This month started with President Trump’s tariff announcement sparking worries about trade wars, a weak dollar, and a possible recession. However, since the April 8 low, the S&P 500 has staged a rally, climbing 11%, after the Trump Administration signaled its willingness to de-escalate the tariff competition, and Beijing responded in kind. Add in a Q1 earnings season delivering more upside surprises than expected, and suddenly, optimism is making a comeback.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

It’s still too early to call it a full recovery, but if momentum holds, this could turn into a self-sustaining rally, which will offer plenty of opportunities for investors to maximize their income.

One popular way of boosting portfolio income, whether stocks go up or down, is investing in dividend stocks. The best dividend stock offers a combination of reliable payments, high yields, and share price growth – sound attributes for any income stream.

Wall Street analysts are on board, suggesting two strong dividend stocks with yields north of 14%. According to the TipRanks database, both stocks also offer a solid double-digit upside potential over the next year. Let’s dive in and take a closer look.

Angel Oak Mortgage (AOMR)

The first stock we’ll look at is Angel Oak Mortgage, a real estate investment trust (REIT), whose main business thrust is in the acquisition of first-lien non-QM loans and other mortgage-related assets from the U.S. mortgage market. Through these investments, Angel Oak has built and maintains a portfolio capable of generating attractive risk-adjusted returns for its shareholders, returns that are realized through cash distributions – dividends – combined with capital appreciation. The company’s key strength is its ability to maintain these returns across interest rate and credit cycles.

Angel Oak is an externally managed REIT, and is affiliated with the larger company Angel Oak Capital Advisors LLC, an alternative credit manager that counts a vertically integrated mortgage origination platform among its subsidiary assets. Through this connection, Angel Oak Mortgage REIT has connections to all aspects of the mortgage business, from sourcing and acquiring loans, to allocating assets and managing the portfolio. The connection with Angel Oak Capital Advisors provides a key advantage for the mortgage REIT.

As noted, Angel Oak Mortgage REIT is committed to strong capital returns, particularly to the dividend. The company last declared the dividend payment on February 6 of this year and paid it out on February 28, at a rate of 32 cents per common share. At that rate, the dividend annualizes to $1.28 per share and gives a powerful yield of 15%. This most recent declaration marked the 10th quarter in a row for the 32-cent dividend payment.

Angel Oak supports its dividend with sound financial results. The company’s last release covered 4Q24, and in that report it showed a top line, the net interest income, of $9.9 million. This was up 20% year-over-year and was in line with the market’s expectations. At the bottom line, the company reported a Distributable Earnings of 42 cents — 16 cents per share better than the forecast and more than enough to fully cover the dividend.

For B. Riley analyst Randy Binner the key points here are Angel Oak’s high dividend yield and the overall portfolio quality. He writes, “The dividend yield, plus our implied return to target, sets up a favorable risk-reward in our view. We forecast another good quarter of NII generation and will look for updates on non-QM growth opportunities in light of potential changes at the GSEs. 10-yr Treasury yields moved from 379bps to 457bps in 4Q24, lowering economic book value from $14.02 to $13.10 at YE24. Given that rates moved lower in 1Q25 and the 10-year ended at 421bps, we expect to see some recovery in BVPS…”

“We believe the portfolio has prepayment/refi protection as mortgage rates in the underlying portfolio are weighted towards higher coupons. Delinquency trends were favorable in 4Q24, and we expect that trend to continue in 1Q25, given our view that residential mortgage is among the better credit risk areas, as other areas have seen spread widening,” the analyst added.

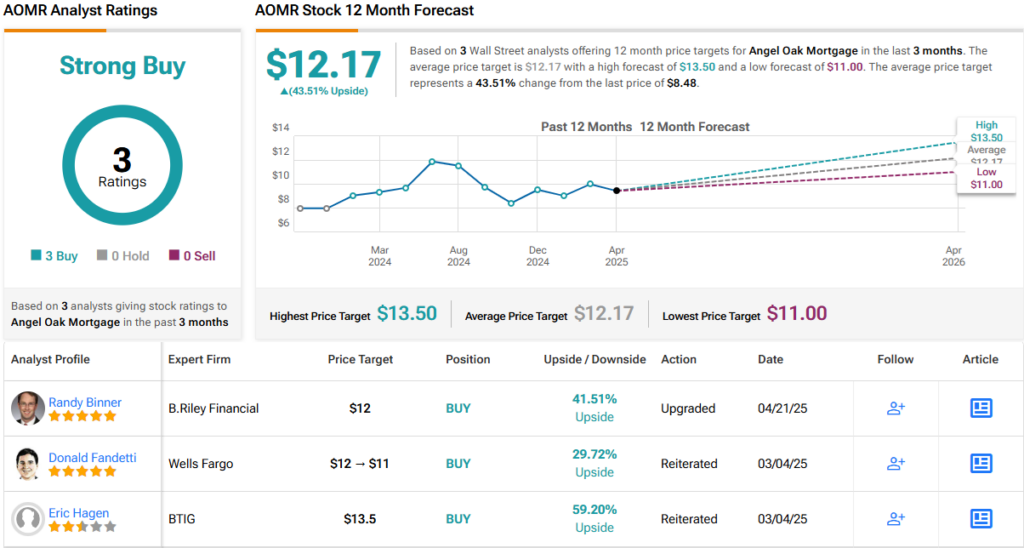

These comments support Binner’s Buy rating on the stock, while his $12 price target points toward a potential one-year upside of 41%. Together with the dividend yield, the total return on this stock can reach as high as 56% for the coming year. (To watch Binner’s track record, click here)

Overall, there are 3 recent analyst reviews on record for Angel Oak Mortgage REIT, and they are unanimously positive for a Strong Buy consensus rating. The shares are currently priced at $8.48 and their $12.17 average price target implies a 43% upside by this time next year. (See AOMR stock forecast)

TXO Energy Partners (TXO)

Next on our list is an energy company, TXO Energy Partners. Like mortgage REITs, energy production firms like TXO have a reputation for delivering strong dividends. TXO earns the income that supports its dividends from the solid hydrocarbon acreage positions in several of the nation’s best energy-producing regions. These include the Williston Basin of North Dakota and Montana; the San Juan Basin, straddling the Four Corners; and the famous Permian Basin along the Texas–New Mexico border. The company prioritizes its acreage holdings by several factors, including low geologic risk, low decline rates, and high recoveries, all relative to drilling and completion costs.

This strategy has led TXO to build up a portfolio of profitable plays in both oil and natural gas, capable of generating benefits for the company and returns for shareholders. Company management has focused its land buys to acquire proven oil and gas production locations, in areas with long and well-known records of hydrocarbon generation. The goal is to build an energy portfolio that is more predictable and reliable than the higher-risk unconventional recovery plays.

On the financial side, TXO realized $109.3 million in net cash provided by operating activities during calendar year 2024. That top-line figure provided a solid sum of cash available for distribution: $79.1 million. The total cash available for distribution was more than double the equivalent figure reported at the end of 2023.

Distributions mean dividends, and TXO’s last declaration, made on March 4, was for a payment of 61 cents per common share. The dividend was paid out on March 21, and the $2.44 annualized rate provided a yield of 14.5%. This last declaration marked the 8th consecutive quarter that TXO has paid out a common share dividend.

TXO has caught the attention of Stifel analyst Selman Akyol, who sees the solid capital return and low-cost business model as attractive attributes for the company.

“We believe TXO Partners offers investors an attractive investment opportunity given its return of capital framework, which is supported by low production decline rates, low leverage and manageable capex levels. Furthermore, we believe each basin TXO is in presents its own unique growth opportunity set. Finally, the management team is well experienced and has a track record of extracting incremental value out of assets, and applying its skill set to potential acquisition targets… TXO aims to payout 100% of its cash available for distribution, which currently is resulting in a 4Q annualized yield of 14.4%. While distributions are variable and directly impacted by commodity prices, we believe low production decline rates are supportive of a higher payout,” Akyol opined.

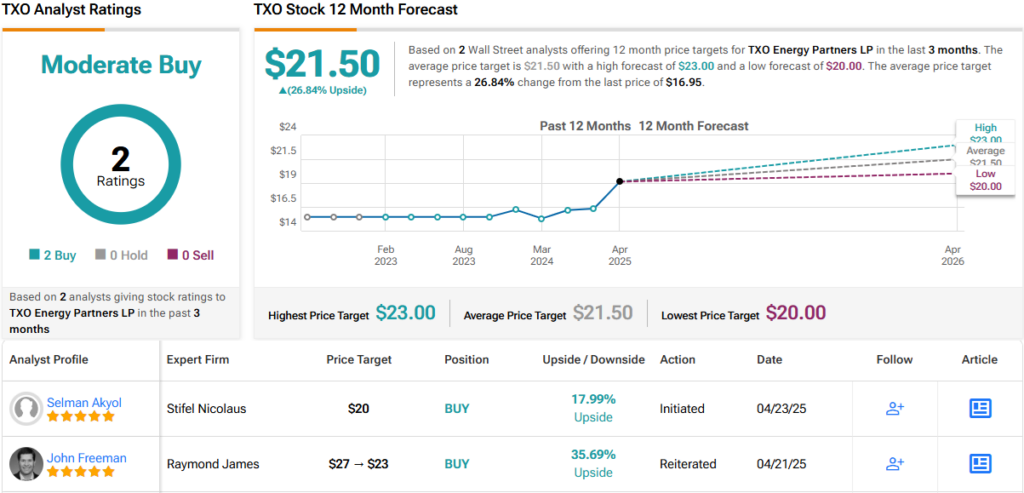

Akyol quantifies his stance on TXO with a Buy rating, and he gives the stock a $20 price target that suggests a gain of 18% on the one-year horizon. Add in the dividend yield, and this stock can bring a one-year return of 32.5%. (To watch Akyol’s track record, click here)

While there are only 2 recent reviews on record here, they are both positive – giving TXO a Moderate Buy consensus rating. The stock has a current selling price of $16.95, and its average target price of $21.50 implies a one-year upside potential of ~27%. (See TXO stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.