In an unexpected shift, the Trump administration decided to pause tariffs for 90 days on most countries—excluding China—on Wednesday. This move was seen as a response to recent market volatility, which may have pressured officials to ease trade tensions. UBS’s global research team noted that the delay suggests the U.S. is not looking to escalate trade disputes with every trading partner, at least for now. Unsurprisingly, the tariff pause triggered a strong market reaction, with Wall Street experiencing its biggest one-day gain since the 2008 financial crisis. Despite the rally, UBS analysts are staying cautious.

Indeed, although they believe that the risk of a severe market downturn has been reduced, they said uncertainty about trade policy still makes markets fragile. UBS warned that even the softened tariffs could still hurt economic growth and that corporate earnings could take a hit as companies adjust to new costs and supply chain disruptions. “We believe even these reduced tariffs will imply a serious hit to growth,” the team wrote in a note to clients Thursday morning.

Looking ahead, UBS warned that the market may not revisit its recent highs anytime soon and expects downward revisions to corporate earnings forecasts to continue as businesses reassess their outlooks. While the tariff delay may have helped avoid deeper damage in the short term, the firm believes the smarter move is to remain cautious and defensive. As a result, the firm recommends taking advantage of short-term rallies to reduce risk exposure and waiting for greater clarity on trade policy before turning bullish again.

Is SPY a Buy Right Now?

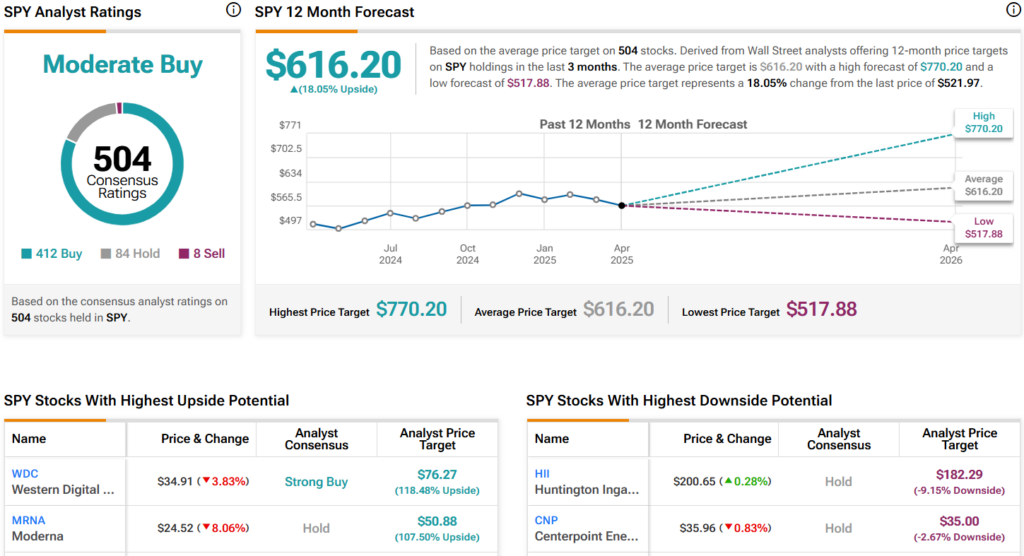

Turning to Wall Street, analysts have a Moderate Buy consensus rating on the SPDR S&P 500 ETF Trust (SPY) based on 412 Buys, 84 Holds, and eight Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average SPY price target of $616.20 per share implies 18.1% upside potential.