The Securities and Exchange Commission (SEC) has imposed fines totaling $3.8 million on 23 entities and individuals for not promptly disclosing key information, such as changes in beneficial ownership and insider stock sales. Some of the key companies involved in the settlement include tech giant Alphabet (GOOGL), investment banking firm Goldman Sachs (GS), and Canadian financial giant Bank of Nova Scotia (BNS).

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The charges stem from SEC efforts focused on Schedules 13D and 13G, which disclose the holdings and plans of investors owning over 5% of a public company’s stock. The investigation also covers Forms 3, 4, and 5, which report stock transactions by corporate insiders or investors holding more than 10%. These are mandatory requirements, irrespective of whether the trades were profitable or not.

It is worth mentioning that Alphabet was penalized $750,000 for failing to timely file 13F forms for its stakes in Duolingo (DUOL) and GitLab (GTLB). Also, Goldman Sachs and the Bank of Nova Scotia faced a penalty of $300,000 and $375,000, respectively.

With this background, let’s look at the Street’s recommendation for GOOGL and GS.

Is Google a Good Stock to Buy?

Turning to Wall Street, GOOGL has a Strong Buy consensus rating based on 28 Buys and nine Holds assigned in the last three months. At $201.44, the average Alphabet price target implies 24.7% upside potential. Shares of the company have gained 7.5% in the past six months.

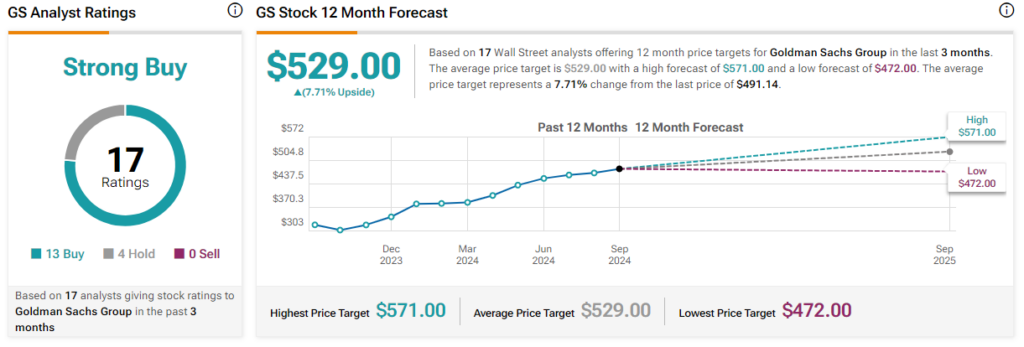

Is GS a Buy Right Now?

Overall, GS has a Strong Buy consensus rating based on 13 Buys and four Holds assigned in the last three months. At $529, the average Goldman Sachs stock price target implies 7.71% upside potential. Shares of the company have gained over 22.4% in the past six months.