Senator Ron Wyden (D-Ore.), a senior member of the Senate Finance Committee, accused Pfizer (PFE) of carrying out what he described as potentially the biggest tax-dodging scheme in pharmaceutical history. He claimed that in 2019, despite selling $20 billion worth of drugs in the U.S., Pfizer reported zero taxable profit in the country by attributing all of its earnings to offshore operations. Wyden said this allowed the company to avoid paying billions in U.S. taxes in a single year.

According to the Senator, this alleged scheme was even larger than those of other drug companies like AbbVie (ABBV), Amgen (AMGN), and Merck (MRK). As a result, he called Pfizer’s tactics a “national-scale scam” and said that Americans should be outraged. The findings come from a broader Senate investigation into how large pharmaceutical companies use tax laws to minimize their U.S. obligations.

In response, Pfizer pushed back on the claims by stating that the report was based on incomplete information and didn’t reflect how the company’s taxes were affected by the 2017 Tax Cut and Jobs Act. A spokesperson said that most of Pfizer’s global income is still taxed in the U.S. and that the company paid $12.8 billion in U.S. income taxes over the past four years.

Is Pfizer a Buy, Sell, or Hold?

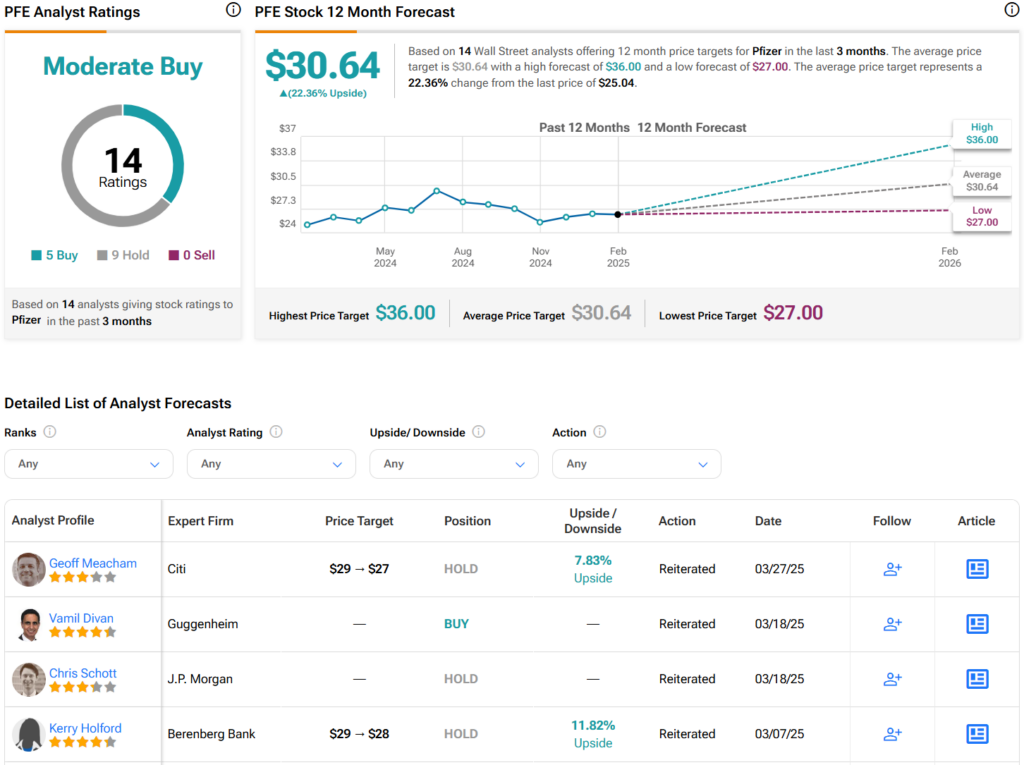

Turning to Wall Street, analysts have a Moderate Buy consensus rating on PFE stock based on five Buys, nine Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average PFE price target of $30.64 per share implies 22.4% upside potential.