E-commerce platform Shopify (SHOP) is scheduled to announce its results for the first quarter of 2025 before the market opens on Thursday, May 8. Wall Street expects the company to report earnings per share (EPS) of $0.27 and revenue of $2.37 billion, indicating year-over-year growth of 35% and 27.4%, respectively. SHOP stock has declined 7.5% year-to-date due to investors’ concerns about tariffs. Investors will pay attention to management’s commentary on the impact of tariffs, especially the elimination of de minimis treatment, on Shopify’s business.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Notably, the de minimis treatment allows for duty-free entry for shipments under $800 in value for imports from China. The elimination of the de minimis exemptions is expected to have a notable impact on the small and medium businesses using Shopify’s platform.

Meanwhile, Shopify missed earnings expectations for Q4 2024 but surpassed revenue estimates. According to Main Street Data, the company’s Gross Merchandise Volume (GMV) grew by 25.8% in Q4 2024, reflecting an acceleration from the 24% growth in Q3 2024. The company said that it expects the solid merchant momentum from Q4 to continue in Q1, though the first quarter has consistently been its lowest GMV quarter seasonally.

Analysts’ Views Ahead of Shopify’s Q1 Earnings

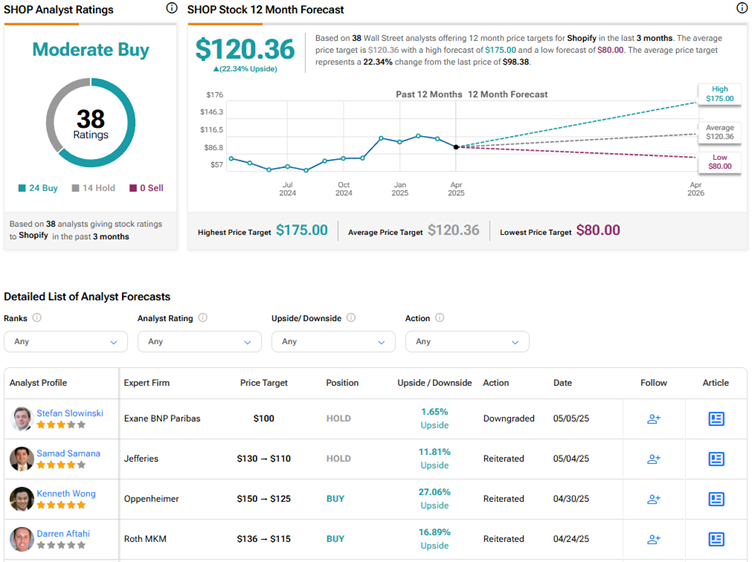

Heading into the results, Jefferies analyst Samad Samana lowered his price target for Shopify stock to $110 from $130 and reiterated a Hold rating. The 4-star analyst believes that the momentum seen in 2024 in Shopify’s business carried into Q1 2025. He expects Q1 growth and margins to beat expectations. However, Samana thinks that the unknown impact of tariffs and the elimination of the de minimis rule make it tough to have confidence that recent momentum is sustainable.

Further, Oppenheimer analyst Ken Wong lowered his price target for Shopify stock to $125 from $150 while reiterating a Buy rating. The 5-star analyst noted that sentiment has trended with tariff headlines. Wong added that investors expect a modest GMV/revenue beat with mixed 3P (third-party) data pointing to slight outperformance. Operating expenses might come below estimates due to a likely pullback in sales and marketing expenses. Wong highlighted that Q2 growth could be consistent with Q1 or in the high-teens to low-20% range, or the company might remove the guidance altogether on limited visibility.

Options Traders Anticipate a Major Move on Shopify’s Q1 Earnings

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting about an 11.8% move in either direction in Shopify stock in reaction to Q1 results.

Is Shopify Stock a Buy, Sell, or Hold?

Overall, Wall Street has a Moderate Buy consensus rating on Shopify stock based on 24 Buys and 14 Holds. The average SHOP stock price target of $120.36 implies 22.3% upside potential.