The U.S. Securities and Exchange Commission (SEC) is poised to drop its lawsuit against Coinbase (COIN). This bullish news has caused COIN stock to soar during regular trading hours today. According to CoinDesk, the SEC’s commissioners are expected to vote on a deal negotiated with Coinbase that would permanently dismiss the case with prejudice, meaning the regulator won’t be able to revive the charges.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Coinbase’s Chief Legal Officer Paul Grewal didn’t mince words about the company’s victory, stating, “We win; they lose.” He added, “It’s a great day for Coinbase, yes, but it’s also a great day for crypto in America.”

A Major Blow to SEC’s Crypto Enforcement

This lawsuit had been at the heart of the SEC’s crackdown on digital assets. The regulator had accused Coinbase of operating an unregistered exchange and listing securities without approval—claims that Coinbase fiercely fought in court. The case had the potential to define whether cryptocurrencies fall under the SEC’s jurisdiction, but now, with the SEC backing down, that decision may shift to Congress.

The SEC’s retreat doesn’t just impact Coinbase. It signals a broader change in how the agency approaches crypto regulation. Grewal expressed hope that the decision would “offer up a template for other cases to be resolved as well.”

SEC’s Crypto Task Force Signals a Policy Shift

The timing of the SEC’s withdrawal aligns with a broader pivot. Just this week, the agency restructured its enforcement unit, expanding its focus beyond crypto to “emerging technologies.” The SEC also dropped its appeal over its attempt to classify more crypto activity under its regulatory umbrella.

Meanwhile, the agency’s new Crypto Task Force, led by Commissioner Hester Peirce, is expected to take a more lenient approach. According to CoinDesk, SEC Acting Chairman Mark Uyeda has been actively reshaping the agency’s stance on digital assets.

Congress Takes Center Stage in Crypto Regulation Fight

With legal battles winding down, Coinbase is turning its attention to Washington. Grewal emphasized that the next priority is clear crypto legislation, stating, “With this cloud now lifted, we can focus our full attention on getting legislation passed on market structure and stablecoins.”

Coinbase has been heavily involved in the political fight for crypto-friendly regulation, backing candidates through the Fairshake PAC, which spent tens of millions of dollars in the 2024 elections.

The SEC’s vote, expected in the coming days, will set the stage for what happens next. If the agency formally backs off, it will be hard to justify pursuing similar cases against other crypto firms. For an industry that has spent years in legal limbo, this could be the moment that finally shifts the conversation from the courtroom to Capitol Hill.

Is COIN Stock a Good Buy?

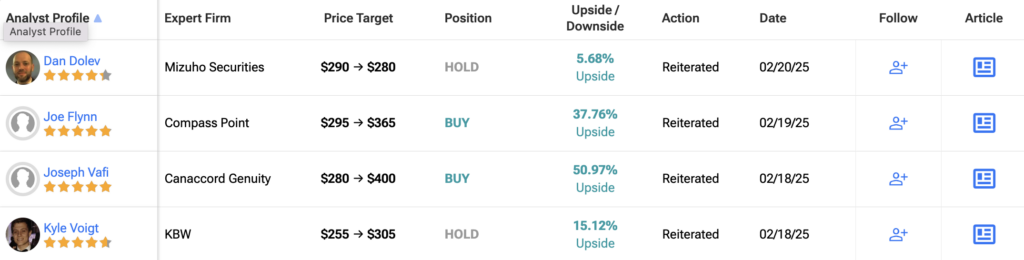

Analysts remain cautiously optimistic about COIN stock, with a Moderate Buy consensus rating based on 10 Buys and 11 Holds. Over the past year, COIN has increased by more than 60%, and the average COIN price target of $350.47 implies an upside potential of 32.3% from current levels. These analyst ratings are likely to change following the results of the SEC vote.