Finding the best returns is the point of stock investing. It’s why people get into the markets. But ensuring strong returns isn’t always as straightforward as it seems. Sometimes, the winning play is a combination strategy.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Investors frequently look for stocks with solid upside potential, and shares that will show a double-digit upside are popular – they’ll generate income, beat inflation, and provide a real rate of return. The other place to look for those attributes, outside of share price appreciation, is in dividend stocks. These income-sharing payments can range from the miniscule to the huge; the best will combine reliability with an inflation-beating yield.

The stock analysts at Goldman Sachs like both strategies – and firm analyst Chandni Luthra is willing to combine these approaches to find solid portfolio choices. So, for investors seeking high dividend yields combined with double-digit upside potential, she has come up with two stocks to consider buying. Let’s delve into the TipRanks database and take a closer look.

Camden Property Trust (CPT)

First on our list is Camden Property Trust, a real estate investment trust (REIT) with a focus on apartment homes and multi-family properties. Camden’s operations revolve around the ownership and construction, acquisition and management, and development and redevelopment of its apartment communities. As of this past January, the company had 172 properties in its portfolio, with a total of 58,634 apartment units.

Based in Houston, Texas, Camden boasts locations and offices in some of the country’s fastest growing urban areas. These include Washington DC, Nashville, Denver, Charlotte, and Phoenix, as well as south Florida.

Camden, like all REITs, has felt pressure in the past year from higher interest rates, and the consequent increase in the cost of real estate mortgages and other loans. The overall pressure on the real estate industry has created a difficult environment for Camden and its peers. The most recent headwind came from the Federal Reserve directly, when the central bank at its last policy meeting held rates steady at the 5.25% to 5.50% range, and indicated a cautious attitude toward potential rate cuts.

However, Camden also delivered solid results in its recent 4Q23 financial release. The company showed a revenue total of $387.6 million, in-line with the forecast and up some 3% year-over-year. At the bottom line, the company reported a core FFO (funds from operations, a key metric in the REIT sector) of $1.73. This was down a penny from the prior year quarter, but like the revenues, it met expectations.

The FFO also fully covered Camden’s dividend payment, which was bumped up in the last declaration by 3% to reach $1.03 per common share. At an annualized payment of $4.12 per share, the dividend gives a forward yield of 4.4%, more than enough to beat inflation and ensure a real rate of return. The increased dividend is scheduled for payment in April.

For Goldman analyst Chandni Luthra, covering the REIT sector for the bank, this stock appears capable of weathering the current headwinds. She writes of Camden, “We acknowledge supply headwinds facing CPT’s markets, but note i) peak supply pressure (from new deliveries and lease-up) is just around the corner (2Q24) and the headwinds should moderate from there on; ii) demand trends have been holding better-than-expected, and signed new lease trends (indicator of February and March) showed acceleration from effective rent growth in January; iii) bad debt is improving in 2024. Finally, at the current levels, we think that valuation has bottomed out, and see the multiple gap to coastal names narrowing from here as we get past peak supply and demand remains healthy.”

Summing up, Luthra puts a Buy rating on these shares, with a $112 price target that points toward a one-year upside potential of 19.5%. With the dividend added in, the return here may exceed 23% in the coming year. (To watch Luthra’s track record, click here)

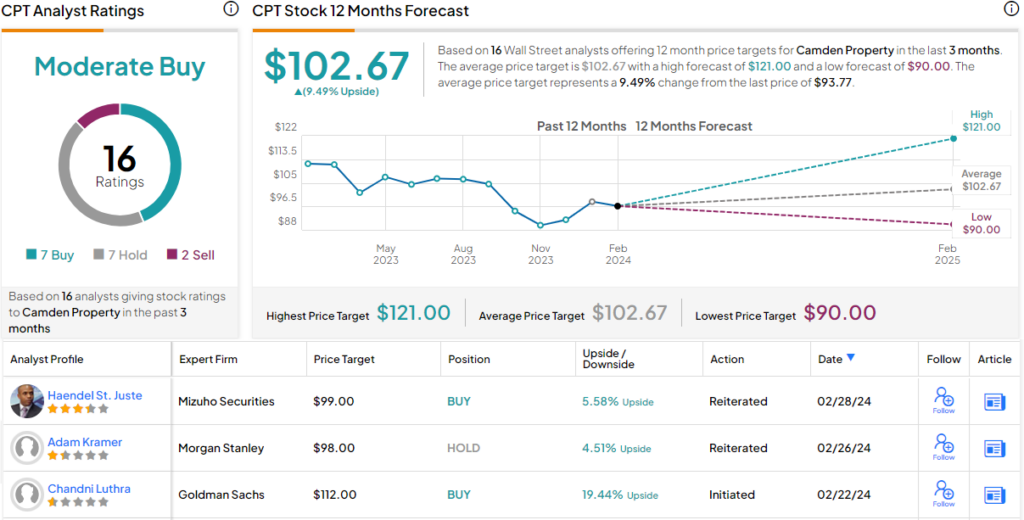

For the Street generally, this stock has a Moderate Buy consensus view, a rating based on 16 recent analyst recommendations, including 7 Buys and Holds, each, and 2 Sells. The shares are priced at $93.77 and the $102.67 average price target suggests a 9.5% increase in share price over the next 12 months. (See Camden stock forecast)

Mid-America Apartments (MAA)

Next on the list is Mid-America Apartments, one of the largest owners of apartment complexes in the US. Mid-America’s operations and properties are focused mainly in three regions, the Mid-Atlantic, the Southeast, and the Southwest. In these areas, as of the end of 2023, the company had ownership interests in 102,662 apartment units. This figure includes apartment communities that are currently under development. On the map, Mid-America has properties in 16 states plus the District of Columbia.

Mid-America is based in Tennessee, from where it manages its portfolio of sunbelt properties. The company bases its portfolio acquisitions on a combination of balance and diversity, to maximize revenues and income, and in 4Q23, the last period reported, had a top line figure of $542.25 million. While up 2.7% year-over-year, this top line just missed the forecast, by $1.1 million. At the bottom line, MAA reported a core FFO $2.32 per share; this was flat year-over-year and a penny better than the forecast had called for.

Like Camden above, MAA’s funds from operations more than covered the current dividend declaration – even after an increase in the payment. The last dividend, which was paid out on January 31 of this year, was set at $1.47 per common share, an increase of 5% on the previous payment. The new dividend annualizes to $5.88 per share and gives investors a forward yield of 4.67%.

For Goldman’s Luthra, the key point to remember on Mid-America is that the headwind pressures have likely peaked, and that the company’s situation will improve over the course of the coming year. She says of the stock, “Looking into 2024, based on our proprietary supply analysis, MAA is positioned unfavorably within our coverage — for every existing MAA building, there are 3 new buildings in close proximity in 2023-24. However, looking at the cadence of supply indexed to 1Q23 for MAA — a year when supply started coming online meaningfully — supply pressures peaks in 1H24, and starts to moderate afterward. More so, multifamily starts have declined -25% on average in the past 6 months, boding well for demand dynamics in the out years. We understand that rent growth in MAA’s markets will be pressured this year as newer constructions undergo lease-up, but we think this dynamic is already reflected in valuation, and with the second derivative of rent improving, we think the extent of current valuation discount is excessive.”

These comments support her Buy rating, while Luthra’s $149 price target implies a gain of 18.5% on the one-year time horizon. With the share upside and dividend yield taken together, this is another stock whose total return may reach above 23%. (To watch Luthra’s track record, click here)

That’s the bullish take. The Street isn’t quite ready to go there; this stock has a Hold from the analysts’ consensus, based on 15 reviews that include 4 Buys, 10 Holds, and 1 Sell. Still, there’s double-digit upside projected here; the shares have a current trading price of $125.83 and their $140.89 average price target indicates room for 12% share price growth over the course of the next 12 months. (See MAA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.