Shares of the Japan-based retail holding company Seven & I Holdings (JP:3382) soared over 20% as of writing after it received a record takeover bid from the Canada-based rival firm Alimentation Couche-Tard (TSE:ATD). The takeover, which positions Seven & I as the largest Japanese target ever for a foreign buyout, pushed its market capitalization over $39 billion. Neither party provided details on the value of Couche-Tard’s offer.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Seven & I Holdings is a holding company, managing various businesses through its subsidiaries. It operates 7-Eleven convenience stores. Meanwhile, Alimentation Couche-Tard is a Canadian retail company that operates multiple convenience stores globally and owns the well-known American chain Circle K.

More on Couche-Tard’s Potential Takeover of Seven & I

Seven & I has established a special committee of non-executive board directors to review Couche-Tard’s proposal. The committee can either accept or reject the proposal based on its review.

According to the Financial Times, Couche-Tard has been considering acquiring Seven & I for several years, making intermittent contact over the past two years to initiate friendly deal discussions.

Meanwhile, Seven & I has been collaborating with banking advisers, including Morgan Stanley, to strengthen itself against foreign-led acquisitions. The company is also pursuing restructuring initiatives to improve its global store chains, which includes divesting lower-performing assets.

Hurdles to the Deal

Couche-Tard is expected to encounter difficulties in finalizing the deal, including potential competition hurdles.

Oshadhi Kumarasiri, an analyst from LightStream, expressed skepticism about the takeover proposal’s success. He is doubtful about the completion of the takeover, particularly given Seven & I’s reluctance to divest their legacy businesses. He added that unless the offer includes a significant premium, it seems unlikely that management would entertain Couche-Tard’s proposal.

Is Seven & I Holdings a Good Stock?

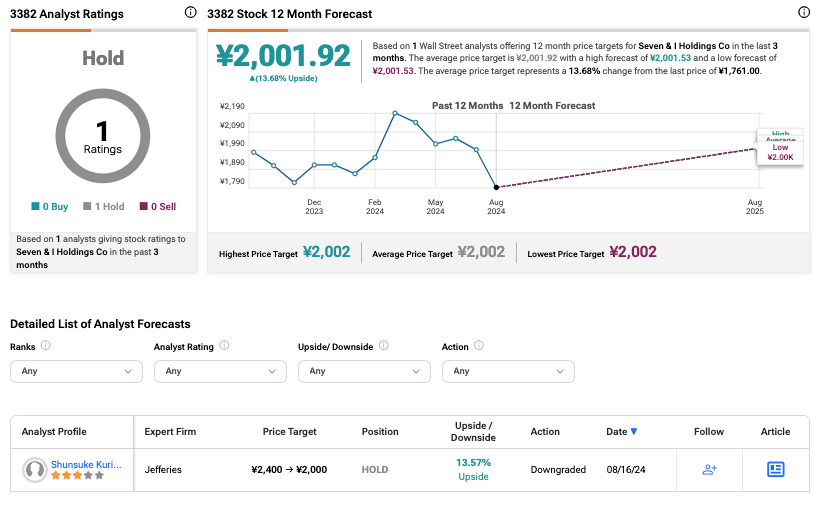

As per the consensus among analysts on TipRanks, 3382 stock has been assigned a Hold rating based on one Hold recommendation from analyst Shunsuke Kuriyama from Jefferies. Kuriyama recently downgraded his rating on the stock from Buy to Hold and reduced the price target from ¥2,400 to ¥2,000. The Seven & I Holdings share price target implies an upside of 13.7% from the current share price level.