Shares in biopharma company Scholar Rock (SRRK) strengthened today despite its drug aimed at helping people retain muscle while losing weight failing to get approval from U.S. regulators.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Manufacturing Woes

The U.S. Food and Drug Administration pointed to issues at a third-party manufacturing facility for its decision not to give the green light to apitegromab, which Scholar hoped would treat conditions such as spinal muscular atrophy and muscle preservation in obesity.

Scholar Rock had been banking on apitegromab to drive its growth, profitability and boost its flagging share price – see below. If it does eventually get approval it could bring in nearly $2 billion in revenues by the early 2030s.

The U.S. Food and Drug Administration’s so-called complete response letter is related to issues identified during a routine inspection of Catalent’s Indiana fill-finish facility, which was acquired by Novo Nordisk (NVO). The agency’s observations were not specific to the drug, it added.

Future Hope

Regeneron’s (REGN) drugs have also lately been impacted by delays and rejections, following the agency’s site inspections at the facility.

Scholar Rock said it will resubmit its application seeking marketing approval for apitegromab, after Catalent fixes the issues raised by the FDA.

At least three analysts said they do not expect the latest development to affect the probability of approval for the drug.

“With some expecting an on-time approval and no specific date for a planned resolution noted, some investors may react more negatively to uncertainty,” said BMO Capital Markets analyst Evan Seigerman, who expects the issue to be resolved in under three months.

Spinal muscular atrophy is the leading genetic cause of infant deaths and affects about 1 in 10,000 people, according to U.S. government data. It prevents the body from producing a protein necessary for neuromuscular development and leaves children too weak to walk, talk and swallow.

When it comes to obesity, Scholar Rock is one of a number of companies trying to help people, many using weight-loss drugs, to retain muscle while losing pounds.

Is SRRK a Good Stock to Buy Now?

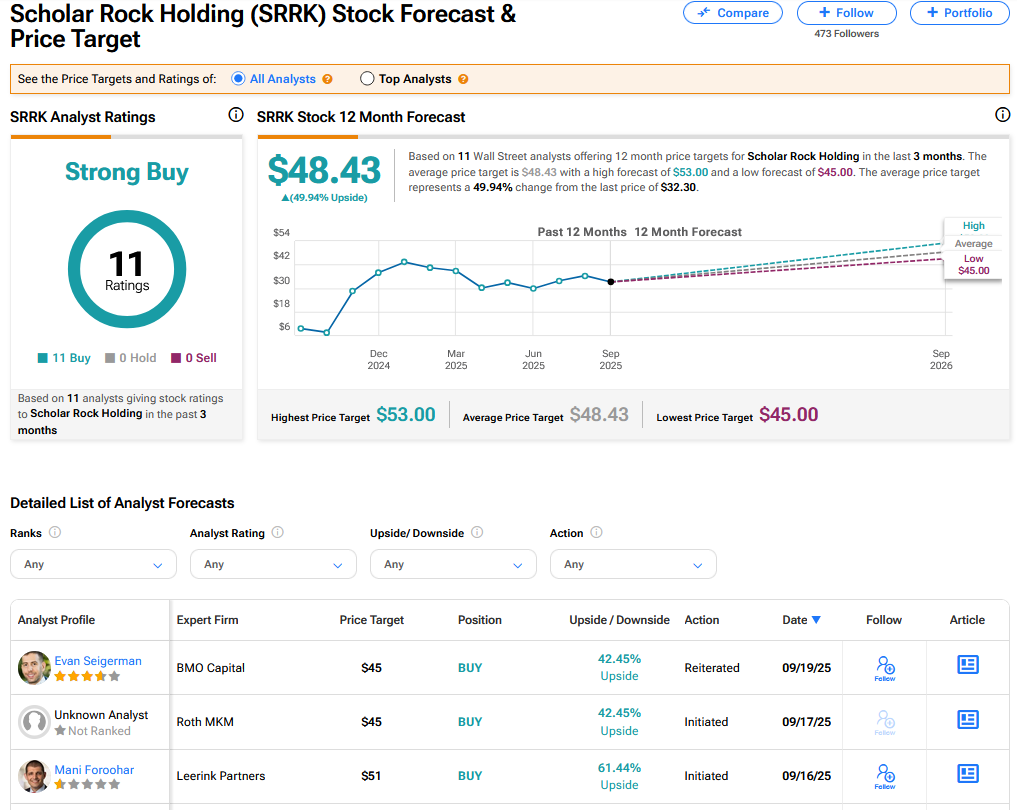

On TipRanks, SRRK has a Strong Buy consensus based on 11 Buy ratings. Its highest price target is $53. SRRK stock’s consensus price target is $48.43, implying a 49.94% upside.