Shoe Zone (GB:SHOE) announced its trading update for the month of August 2022, as the discount shoe retailer continued to benefit for soaring demand as children head back to school.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Shoe Zone has around 400 stores in the UK. The company is known for its reasonably priced shoes, with an average price of around £10.

The easing of COVID restrictions and opening of schools boosted sales in a big way. Summer remains a hot selling season for the company, which has a strong hold on the market for school and workwear shoes.

The company is eyeing good profits in its full-year results as margins also look strong. The company undertook some cost-saving initiatives, such as better supply chain management, reducing unwanted rents, and more, which helped it push its margins.

As a result, the company increased its profit before tax for the year 2022 to £10.5 million, up from £9.5 million as reported in July’s trading update. This is the third time that the company has revised its profit after expecting it to be around £8.5 million in June.

Show Zone stock performance

The stock has done exceptionally well during the recovery after the pandemic.

The shares have grown by 108.7% in the last year, beating most retailers in the market. The recently announced update has led to another jump in the already soaring share prices.

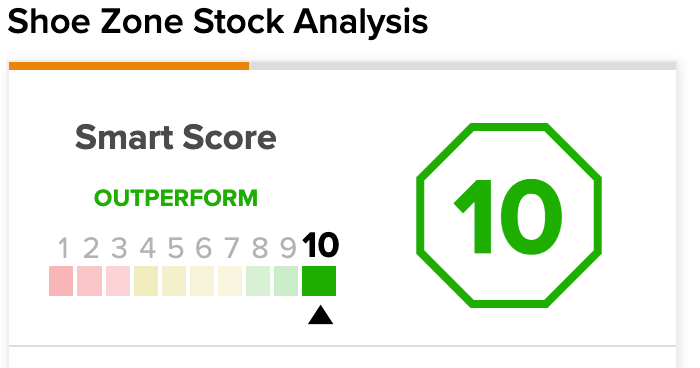

Shoe Zone Smart Score

Shoe Zone stock has a score of ‘Perfect 10’ as per TipRanks’ Smart Score tool. This represents that the company is well-positioned to outperform the market returns.

The score is derived from analysing the stock on eight different parameters including hedge fund activities, insider transactions, fundamentals, etc.

Conclusion

With rising prices everywhere, customers are opting for low-cost alternatives. This makes the company’s position strong in the market, along with top-line growth.

The positive trading updates are coming one after another, and the company is confident in posting a strong set of results for its full year of 2022, due in October.