The stock of Stitch Fix (SFIX) is up 10% after the online clothing and personal styling service posted quarterly financial results that beat Wall Street estimates.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

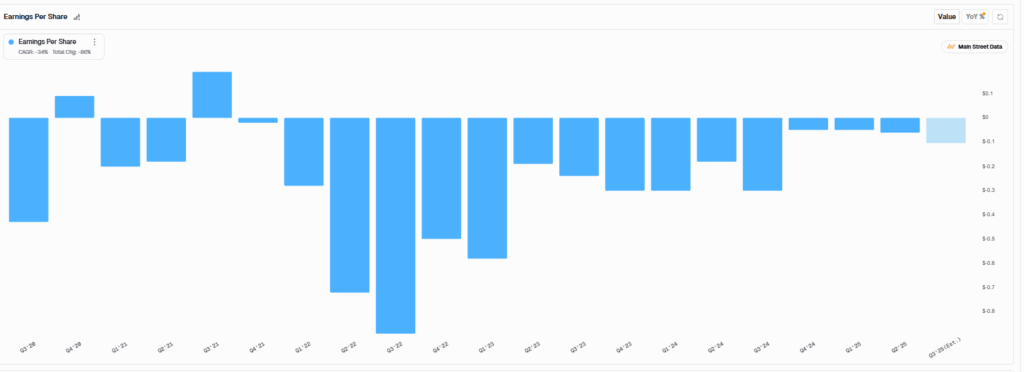

The company, which is not yet profitable, posted an earnings per share loss of $0.07, which was better than the loss of $0.10 that had been forecast on Wall Street. Revenue in the quarter totaled $311.2 million, which topped analysts’ consensus estimate of $304 million. However, sales were down 2.6% from a year earlier.

The San Francisco-based company reported having 2.31 million active clients at the end of what was the year’s second quarter. That was down 199,000 year-over-year. Stitch Fix also reported a free cash flow margin of 0.9% at the end of the quarter, which was the same as a year ago.

The earnings per share of Stitch Fix. Source: Main Street Data

Outlook

In terms of guidance, Stitch Fix said that it expects to report revenue of $335.5 million at the midpoint for the current third quarter. That’s above analyst estimates of $296.7 million in sales. Earnings guidance for Fiscal 2026 is expected to come in at $37.5 million at the midpoint. That’s below analyst estimates that called for $43.1 million.

In the company’s earnings release, CEO Matt Baer highlighted that this was the second consecutive quarter of year-over-year revenue growth for Stitch Fix, calling it a “milestone” for the company. One of the first subscription box companies, Stitch Fix is an online personal styling and fashion service that curates personalized clothing selections for its customers. SFIX stock has gained 30% this year.

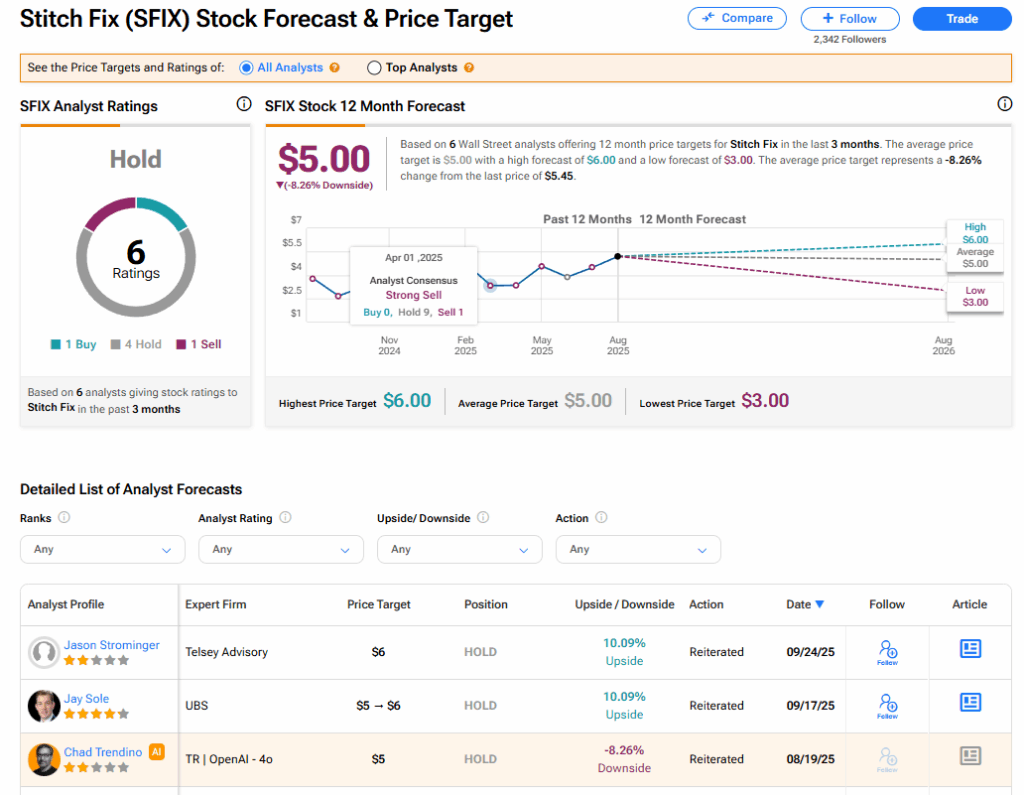

Is SFIX Stock a Buy?

The stock of Stitch Fix has a consensus Hold rating among six Wall Street analysts. That rating is based on one Buy, four Hold, and one Sell recommendations issued in the last three months. The average SFIX price target of $5 implies 8.26% downside from current levels. These ratings could change after the company’s financial results.