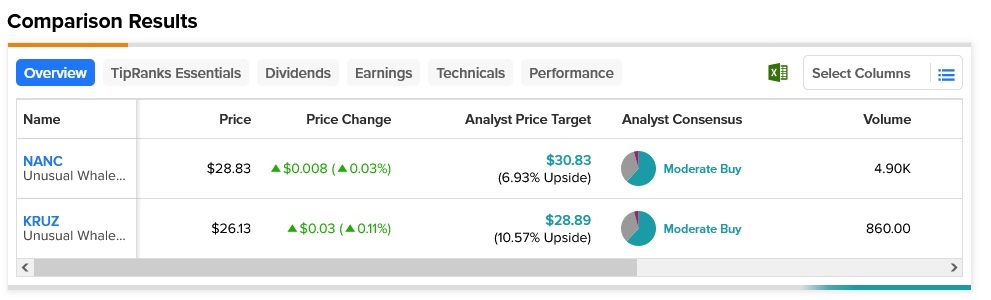

Nevertheless, both the Democrat and Republican ETFs are up in today’s trading. Both are considered Moderate Buys, though KRUZ has a slightly higher upside potential of 10.57% based on its average price target of $28.89. NANC, meanwhile, has 6.93% upside potential with an average price target of $30.83.