Berkshire Hathaway ($BRK.B) stock has risen 28% this year even as Warren Buffett sold off several key holdings and raised the company’s cash position. I believe this divestiture, including recent sales of Bank of America (BAC) stock, sends mixed signals to the market and investors. But, personally, I remain Neutral on BRK.B stock.

Why is Berkshire Hathaway Selling?

Berkshire Hathaway has been selling stocks, which is a reason I am Neutral on the company and its own shares. Berkshire, which is a diversified holding company that owns everything from railroads and insurance companies to restaurant and furniture store chains, has made headlines as CEO Warren Buffett reduces Berkshire’s massive equity portfolio that is currently valued at nearly $315 billion.

Buffett has reduced some of Berkshire’s biggest holdings, including halving his stake in Apple (AAPL). That has raised Berkshire’s cash position to a record $277 billion. So, why is Berkshire Hathaway selling? Here are a few theories:

- Valuation concerns: Berkshire may view current market valuations, especially for mega-cap stocks like Apple, as unsustainably high. Apple’s price-to-earnings (P/E) ratio has tripled since Berkshire’s initial investment in 2016.

- Preparation for economic downturn: Buffett may be anticipating a recession or market correction. For now he appears to be missing out on a bull run, but things can change and the market is jittery before the upcoming U.S. election on Nov. 5.

- Acquisitions: Buffett might be eyeing a major acquisition. With $277 billion in cash, Berkshire has the capital to pursue large-scale takeovers in sectors such as insurance and energy. These are two sectors where the company already has significant holdings.

- Portfolio rebalancing: The sale could be part of a broader strategy to rebalance Berkshire’s portfolio. Apple previously represented half of the company’s holdings.

- Profit-taking: Given the significant appreciation in stocks such as Apple and Bank of America, Berkshire might simply be locking in profits at what it perceives to be peak valuations.

While the exact reason for the stock sales remains unclear, Berkshire’s substantial cash position suggests a strategic shift in Buffett’s investment approach. It is sending a signal of caution about the markets and the economy. Investors who are also feeling cautious may find Berkshire Hathaway’s own stock to be an attractive option right now.

Is Buffett Hedging His Bets?

Uncertainty is another reason to remain Neutral on BRK.B stock. Berkshire Hathaway’s massive $277 billion cash hoard has positioned the company as a potential hedge against economic uncertainty and any potential disruptions that occur following the U.S. election on November 5. The current level of liquidity provides Berkshire with the flexibility to navigate any number of market scenarios.

Berkshire’s big cash position could be a hedge against potential market volatility that might occur immediately after the U.S. election. Concerns about changes to tax policies, including raising corporate tax rates and capital gains taxes, have led some investors to adopt defensive strategies.

Conversely, the market may rally if the election outcome is known quickly and decisively in November. Regardless of the election outcome, Berkshire’s substantial cash position allows it to act swiftly on investment opportunities or weather potential economic downturns, making it an attractive option for investors seeking stability in uncertain times.

Berkshire Hathaway’s Oil Exposure

While Berkshire Hathaway could provide some sort of a hedge against market volatility given its sizeable cash position, it’s also worth recognizing that more than 12% of the company’s holdings are in the oil space — namely Chevron (CVX) and Occidental Petroleum (OXY). The current situation with energy prices is not encouraging, reinforcing my Neutral view of Berkshire Hathaway.

At the time of writing, oil prices are falling, with Brent crude, the international standard, down near $70 a barrel. This is because the risk premium associated with Middle East conflict is fading after Israel’s more measured response to Iran’s attack and the potential for a ceasefire. While geopolitical risks remain, some analysts have pointed to further downside for oil prices, which could impact Berkshire’s holdings of CVX and OXY stock.

Neither Chevron nor Occidental Petroleum look particularly cheap right now, so there could be some pain if oil prices continue declining. However, it’s also worth noting that these energy investments provide diversification against Buffett’s other assets such as his railroad investments.

Is Berkshire Hathaway Stock a Buy?

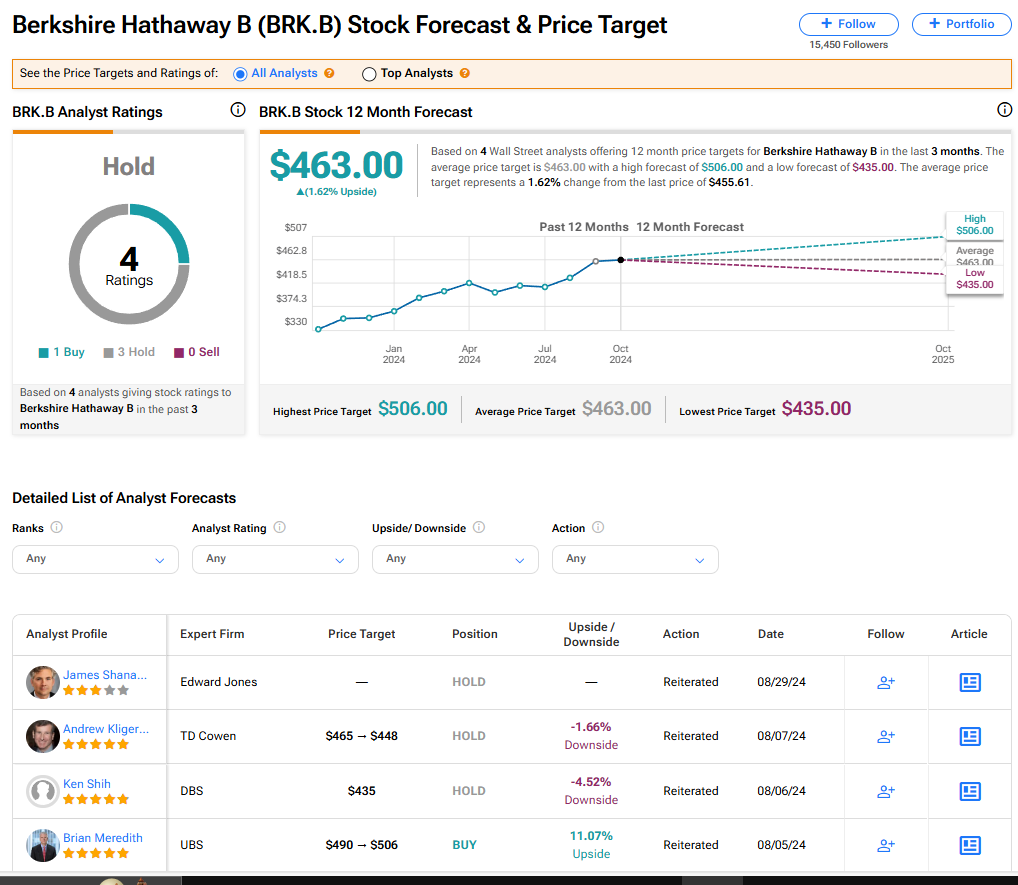

Berkshire Hathaway’s more affordable Class B stock has a consensus Hold rating based on one Buy, three Hold, and no Sell ratings assigned by analysts in the past three months. The average BRK.B price target of $463 implies 1.6% upside potential from current levels.

Read more analyst ratings on BRK.B stock

Conclusion

As the price target suggests, Berkshire Hathaway might be trading near fair value. That’s interesting, and it supports my Neutral position on the stock. The bottom line is that uncertainty remains with Berkshire. It continues to be unclear why Buffett has sold off some of his biggest holdings and it’s also not obvious as to how the cash that’s been raised will be deployed. I’m also a little concerned about Berkshire Hathaway’s energy stocks as falling oil prices could put downward pressure on share prices. For these reasons, I hold a Neutral view of BRK.B stock.