For weeks, stocks have been volatile amid escalating uncertainties about the U.S. economic trajectory. With a trade war brewing between the U.S. and its key trading partners, the specter of rising inflation looms large, threatening to squeeze consumers and businesses alike. Amid these fears, investors are bracing for the possibility that the market could tumble into a significant correction.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

It’s an environment that has investors looking to defend their portfolios, and that, in turn, has them turning to dividend stocks. These are the traditional defensive play, and as part of a diversified portfolio strategy, strong dividend payers provide a protective cushion for investors along with a reliable income stream.

The best dividend stocks offer a combination of reliability and attractive yields. We’ve opened up the TipRanks platform to look at two such dividend stocks that have recently received analyst recommendations, with one yielding as high as 11%. Here’s a closer look.

Ellington Financial (EFC)

We’ll start in the world of REITs, real estate investment trusts, which is a good place to look for dividend champs. These companies work in the acquisition, ownership, and management of real properties, act as originators or investors in mortgages and mortgage-backed securities, or operate as a combination of all of these. While Ellington invests in a wide range of financial assets, the company sets a strong focus on mortgage loans and mortgage-backed securities in both the residential and commercial markets. Ellington also invests in debt and equity instruments in loan origination companies.

Looking at a key metric, we find that Ellington has approximately $13.7 billion in total assets under management as of this past December 31. The company prides itself on the quality of its experience, and its senior portfolio managers have an average of 30 years of industry experience. Ellington boasts that its management team is among the most experienced in the MBS sector.

This combination of strong management with a diversified, return-oriented investment strategy has allowed Ellington to build a reputation as a solid dividend stock. The company makes these payments monthly rather than quarterly, presenting an alternative for investors seeking a more rapidly paced income stream. Its last dividend payment, made on February 25, was for 13 cents per common share; the next two payments are scheduled for March 25 and April 25. At the 13-cent rate, the dividend annualizes to $1.56 per share and gives a forward yield of nearly 12%.

The company’s dividend is supported by its financial results – and even though Ellington missed the forecast on revenue in 4Q24, its last reported period, the company’s bottom line beat estimates and was enough to fully cover the dividend. Ellington reported total revenue of $106.74 million for the quarter, a total that was $6.14 million lower than expected; the non-GAAP EPS of 45 cents, however, was 7 cents better than anticipated and significantly higher than the total quarterly dividend of 39 cents.

For analyst Michael Diana, of Maxim, the key point here lies in the stock’s potential for returns. He notes that EFC’s combined dividend-plus-share appreciation is high, writing, “Over the next four quarters, we expect: 1) a dividend yield of 11.5%; and 2) stock price appreciation of [13]% (to our $15 price target)… In our view, EFC has a strong track record of preserving BV, especially in downturns and dislocations such as the 2008/2009 financial crisis, the so-called ‘taper tantrum’ in 2013, and the pandemic… We believe that the $0.39 quarterly dividend level is sustainable as core earnings already cover the dividend and could increase as leverage increases.”

Diana’s $15 price target aligns with his confident Buy rating on the stock. (To watch Diana’s track record, click here)

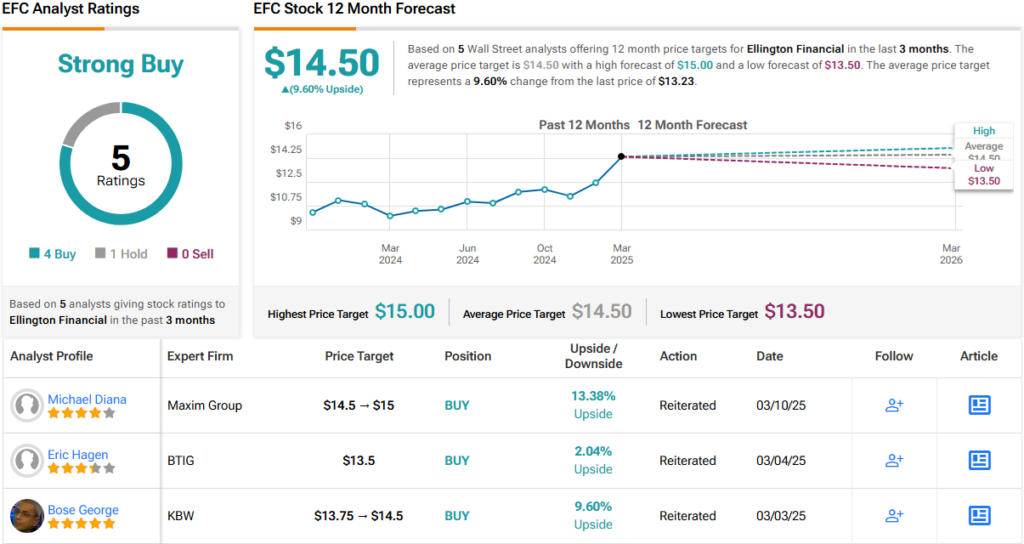

Overall, EFC has a Strong Buy consensus rating, based on 5 recent analyst reviews that include 4 to Buy and 1 to Hold. The stock is priced at $13.23, and its average target price of $14.50 suggests a 12-month gain of ~10%. (See EFC stock forecast)

Global Medical REIT (GMRE)

Next up is another REIT, this one with a focus on various medical properties and facilities. Global Medical REIT targets quality properties in the healthcare system, emphasizing those operated by profitable healthcare systems and physician groups. The company’s complete footprint includes 190 buildings across the US, comprising a total of 4.76 million square feet of leasable space. Global has 403 lease agreements with tenants and operates on a net-lease model.

Put into dollar terms, this portfolio includes $1.45 billion in assets, of which the largest categories are Buildings, valued at $1.04 billion, and Land, valued at $174 million. As of the end of this past December, Global’s portfolio had a leased occupancy rate of 96.4%.

This strong portfolio generated sound financial results in 4Q24. The quarterly revenue of $36.2 million was up 6.7% from the prior-year period, while the adjusted funds from operations – one of the key metrics in dealing with property-owning REITs – came in at 22 cents per share, or 2 cents above the forecast. That last is important to dividend investors, as it fully covers the 21-cent common share dividend payment.

That dividend was declared on February 27 and is scheduled for payment this coming April 9. With an annualized rate of $0.84 per share, the dividend features a solid forward yield of 9.7%, more than enough to spark investor interest.

The strong adjusted funds from operations (AFFO) was one factor that sparked interest from Compass Point analyst Merrill Ross. Ross notes how this metric is now performing better than in recent years and goes on to chart out an upbeat course for Global Medical REIT.

“The bond market rally supports our belief that CRE transaction activity, whether in the form of sale/ leasebacks with property owners or the acquisition of existing leases, could accelerate, making 2025 into the year when GMRE’s AFFO run rate can be restored to (or slightly better than) 2022 results. For the past two years, AFFO contracted slightly as the company divested of certain assets and maintained discipline in acquiring… We think the return to the acquisition theme that had been part of GMRE’s business model — in addition to the easing cycle that makes its dividend more attractive — could trigger a re-valuation of the stock and compression in the cap rate used to discount stronger NOI,” Ross opined.

These comments back up Ross’s Buy rating here, while her $12.50 target price points toward a 12-month upside potential of 49%. With the dividend yield, the total one-year return here can approach 59%. (To watch Ross’s track record, click here)

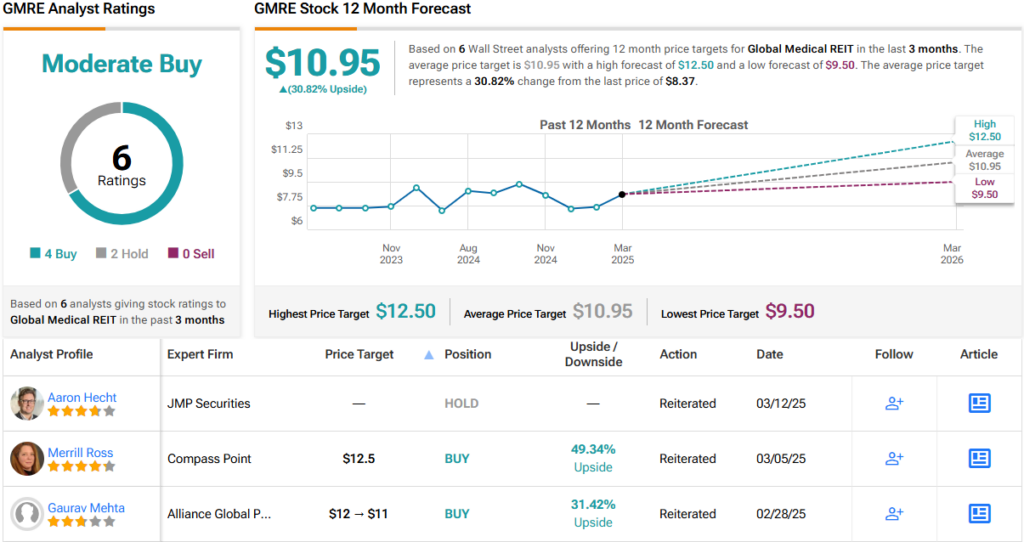

All in all, this stock’s Moderate Buy consensus rating is derived from 6 recent analyst reviews that break down 4 to 2 in favor of Buys over Holds. The shares are currently priced at $8.37, and their $10.95 average target price implies that the stock will gain ~31% in the year ahead. (See GMRE stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue