As the world’s demand for energy rises, major shifts are occurring in the LNG (Liquefied Natural Gas) market. Top oil producers such as Shell (NYSE:SHEL), BP (NYSE:BP), and TotalEnergies (NYSE:TTE) are investing in a significant LNG project in Abu Dhabi.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Energy Giants Pick Up Stakes in Major LNG Project

The investment represents another bet on the anticipated rise in LNG demand over the coming years. Shell, BP, TotalEnergies, and Mitsui & Co. are each taking a 10% stake in Adnoc’s (Abu Dhabi National Oil Co.) LNG project in Ruwais, UAE, a $5.5 billion facility expected to come online in 2028.

Notably, the Ruwais facility, with a capacity of 9.6 MTPA, is set to more than double Adnoc’s LNG production capacity in the UAE. The company has already secured sales commitments for nearly 70% of the plant’s capacity, underscoring the surging global demand for LNG.

This trend extends beyond the UAE. Other Middle Eastern nations like Qatar and Saudi Arabia are ramping up their LNG output. Recently, Saudi Aramco signed a 20-year LNG deal with NextDecade (NASDAQ:NEXT), involving the supply of 1.2 MTPA of LNG from NEXT’s Rio Grande LNG terminal in Southern Texas to Saudi Aramco. Adnoc has also inked a 20-year supply deal with NextDecade for 1.9 MTPA of LNG.

Which Energy Stock Is Best to Invest In?

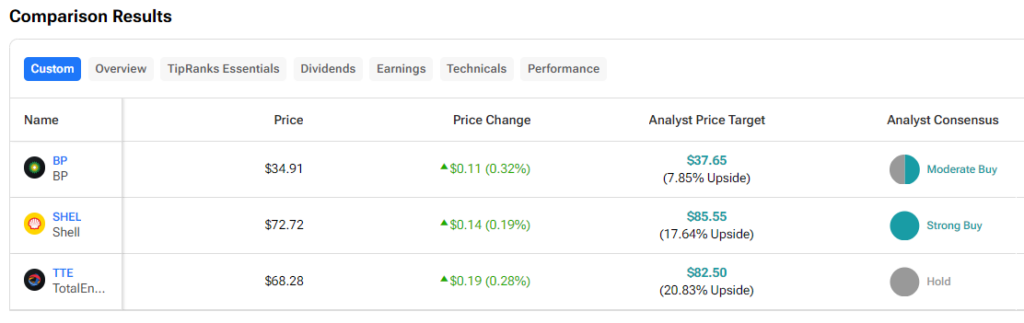

These energy stocks could deliver bumper returns for shareholders in H2 2024 as oil prices stay buoyant. The TipRanks Technical Analysis tool, meanwhile, points to the highest potential upside of around 21% for TTE among the names on our list today.

Read full Disclosure