The U.S. Securities and Exchange Commission (SEC) has delayed its decision on a proposed spot Litecoin (LTC) exchange-traded fund (ETF).

Canary Capital has applied to launch an ETF that would track the spot price of Litecoin, a leading cryptocurrency and one of the larger “altcoins” that are any crypto other than Bitcoin (BTC). The Wall Street regulator’s delay of the Litecoin ETF comes after the agency also delayed several other applications for spot crypto ETFs, including ones proposed for XRP (XRP) and Dogecoin (DOGE).

Crypto enthusiasts had high hopes that the Litecoin ETF from Canary Capital would get the greenlight from the SEC. But now, the securities regulator has announced a delay in its decision and taken the added step of opening a public comment period related to the Litecoin ETF. “The Commission seeks comment on any new or novel concerns not previously contemplated by the Commission,” wrote the SEC.

New Crypto ETFs

Litecoin currently has a $6.6 billion market capitalization and is a cryptocurrency that runs on an open source blockchain whose code is copied directly from Bitcoin. Canary Capital applied for the Litecoin ETF last October. Asset managers are eagerly awaiting decisions on a new crop of crypto ETFs under SEC Chair Paul Atkins, who took the helm of the regulator in April of this year.

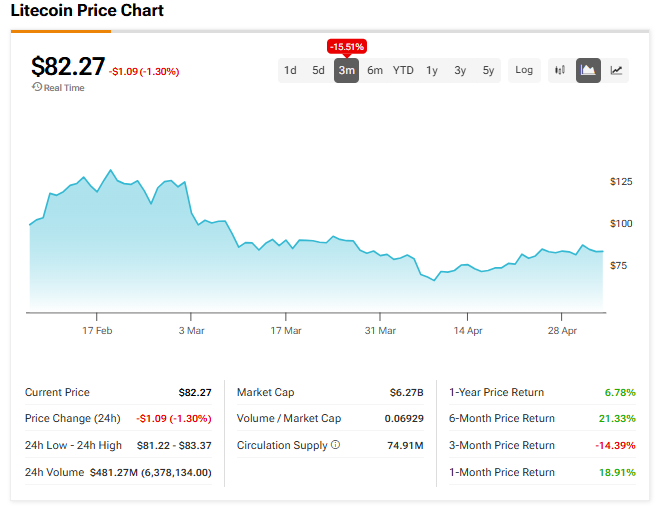

Crypto bulls have been calling for new ETFs that track the spot price of various cryptocurrencies such as XRP, DOGE, LTC, and Solana (SOL). There haven’t been any new crypto ETFs approved since spot Bitcoin and Ethereum (ETH) ones were given the greenlight in the first half of 2024. LTC has declined 21% this year.

Is LTC a Buy?

Most Wall Street analysts don’t provide price targets on Litecoin, so we’ll look at the cryptocurrency’s three-month performance instead. As one can see in the chart below, the price of LTC has declined 16% over the last 12 weeks.