As the digital age has become ever more pervasive, securing digital data has become a high-priority challenge. In that regard, SEALSQ (LAES) is making the most of this unique market opportunity by developing quantum-ready security solutions. The company’s focus on improving semiconductor security for current-generation IoT devices and applications, post-quantum cryptography, and managed public key infrastructure suggests a promising future in the rapidly growing IoT and quantum cryptography markets.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

In this developing landscape, the U.S. FCC introduced the Cyber Trust Mark, which mandates IoT device manufacturers integrate secure identities, implement encryption, and use Public Key Infrastructure (PKI) by mid-2025. In Europe, the Cyber Resilience Act, expected to be in force by 2025, requires devices to have intrinsic security, such as secure boot mechanisms and regular software updates.

The UK’s PSTI Act enforces similar regulations from 2024, including mandatory vulnerability disclosure policies. Meanwhile, Singapore’s Cybersecurity Labelling Scheme, operational since 2020, was enhanced in 2023 to necessitate advanced security features.

SEALSQ’s new chips, slated to launch in 2025, have been designed to run the latest National Institute of Standards and Technology (NIST) approved post-quantum encryption standards, a feat traditional chips aren’t inherently optimized for. The stock has climbed 53% in the past week, causing volatility-induced trading halts. It is a high-risk, high-reward lotto-ticket opportunity for investors looking to speculate on the future of quantum computing-related developments.

Building for Post-Quantum Computing

SEALSQ creates hardware and software solutions, public key infrastructure (PKI), and provisioning services. The company has focused on developing cutting-edge quantum-resistant cryptography and semiconductors to address the security threats posed by quantum computing for sensitive data in various sectors, such as healthcare, defense, and automotive.

The company recently announced two new post-quantum chips – the QS7001 Open Platform and the QVault Trusted Platform Module (TPM), with a full launch expected in 2025. The QS7001 has achieved an EAL5+ certification, indicating high-level security against traditional and quantum threats. The launch is expected to significantly impact the company’s market presence and financial growth.

SEALSQ has also announced a landmark strategic partnership with Hedera and the launch of the SEALQUANTUM.com Lab, a state-of-the-art research and innovation hub. The collaboration aims to develop and deliver next-generation quantum-resistant semiconductors and other cutting-edge security solutions for protecting critical infrastructures in the emerging post-quantum world.

Furthermore, SEALSQ has raised $60 million by issuing 13,157,896 ordinary shares to institutional investors. The proceeds will fund the development of next-generation post-quantum semiconductors and ASIC capabilities in the United States, support working capital, and general corporate objectives.

Lackluster Recent Financial Results

For H1 2024, the company reported a significantly reduced gross profit margin from 52% to 19%, mainly attributable to high inventory costs and lower parts shipments. However, the company views the decline as temporary and expects to rebound as customers order new products.

Meanwhile, R&D expenses increased by roughly $1 million, representing the most significant part of the operating expenses at 24% of the total.

The reduction in gross profit and increased R&D and G&A expenses led to an overall increase in operating loss. For H1 2024, net loss was $10.8 million compared to a net loss of $0.9 million for the six months ended June 30, 2023.

From Potential Delisting to Investor Delight

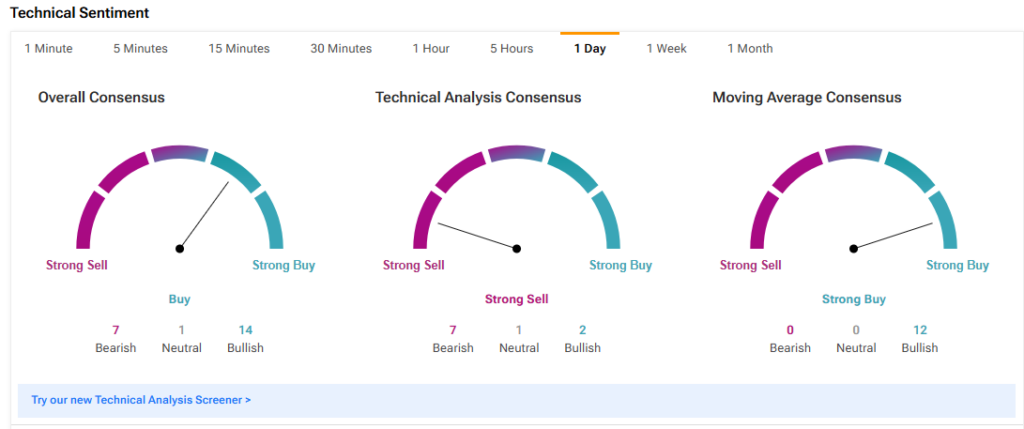

The stock has been on a rollercoaster ride this year, cascading down from $3.55 a share to $0.29 (and a possible delisting from the NASDAQ) to an explosive 2000% rebound up to $11 a share. It trades near the top of its 52-week price range and shows ongoing positive price momentum as it trades above the major moving averages.

Takeaway

With regulatory bodies worldwide introducing stringent cybersecurity standards and the rise of quantum computing presenting unprecedented security challenges, SEALSQ anticipates an upswing in demand. The company’s focus on semiconductor security positions it well in the burgeoning IoT and quantum cryptography markets. Despite the recent surge in share price, SEALSQ remains a high-risk, high-reward opportunity for investors with a speculative edge.