Notorious short seller Hindenburg Research has announced that it is closing up shop.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

In an email to clients and note posted to the company’s website, Hindenburg Research founder Nate Anderson announced that he is shutting down his upstart firm that made a name for itself by accusing some of the biggest companies in the world, and Wall Street titans, of corporate malfeasance.

“I have made the decision to disband Hindenburg Research. The plan has been to wind up after we finished the pipeline of ideas we were working on. And as of the last Ponzi cases we just completed and are sharing with regulators, that day is today,” Anderson wrote on the company’s website.

Scourge of Wall Street

Nate Anderson founded Hindenburg Research in 2017, and the company has published negative research reports on dozens of companies around the world, from electric vehicle start-up Nikola (NKLA) to, most recently, used car retailer Carvana (CVNA).

Hindenburg Research has also taken on the financial world’s elite, from American corporate raider Carl Icahn and his holding company Icahn Enterprises (IEP) to the business empire of Indian billionaire Gautam Adani. Throughout it all, Hindenburg placed short bets on the companies it was criticizing, essentially betting that their share prices would decline.

Proved Right

However, Anderson and his team were often proved right in their criticisms. Hindenburg’s report accusing Nikola of faking the autonomous capabilities of its semi-truck landed company founder Trevor Milton in prison. After Hindenburg accused Icahn Enterprises of an unsustainably high dividend, the company slashed its payout to shareholders by 50%.

In one of its more high-profile short bets, Hindenburg last summer targeted then high-flying technology company Super Micro Computer (SMCI), accusing the company of accounting irregularities. While Super Micro Computer denied the accusations, the company’s auditor subsequently quit and management delayed the release of the annual report, sending the stock spiraling downward.

Is Carvana Stock a Buy?

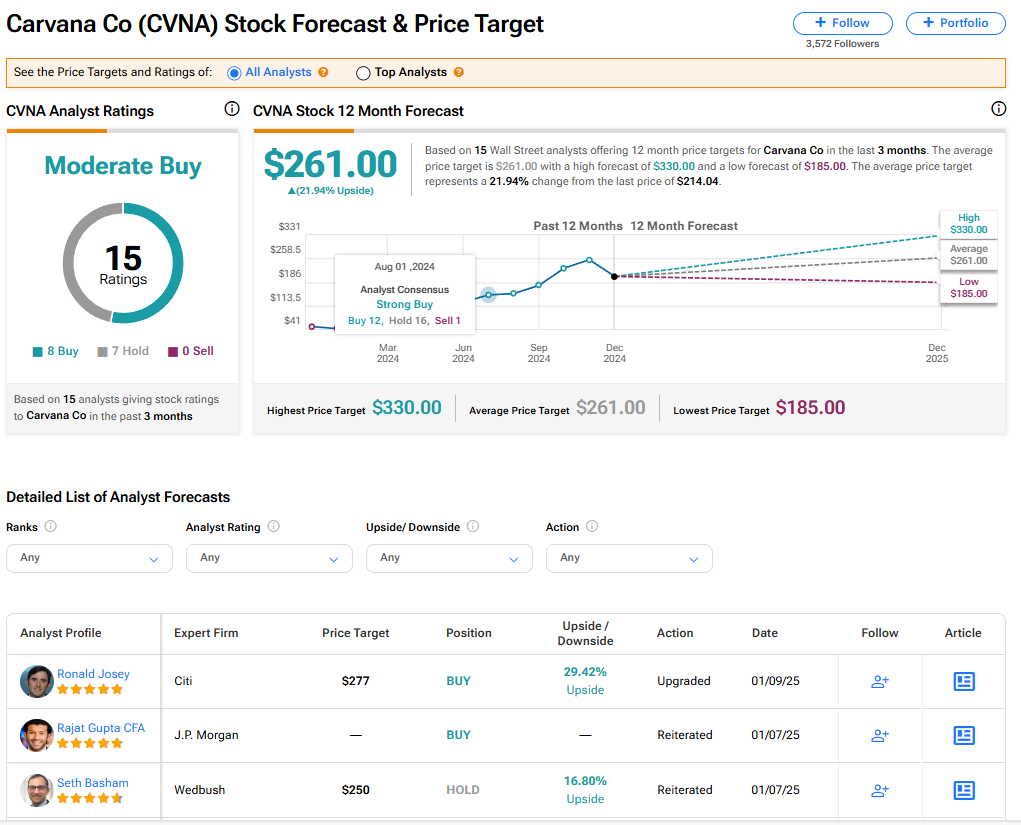

As Hindenburg Research is not publicly traded, we look instead at the company’s most recent target, Carvana. CVNA stock has a consensus Moderate Buy rating among 15 Wall Street analysts. That rating is based on eight Buy and seven Hold recommendations issued in the last three months. The average CVNA price target of $261 implies 21.94% upside from current levels.