Altria (MO) stock has risen about 9% over the past year, underperforming the nearly 17% rise in the S&P 500 Index (SPX). Including a dividend yield of 7%, the tobacco company has generated a total return of 16% over the past year. Wall Street is cautiously optimistic about Altria stock in 2026, with the continued weakness in the company’s cigarette business expected to be offset by the traction in its smokeless offerings, such as on! oral nicotine pouches. Given its high dividend yield, MO stock is an attractive option for income-seeking investors.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It is worth noting that Altria is a dividend king, a company with at least 50 consecutive years of dividend increases. Its dividend hike of about 4% to an annualized dividend of $4.24 per share (a quarterly dividend of $1.06 per share) in 2025 marked the 60th dividend increase for the company.

Altria’s Efforts to Offset Declining Cigarette Demand

Altria, which sells popular brands like Marlboro cigarettes and smokeless tobacco products such as Copenhagen and Skoal, reported a 3% decline in its Q3 2025 revenue as the demand for cigarettes continues to decline in the U.S. Given the evolving demand backdrop, the company has been building a portfolio of smoke-free alternatives, including e-vapor, oral nicotine pouches, and heated tobacco.

However, these initiatives have been impacted by regulatory hurdles and intense competition from unregulated vapes, mainly from China. Also, the company had to halt sales of its vape brand, NJOY, due to a patent dispute with Juul Labs. Meanwhile, Altria bulls expect the demand for its on! nicotine pouches to mitigate the weakness in other products.

Wall Street Weighs in on Altria Stock

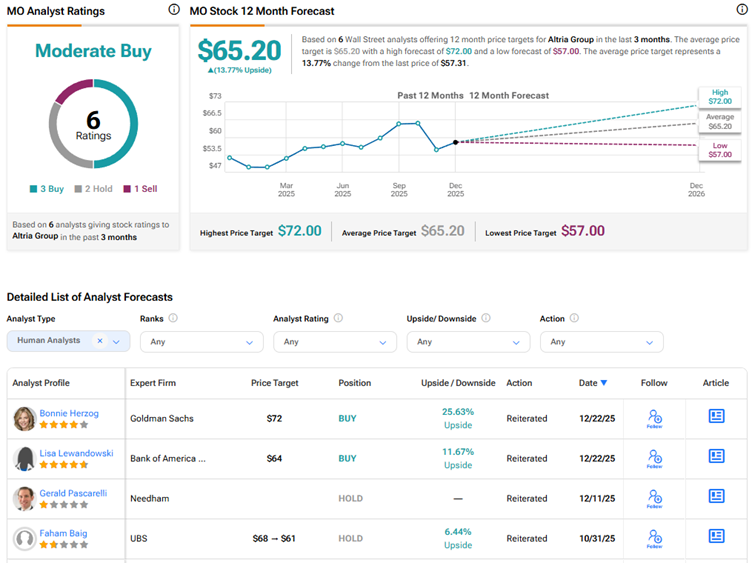

Last month, the U.S. Food and Drug Administration (FDA) granted market authorization to six on! Plus nicotine pouches that are manufactured by Altria’s subsidiary Helix. Following this favorable news, Goldman Sachs analyst Bonnie Herzog reiterated a Buy rating on Altria stock with a price target of $72. The 4-star analyst views the FDA authorization as a positive catalyst for Altria, given that it bolsters the company’s transition to smoke-free products. Moreover, Herzog believes that this authorization reflects a potentially more favorable regulatory backdrop for nicotine pouches following the FDA’s new streamlined review program.

Herzog added that the approval will support an immediate test-market relaunch, followed by a nationwide launch by the second half of 2026. The analyst noted that this rollout is expected to help Altria deliver mid-single-digit adjusted EPS (earnings per share) growth through 2028 and beyond and drive MO stock higher.

Meanwhile, Bank of America analyst Lisa Lewandowski recently lowered her price target for Altria stock to $64 from $66 while maintaining a Buy rating. The 5-star analyst thinks that the main unresolved question for the consumer staples sector is whether demand will grow in 2026. Lewandowski noted that valuations across the sector remain mixed, and there’s little reason for investors to move away from the sidelines in 2026 until fundamentals clearly improve.

Is Altria Stock a Buy, Sell, or Hold?

Overall, Wall Street has a Moderate Buy consensus rating on Altria stock based on three Buys, two Holds, and one Sell recommendation. The average MO stock price target of $65.20 indicates 14% upside potential from current levels. Including the dividend yield of 7%, the company is expected to generate a total return of about 21%.