Whether the markets are rallying or retreating, income investors often look beyond the headlines to find reliability – and that’s where Business Development Companies, or BDCs, come in. These firms are structured to return capital to shareholders, often through substantial dividend payouts supported by steady investment income. For those seeking high yields, BDCs can offer a solid combination of predictability and income-generating power.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

These companies specialize in providing credit to small and mid-sized private businesses that often fall outside the reach of traditional lenders. In return, BDCs generate interest income – most of which is returned to shareholders in the form of dividends. And thanks to their floating-rate loan portfolios, many BDCs are well-positioned to benefit in higher-rate environments.

Analyst Sean-Paul Adams of B. Riley sees opportunity here, pointing to two BDCs with high-yield dividend payouts – one as high as 13%. We used the TipRanks platform to see how the rest of Wall Street views these names. Let’s take a closer look.

Trinity Capital (TRIN)

First up is Phoenix-based Trinity Capital, an alternative asset manager with a global footprint and $2.1 billion in assets under management at the end of Q1 this year. The company acts as a business development corporation, and makes private capital available to smaller firms that may have difficulty entering the traditional banking system. Trinity typically works with emerging growth-oriented client firms as a provider of venture debt and equipment financing; since its founding, Trinity has made available $4.3 billion in such funding.

Trinity works across five distinct verticals: tech lending; life sciences; equipment finance; sponsor finance; and asset-based lending. The company vets its investment targets carefully and selects them to ensure that Trinity shareholders receive solid returns on their own investments. The results of this strategy can be seen in Trinity’s long-term return data. The company has paid out consistent or increased dividends in each of the last 21 quarters, and since its 2021 IPO, the company has paid out a total of $337 million in cumulative dividend distributions.

The company’s most recent dividend was paid out on April 15, at a rate of 51 cents per common share. This marked the fifth quarter in a row with the dividend at that rate. The annualized payment of $2.04 per common share gives a forward yield of 13.8%.

That dividend is supported by Trinity’s investment and lending activities. At the start of 1Q25, the company had $125.6 million invested in 19 existing portfolio companies; by the end of the quarter, Trinity had added $94.8 million worth of investments in 6 additional companies. Trinity realized a total investment income of $65.4 million from this activity, a total that was up 30% year-over-year, although it missed the forecast by $2.5 million. At the bottom line, Trinity’s GAAP net investment income of 52 cents per share was 13 cents better than expectations – and it fully covered the above-noted dividend.

For B. Riley analyst Adams, in his coverage of this stock, the key point is Trinity’s success in building its business model. He believes the company will continue to build value for investors, and writes, “We believe the company’s differentiated venture focus, strong risk-adjusted yields, and continued momentum in the pace of originations and platform growth provide meaningful upside potential in the near term.”

Based on this stance, Adams rates Trinity as a Buy, with a $16 price target that points toward a one-year upside potential of 8%. Add in the dividend yield, and the total one-year return may reach ~22%.

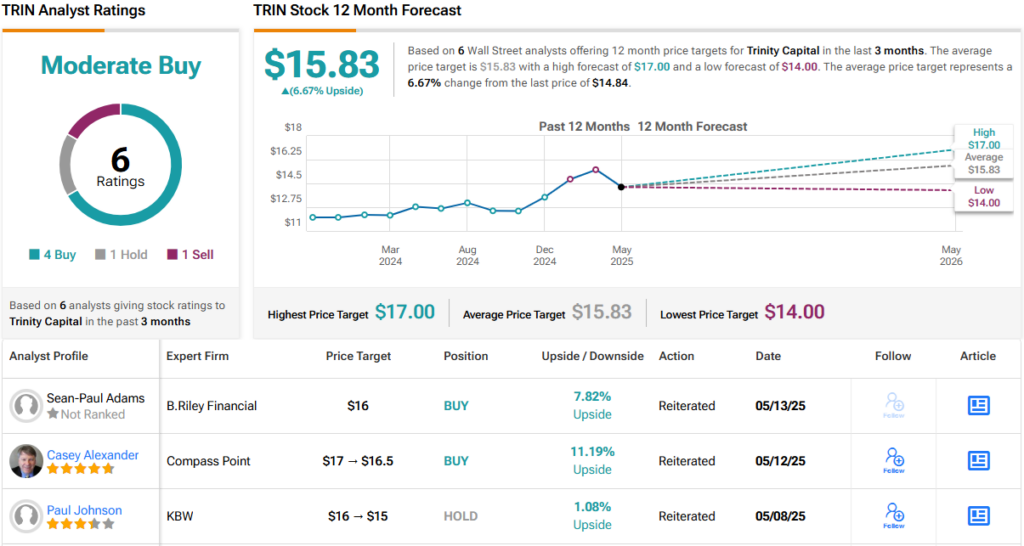

Overall, there are 6 recent analyst reviews on record for TRIN shares, and their breakdown – 4 Buys, 1 Hold, and 1 Sell – gives the stock its Moderate Buy consensus rating. The shares are priced at $14.84 and have an average price target of $15.83, implying a 7% increase for the year ahead. (See TRIN stock forecast)

Sixth Street Specialty Lending (TSLX)

Next on our list is Sixth Street Specialty Lending. This firm is a finance company, offering a combination of credit and financial services to middle-market private enterprises. These are the companies that have for decades been in the driver’s seat of the American economy, but they cannot operate without access to reliable capital and credit. Sixth Street exists to help meet that need – and in doing so, to generate profits and returns for its own investors.

Sixth Street focuses on US-domiciled firms as its client base, and since it started operations in 2011 the company has originated an aggregate of approximately $47.5 billion in loan principal. These loans generate current income for Sixth Street, while providing support for its clients. Sixth Street’s portfolio is composed mainly of direct origination senior secured loans, but also includes mezzanine and unsecured loans, as well as corporate bond and equity security investments. The bulk of this portfolio, 97%, bears floating-rate interest, which helps to hedge the portfolio against inflation.

At the end of 1Q25, this specialty lender’s portfolio boasted a fair value of $3.412 billion, a sum that was spread across 115 portfolio companies. Sixth Street’s return from these investments was summed up in the quarterly financial release, which showed that in 1Q25 the company saw a total investment income of $116.3 million, down slightly from the $117.8 million figure reported in 1Q24. The company’s bottom line net investment income came to 62 cents per share.

That net investment income was more than sufficient to cover the company’s declared dividend in full. On April 30, Sixth Street declared a base quarterly dividend of 46 cents per share, for Q2, to be paid on June 30; in addition, the company declared a supplemental variable dividend for Q1, of 6 cents per share to be paid on June 20. The base dividend gives an annualized rate of $1.84 and a forward yield of 8.3%; with the supplement, the total 52-cent dividend annualizes to $2.08 and gives a forward yield of 9.3%. Sixth Street has been paying dividends since 2011, and has been providing supplementary payments since 2017.

Turning again to Adams and the B. Riley view, we find the analyst impressed with Sixth Street’s reliable returns. He writes of the stock, “TSLX continues to deliver consistent ROEs with a conservative earnings outlook. We believe the company’s disciplined approach to both sponsor and non-sponsor originations positions it well across market environments, given the large downtick in sponsor deal flow in the space.”

To this end, Adams rates TSLX as a Buy, and he complements his rating with a $23 price target that implies a 12-month gain of just 1.37%. Together with the base dividend yield, this brings the total potential one-year return to ~11%.

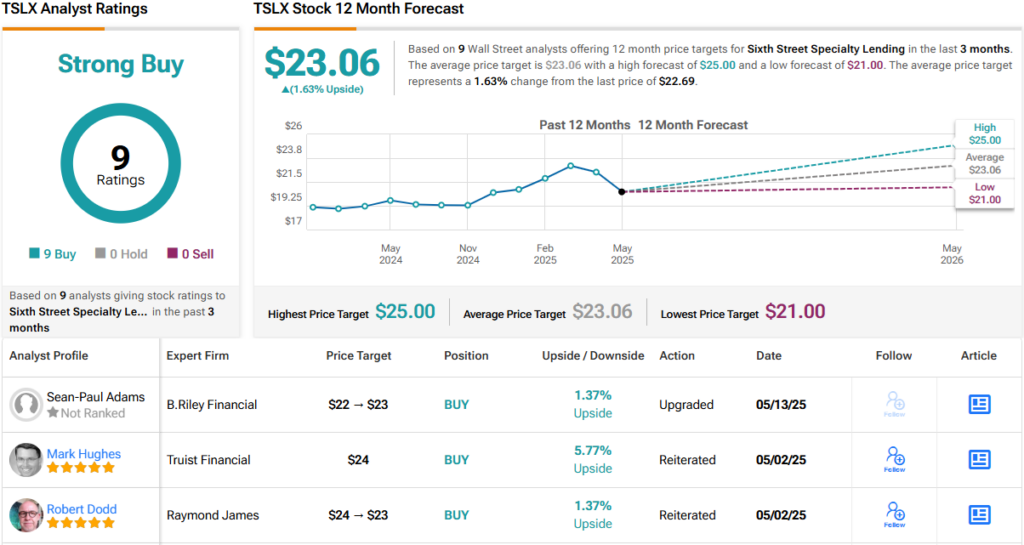

Overall, TSLX stock gets a Strong Buy consensus rating from the Street, based on 9 recent reviews with a lopsided 8 to 1 split favoring Buy over Hold. The stock is trading for $22.69 and has an average target price of $23.06, implying a modest ~2% gain by this time next year. (See TSLX stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.