ServiceNow (NYSE:NOW) is a cloud computing company that helps businesses increase their productivity. The stock has steadily outperformed the stock market and has gained 222% over the past five years. NOW’s gains exceed 79% over the past year, but the stock has been flat since late January. Despite a flat start, I am bullish and believe a rally is on the way, as the company has a reliable customer base, growing Subscription revenue, and expanding profit margins.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

ServiceNow is projected to report earnings at the end of April, which can be the catalyst that the stock needs to generate some momentum again.

Reliable Customer Base

ServiceNow prioritizes corporations with deep pockets as its customers. The cloud computing firm has 8,100 enterprise customers, which is approximately 85% of the Fortune 500 companies.

The difficulty of switching cloud computing platforms and finding a competitor worth the effort means ServiceNow can count on steady revenue from these customers. The platform’s 99% renewal rate cements this point, as most clients continue to use the product instead of canceling their subscriptions.

ServiceNow continued to grow in 2022 when many businesses were cutting back and reporting headwinds due to interest rate hikes and other factors. ServiceNow reported 23% year-over-year revenue growth in full-year 2022.

The company’s success in 2022 highlights the strength of its customer portfolio and how reliant enterprises have become on its Now Platform.

Subscription Revenue Continues to Grow

Revenue growth continued in 2023 once macroeconomic headwinds started to ease. Q4-2023 revenue increased by 26% year-over-year, while full-year 2023 revenue jumped by 24% year-over-year. Additionally, Subscription revenue growth remained elevated, while the company’s much smaller Professional Services and Other Revenues segment saw some year-over-year declines.

Subscription revenue is the main driver and is attributed to 96.8% of full-year 2023 revenue. Leadership decided to raise its 2024 Subscription revenue guidance. The company is anticipating a 24-24.5% year-over-year growth rate for Q1-2024 revenue. ServiceNow exceeded revenue guidance in the previous quarter and can do so again.

Artificial intelligence initiatives can also increase revenue by attracting new customers and giving existing clients more reasons to stick around and pay higher prices. The Now Assist generative AI portfolio helped ServiceNow see the largest net-new annual contract value contribution “for a first quarter of any new product family release,” according to the company.

Profit Margins Are Expanding

Revenue growth can generate plenty of excitement, but earnings growth is necessary to justify high valuations. ServiceNow shares aren’t cheap from a value investing perspective since they trade at a 93x P/E ratio. However, the stock’s 58x forward P/E ratio demonstrates earnings are growing and can make the valuation more reasonable for long-term investors.

Earnings growth has outpaced revenue growth for several quarters, including Q4 2023. While revenue increased by 26% year-over-year, net income almost doubled year-over-year to reach $295 million.

ServiceNow’s scalability will help to deliver higher net profit margins in the future. The company is working on growing its customer base, but existing customers have also been improving the company’s profit margins.

ServiceNow’s existing customers have been upgrading their plans to receive more features. The company closed Q4 2023 with 1,897 customers that had annual contract values above $1 million. Moreover, the company closed 168 new transactions with this annual contract value in the quarter, up 33% year-over-year.

The average annual contract value among these customers is also increasing. This customer pool went from paying an average of $4.1 million in Q4 2022 to $4.5 million in Q4 2023. ServiceNow has been able to generate more money from its customer base while maintaining an impressive 99% renewal rate.

Is NOW Stock a Buy, According to Analysts?

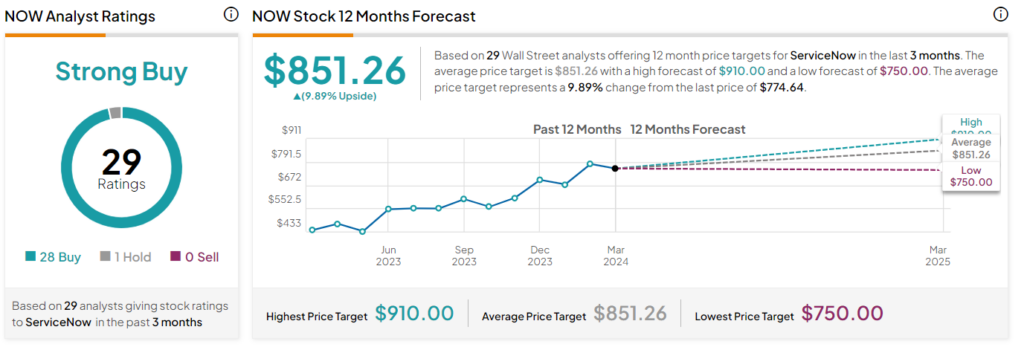

Analysts are feeling bullish on the stock, giving it a Strong Buy rating. No analyst rated it as a Sell, while 28 analysts rated it as a Buy. Only one analyst rated ServiceNow stock as a Hold. The average ServiceNow stock price target suggests 9.9% upside from the current price.

The Bottom Line on ServiceNow Stock

ServiceNow has a history of outperforming the stock market but has remained flat since the end of January. I believe it’s unlikely that the stock will remain flat for long, and an April earnings report can reignite the stock’s momentum.

A healthy subscription model with a 99% renewal rate and rising annual contract values gives the company many ways to increase its revenue and earnings. Profit margins have been expanding considerably and can improve the stock’s valuation. ServiceNow continued to grow in 2022, even with rapid interest rate hikes and other headwinds.

The company has a large moat and is using artificial intelligence to strengthen its position. Therefore, the stock has the potential to deliver strong returns for long-term investors.