Scholar Rock Holding (SRRK) has shown a staggering 335% jump in share price following the success of its spinal muscular atrophy (SMA) treatment drug, Apitegromab, in a phase 3 trial. The treatment achieved a statistically significant improvement in motor function, far outperforming the placebo group over 52 weeks. This marks the first treatment explicitly targeting muscle fiber atrophy in SMA and potentially alters the standard of care in a market that is anticipated to reach a hefty $13 billion by 2034.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company plans to submit regulatory applications for the drug to the U.S. and European Medicines Agency in Q1 2025, a potential further catalyst for the stock. Investors may find this surging biotech stock an intriguing option with growth potential.

Scholar Rock Announces Successful Phase 3 Trial Results

Scholar Rock is a clinical-stage biopharmaceutical company specializing in severe diseases with insufficient current treatments. Known for its work with the transforming growth factor beta (TGFβ) superfamily of cell proteins, Scholar Rock has established a robust pipeline of growth factor-targeted drugs.

The company has exhibited clinical success with a muscle-targeted treatment for spinal muscular atrophy (SMA), Apitegromab. It recently announced positive results from the Phase 3 SAPPHIRE clinical trial, which met its primary endpoint, confirming a statistically significant and clinically meaningful improvement in motor function in SMA patients treated with the drug compared to a placebo. The safety and efficacy profile of the treatment was consistent across age groups, and no new safety issues were observed during the trial.

Based on these promising results, Scholar Rock will submit applications to the FDA and the EMA in the first quarter of 2025. Furthermore, the company initiated an underwritten public offering of $275 million of shares of its common stock to support commercialization efforts for Apitegromab, among other operational needs.

Scholar Rock’s Recent Financial Results

Scholar Rock has reported its second-quarter results for 2024. The company did not generate any revenue for the quarter. However, compared to the same period last year, there was a noticeable increase in the net loss, from $37.9 million in Q2 2023 to $58.5 million. Both research and development and general and administrative expenses have increased from $26.9 million to $42.4 million and from $12.2 million to $17.1 million, respectively, primarily due to clinical trial costs, employee compensation, and other employee-related costs. Earnings per share (EPS) of -$0.60 missed analysts’ expectations by $0.01.

At the quarter’s end, the company reported a healthy balance of approximately $190.5 million in cash, cash equivalents, and marketable securities. This reserve is anticipated to cover the company’s operating and capital requirements through the second half of 2025.

Is SRRK Stock a Buy?

The stock is no stranger to extreme behavior, having spiked to over $66 a share several years ago, but it has been mainly range-bound for the past few years. With the most recent price jump, it trades at the top of its 52-week price range and shows positive price momentum, trading above its 20-day (8.69) and 50-day (8.95) moving averages.

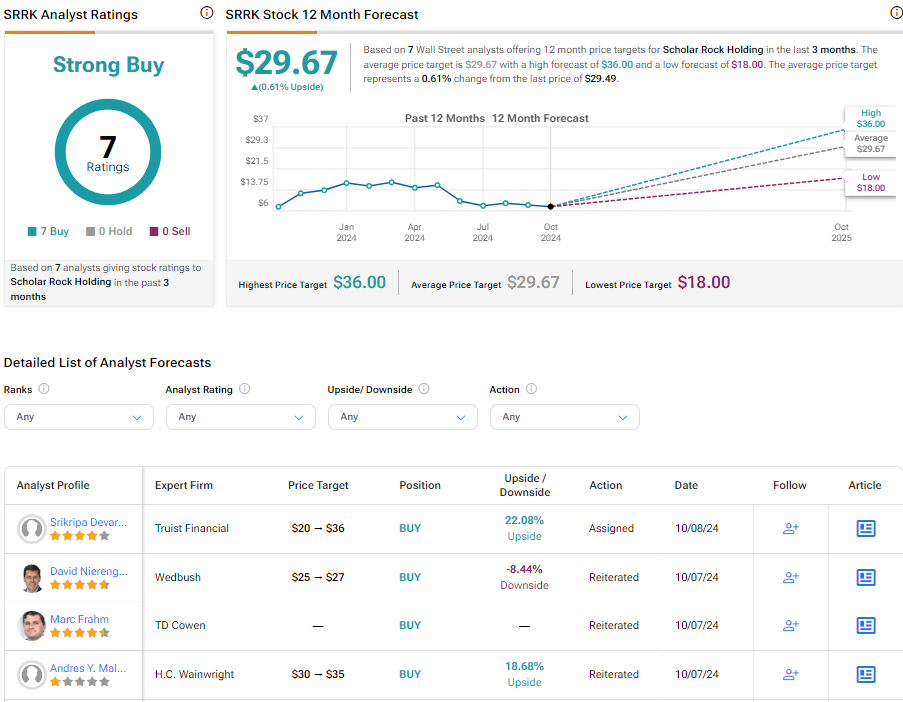

Analysts covering the company have been bullish on SRRK stock. For example, Wedbush analyst David Nierengarten reiterated an outperforming rating on the stock and raised the price target from $27 to $37 following the release of Phase 3 trial data. He noted likely regulatory approval, leading to an upward revision of the firm’s sales estimates and multiple opportunities for shares to appreciate further.

Scholar Rock Holding is rated a Strong Buy based on the cumulative recommendations of five analysts. The average price target for SRRK stock is $29.67, representing a potential 0.61% change from current levels.

SRRK in Summary

Scholar Rock has recently announced success in a phase 3 trial, sparking a remarkable surge in the company’s share price. The company plans to introduce regulatory applications to the U.S. and European Medicines Agency in Q1 2025 – a move that could catalyze further growth. The company has also initiated a public offering for $275 million of its common stock, demonstrating its commitment to commercializing this novel treatment. This positive momentum presents a compelling opportunity for investors to capitalize on a potentially breakthrough treatment in a sizable market.