Perhaps the truest basis of the PC gaming market is the processor. Of course, there are numerous other vital components, but without that processor, PC gaming just does not go very far. And chip stock Intel (INTC) may have something special in this vein prepared for the upcoming Nova Lake lineup. The news left shareholders a bit less than enthusiastic, as shares slid just over 1.5% in Wednesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

So what will be so big about the Nova Lake lineup? Apparently, Intel is taking a page out of rival Advanced Micro Devices’ (AMD) book, and adding a powerful new cache to its operations. The result? A new processor that could match, or even exceed, some of the best that AMD can put out.

Intel has been struggling, losing market share against AMD’s mounting threat in the consumer market space for some time now. But if the Nova Lake platform comes out with cache improvements—specifically a boost to the bLLC, big Last Level Cache—the result could be a marked improvement over previous processors and a product line that could win some players back to Intel. That is a development sorely needed as Intel cuts costs like soccer moms cut coupons.

A New Team-Up

Moreover, Intel is also working to develop its consumer chops with some new team-ups as well. In fact, Intel recently got together with HP (HPQ) to give the EliteBook X and EliteBook Ultra the ability to pack some artificial intelligence into these already potent systems. In fact, reports from Intel noted, this combination of Intel software and new AI assistants hit Windows-based PCs for the first time ever.

The end result was a laptop that offered several AI-enhanced applications, doing just about everything from improving users’ privacy to making them more productive. And, better yet, all those tools would run effectively across several different HP devices, all thanks to Intel’s underlying architecture.

Is Intel a Buy, Hold or Sell?

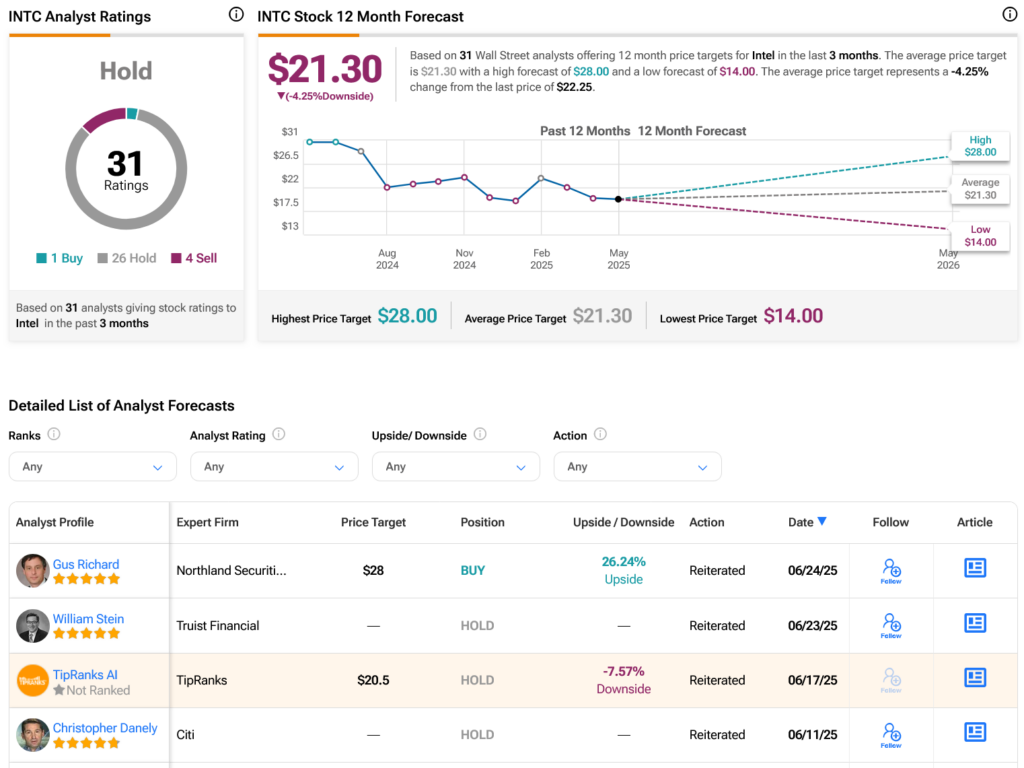

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 26 Holds and four Sells assigned in the past three months, as indicated by the graphic below. After a 26.16% loss in its share price over the past year, the average INTC price target of $21.30 per share implies 4.25% downside risk.