SolarEdge Technologies (SEDG) stock declined over 9% in the after-hours trading session on Wednesday. The downside can be attributed to weak second-quarter results due to ongoing softness in the retail solar market.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

SEDG provides smart energy solutions, such as solar inverters, power optimizers, and monitoring systems for solar installations.

SEDG: Q2 Highlights

The company reported an adjusted loss of $1.79 per share, against earnings of $2.62 per share in the prior-year quarter. Also, the loss surpassed the consensus estimates of a loss of $1.52 per share. Furthermore, the company’s revenue declined 73.2% year-over-year to $265.4 million but marginally beat the analysts’ expectations of $265.2 million.

SolarEdge’s disappointing performance is due to weak demand for its products and supply chain disruptions during the quarter. The company witnessed a drop of 64% and 80% in shipments of optimizers and inverters, respectively.

For the third quarter, the company expects revenues to be in the range of $260 million to $290 million. Also, adjusted expenses are expected in the range of $111 million to $116 million.

TD Cowen Analyst Remains Bullish

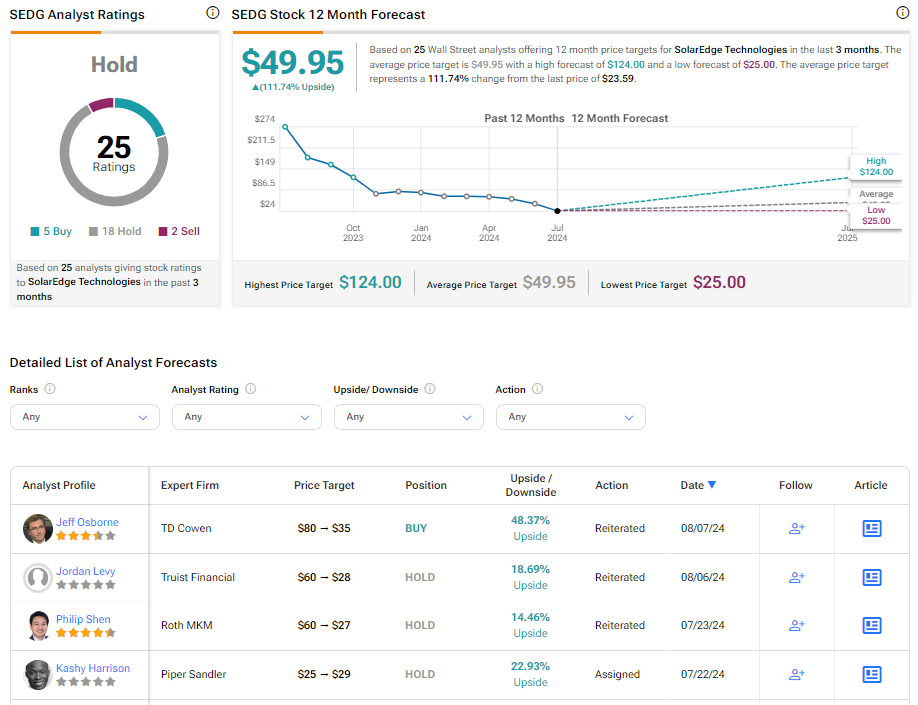

Despite the company’s weak Q2 report, TD Cowen analyst Jeff Osborne reiterated a Buy rating on SolarEdge stock. However, he slashed the price target to $35 (48.4% upside potential) from $80.

Osborne anticipates that channel inventory levels will normalize by the end of Q3, indicating a rise in demand. He also believes that SolarEdge’s emphasis on creating differentiated and cost-effective products may offer a competitive edge.

Importantly, the analyst has an average return of 55.03% and a success rate of 62% on SEDG (to watch Osborne’s track record, click here).

Is SEDG Stock a Good Buy?

On TipRanks, SolarEdge has a Hold consensus rating based on five Buy, 18 Hold, and two Sell ratings. The analysts’ average price target on SEDG stock of $49.95 implies a significant upside potential of 111.74%. Shares of the company have declined by 59% over the past three months.