Stocks of oil majors such as Shell (SHEL), Chevron (CVX), and British Petroleum (BP) are crashing alongside prices for crude as the OPEC+ cartel increases production just as new U.S. tariffs sink global energy demand.

Crude oil prices are down 8% and near $60 a barrel as the demand outlook takes a hit after U.S. President Donald Trump announced a baseline 10% tariff on nearly all imports into America. The tariffs are expected to be especially devastating on demand in China, which President Trump slapped with an additional 34% import duty.

News of the U.S. tariffs, and retaliatory measures around the world, has sent stock markets into a tailspin and raised concerns about global demand for commodities, including oil and natural gas. However, just as the tariff turmoil peaks, the Organization of the Petroleum Exporting Countries and its allies (OPEC+), which produces about 40% of the world’s crude, has gone ahead with plans to nearly triple oil production.

Swamping the Market

The production increase has raised the prospect that OPEC+ could swamp the global market with crude oil at a time when inventories are already high and demand is sinking. Eight OPEC+ producers agreed to raise combined crude oil output by 411,000 barrels per day, speeding up the pace of their scheduled hikes and pushing down oil prices by nearly 10%.

Brent crude oil, the international standard, is now trading right around $65 per barrel. West Texas Intermediate (WTI) crude oil, the American standard, is trading at $61.98 a barrel. The production increase comes as U.S. investment bank Goldman Sachs (GS) lowers its year-end forecasts for oil prices to $66 a barrel for Brent crude and $62 for WTI, citing “downside risks” for global energy markets.

OPEC+ said it increased crude production because it remains bullish on oil demand later in the year. However, there is speculation online and among some analysts that OPEC+ raised its production to lower oil prices and appease President Trump who has promised consumers lower prices at the gas pumps. OPEC+ has denied those charges.

Is CVX Stock a Buy?

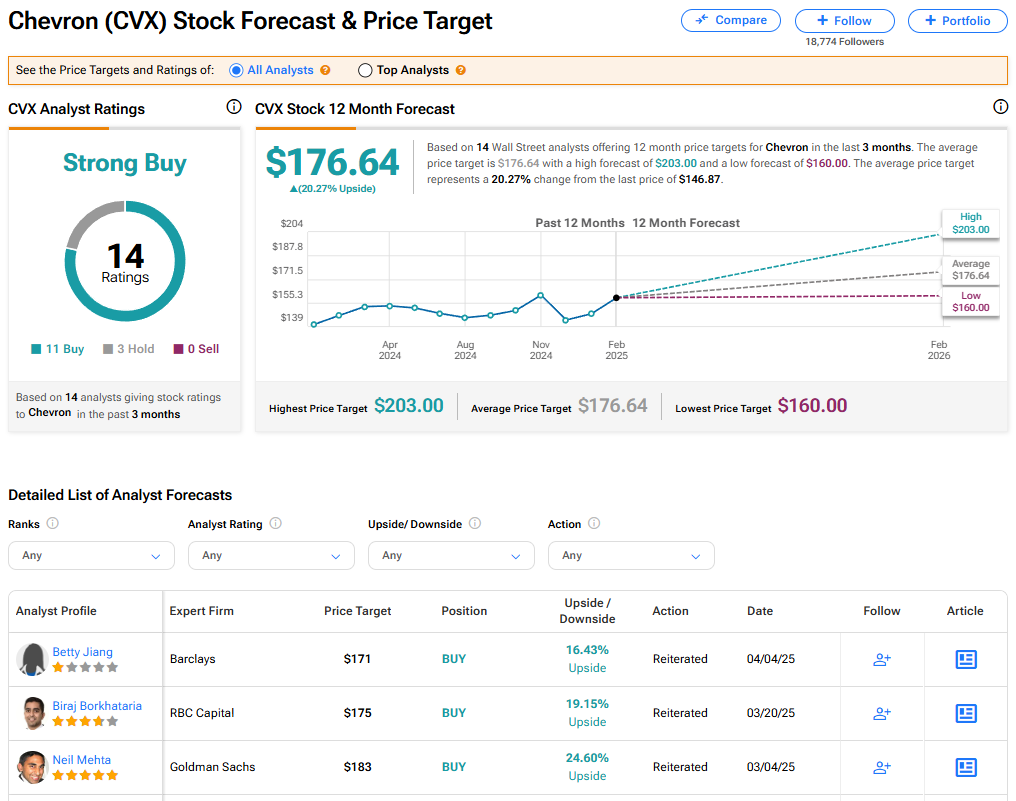

The stock of Chevron, one of the leading U.S. oil majors, has a consensus Strong Buy rating among 14 Wall Street analysts. That rating is based on 11 Buy and three Hold recommendations assigned in the past three months. The average CVX price target of $176.64 implies 20.27% upside from current levels.