Singapore-based consumer internet company Sea Ltd. (NYSE:SE) fell in trading today after the company reported its third-quarter results. The company’s Q3 losses narrowed to -$0.26 per share compared to -$1.10 per share in the same period last year. However, analysts were expecting earnings of $0.12 per share, meaning that today’s result was a huge miss.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Nonetheless, revenue was a bright spot, as it increased 4.9% year-over-year to $3.3 billion, above the consensus estimate of $3.17 billion.

Forrest Li, Sea’s Chairman and CEO, commented, “In this current period, we will prioritize investing in the business to increase our market share and further strengthen our market leadership.”

What is the Future Price of SE Stock?

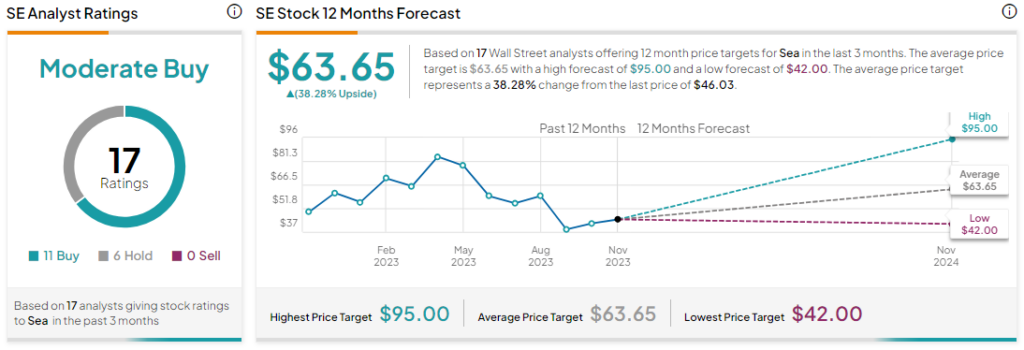

Turning to Wall Street, analysts have a Moderate Buy consensus rating on SE stock based on 11 Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 17% drop in its share price today, the average SE price target of $63.65 per share implies an upside potential of 38.3%.