Shares of consumer internet and mobile platform company Sea Ltd. (NYSE:SE) are on the rise today after its first-quarter top line rose by double digits and credit losses narrowed.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Sea’s Q1 revenue soared by 22.7% year-over-year to $3.73 billion, outpacing estimates by $90 million. Its net loss per share of $0.04, however, lagged expectations by $0.27.

A Sea of Growth

The quarter was marked by gains across Sea’s user metrics and a promising profit profile. Shopee, the company’s e-commerce unit, clocked its best-ever quarter for orders, GMV (gross merchandise value), and revenue. In Q1, eCommerce revenue surged by 32.9% year-over-year to $2.7 billion on the back of robust gains in core marketplace revenue and value-added services revenue. The unit’s gross orders rose by nearly 57% to 2.6 billion during this period.

Furthermore, revenue from the Digital Financial Services vertical popped by 21% to $499.4 million. While revenue from the Digital Entertainment vertical dropped to $458.1 million from $539.7 million in the year-ago period, the unit experienced a nearly 39% rise in paying users. Average bookings per user, however, moderated to $0.86 from $0.94 a year ago.

Importantly, Sea’s provision for credit losses declined by 8.8% to $161.77 million. Still, higher operating expenses resulted in a negative bottom line for the company.

What Is the Price Prediction for SE Stock?

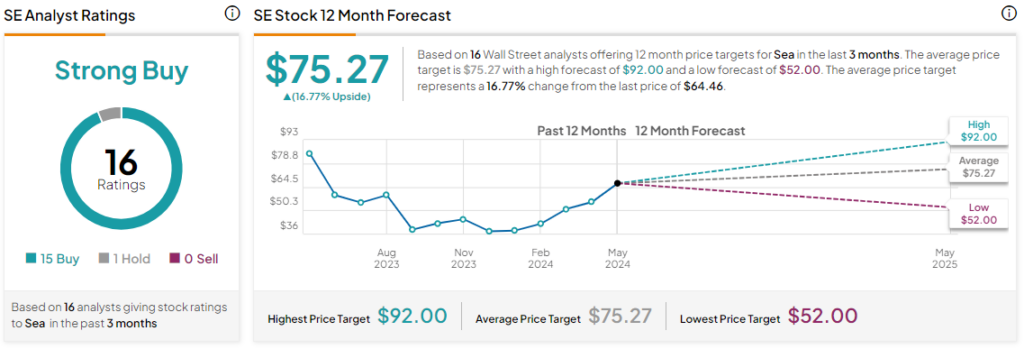

Sea’s share price has rallied by nearly 80% over the past six months. Overall, the Street has a Strong Buy consensus rating on the stock, alongside an average SE price target of $75.27. However, analysts’ views on the company could see changes following today’s earnings report.

Read full Disclosure