Healthcare stocks like pharmaceutical makers often benefit from the release of a solid earnings report. A good report about a flagship drug line seldom hurts either. Both at once is even better, as recently discovered by scPharmaceuticals (NASDAQ:SCPH), who had both strokes of positive development hit right around the same time. It was enough to catch investors’ attention, who got together to send the stock up over 22% in Thursday afternoon’s trading.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The scPharmaceuticals earnings report was the big winner, without question. Though it turned in a loss of $0.30 per share—that was enough to count as a win. Analysts were looking for a loss of $0.39 per share. Further, scPharmaceuticals also posted a loss for Fiscal Year 2022, coming in at -$36.8 million. That was a big jump from 2021, when only $28 million was lost. However, given that, once again, scPharmaceuticals managed to beat the spread, it was still good enough for a win. in addition, the guidance range scPharmaceuticals posted was between $38 million and $41 million.

Further gains came when John Tucker, scPharmaceuticals’ CEO, offered up some notes on furoscix. For those not familiar, furoscix is a treatment for chronic heart failure caused by heart congestion. That’s great news by itself, but it got better: furoscix can be used wholly at home, which will be welcome news for hospitals eager to save bed space. Tucker also pointed out that furoscix, when timed properly—ahead of hospital admission or after being discharged—can deliver positive results in healing.

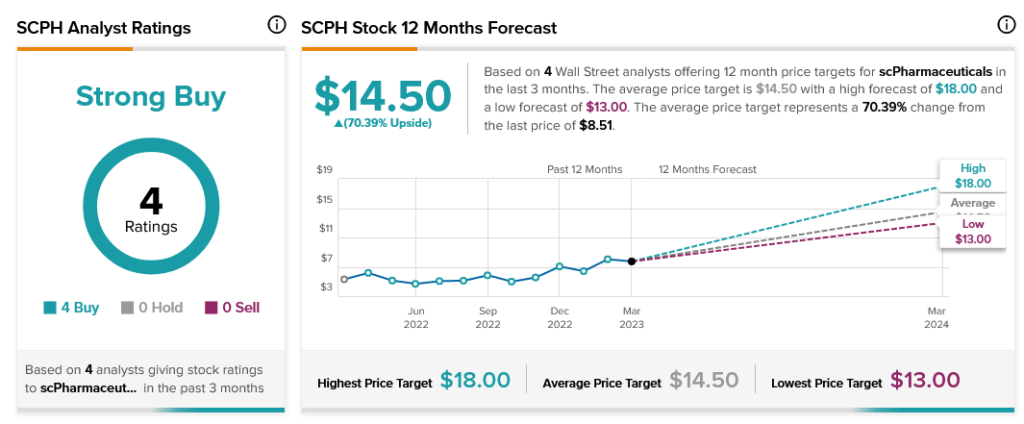

Analysts, meanwhile, are just as upbeat. They’re unanimous in calling scPharmaceuticals a Strong Buy. Better yet, scPharmaceuticals stock’s average price target of $14.50 gives it 70.39% upside potential.