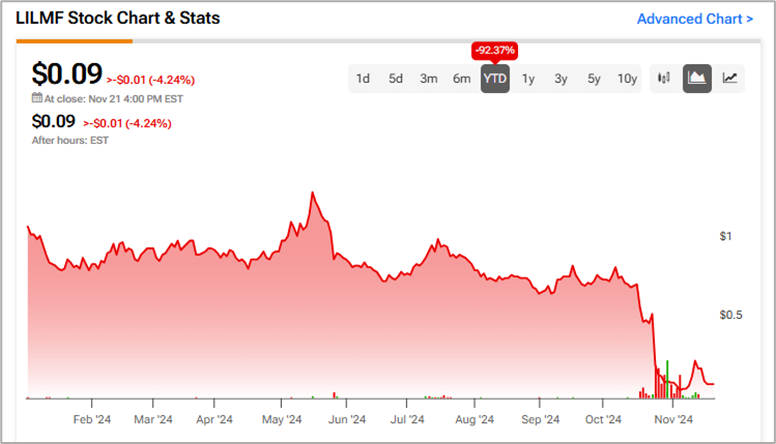

A new complaint was filed against Lilium N.V. (LILMF) by shareholder (plaintiff) Markus Kloster on November 15, 2024, in the U.S. District Court for the Southern District of New York. The defendants in the complaint are the company, CEO Klaus Roewe, and CFO Johan Malmqvist. The plaintiff alleges that he bought LILM stock at artificially inflated prices between June 11, 2024 and November 3, 2024 (the “Class Period”) and is now seeking compensation for his financial losses. To learn more about the lawsuit, click here.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company was delisted from Nasdaq on November 6, 2024, following its insolvency. Prior to the delisting, Lilium’s common stock traded on the exchange under the ticker symbol “LILM.” The stock’s ticker was changed to “LILMF” due to its listing on the OTC market effective November 7, 2024.

Germany-based Lilium N.V. is a start-up company that operates in the aerospace industry. Lilium is engaged in manufacturing sustainable, all-electric vertical take-off and landing jets, called Lilium Jet.

The filed complaint alleges that during the Class Period, the defendants misled Lilium investors in violation of Sections 10(b) and 20(a) of the Securities Exchange Act.

Plaintiff’s Allegations

According to the complaint, Lilium intentionally misrepresented information in its financial statements. In particular, the defendants wilfully misled investors to believe that the company’s efforts to raise funding were taking shape and that it had no debt burden.

For instance, on June 11, 2024, Lilium released a shareholder letter giving a quarterly update. In the letter, Lilium said that it had successfully raised $114 million in a funding round. Plus, the company mentioned that it had pre-orders for planes on “payment plan” terms. Furthermore, Lilium added that this would be enough to fund its operations, while the company awaited final certifications and final payments for the planes.

Additionally, in the quarterly report dated September 30, 2024, Lilium said it had “no substantial debt.” Also, Lilium stated that the financials were prepared assuming that it was a going concern, while the defendants clearly knew the heavy debt burden and the financial stress the company was facing.

Lilium’s Misrepresentations

In contrast to the claims made by Lilium N.V. and its executives, Lilium was not able to raise the required funding to continue its operations. Its subsidiaries were facing insolvency issues and a hefty debt burden.

The information became clear on October 24, 2024, when Lilium reported that its German subsidiaries were going insolvent, following which Lilium would lose control over them. Lilium shares plunged over 159% on the news.

To make things worse, on November 4, 2024, Lilium notified investors that it was unable to raise sufficient funding and was thus compelled to file for insolvency. LILM shares collapsed 37% on the news.

To conclude, the defendants allegedly misled investors about the fund-raising activities, its ongoing debt issues, and the insolvency challenges faced by subsidiaries. All these finally led to the insolvency of Lilium N.V. and its delisting from the Nasdaq, causing massive losses to shareholder returns.