Shares of energy giant Shell (NYSE:SHEL) rose by over 2% in the early session today after the company announced its fourth-quarter results and a new $3.5 billion share repurchase program.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

During the quarter, revenue tanked by 22.3% year-over-year to $78.73 billion. Still, the figure came in better than expectations by $1.87 billion. However, EPS of $1.11 lagged estimates by $0.71. Sequentially, the company saw improved LNG trading and optimization margins as well as increased production. However, lower margins in refining and trading of oil products weighed on the company’s performance.

Notably, Shell completed the $3.5 billion share repurchase program it previously announced during its Q3 earnings report. The company is undertaking a new share buyback program of $3.5 billion. The buybacks are expected to be completed by Shell’s Q1 earnings announcement on May 2. Further, Shell is increasing its quarterly dividend by nearly 4% to $0.688 per American depository share. The SHEL dividend is payable on March 25 to investors of record on February 16.

For Fiscal Year 2024, Shell expects capital expenditures in the range of $22 billion to $25 billion. The company anticipates integrated gas production of 930-990 thousand boe per day and 7-7.6 million tonnes of LNG liquefaction volumes. Owing to the completion of planned maintenance activities in North America, refinery utilization is expected to be 83%-91%.

Is Shell a Good Stock to Buy?

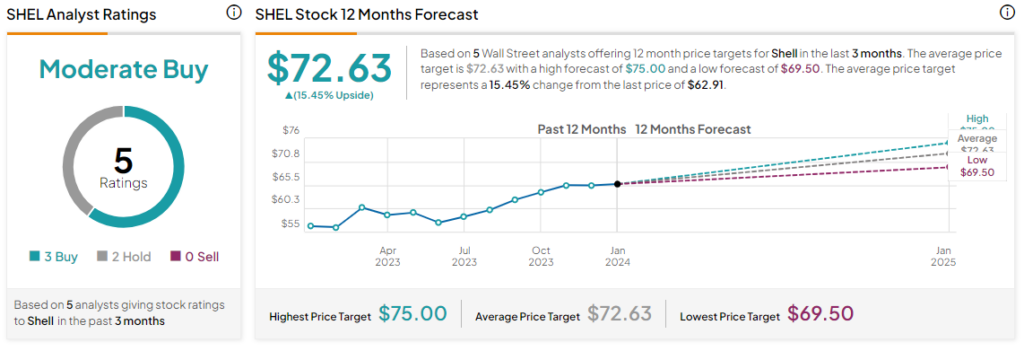

Overall, the Street has a Moderate Buy consensus rating on Shell, and the average SHEL price target of $72.63 implies a nearly 15.5% potential upside in the stock. That’s on top of a nearly 7% rise in the company’s share price over the past year.

Read full Disclosure