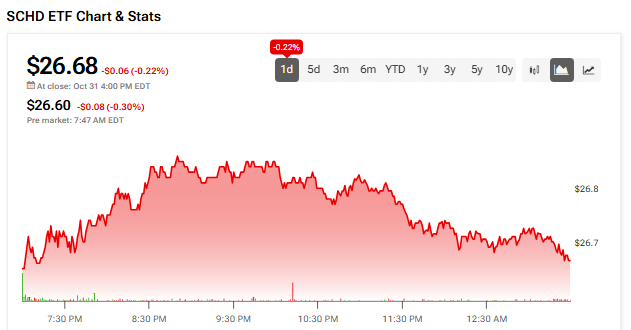

How is SCHD stock faring? The Schwab U.S. Dividend Equity ETF (SCHD) is down 0.30% in pre-market trading today. The ETF also slipped on Thursday, falling 0.22% to $26.68, as investors pulled back from dividend-heavy funds and shifted toward growth and tech stocks.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Meanwhile, the SCHD is down 1.39% in the past five days, but up 0.45% year-to-date.

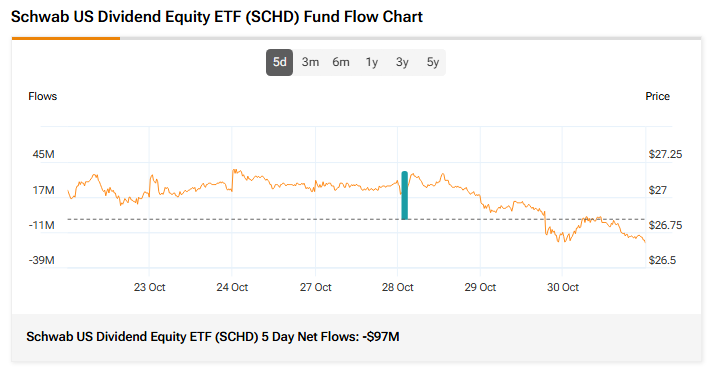

Fund Flows and Sentiment

The SCHD ETF tracks the performance of high-dividend U.S. stocks from the Dow Jones U.S. Dividend 100 Index. According to TipRanks data, SCHD recorded 5-day net flows of about -$97 million, indicating that over the last five trading days, investors withdrew more money from the SCHD ETF than they added.

SCHD’s Price Forecasts and Holdings

According to TipRanks’ unique ETF analyst consensus, determined based on a weighted average of analyst ratings on its holdings, SCHD is a Moderate Buy. The Street’s average price target of $30.46 implies an upside of 14.17%.

Currently, SCHD’s five holdings with the highest upside potential are Coterra Energy (CTRA), FMC Corp. (FMC), AMERISAFE, Inc. (AMSF), Kforce (KFRC), and Inter Parfums (IPAR).

Meanwhile, its five holdings with the greatest downside potential are Murphy Oil Corp. (MUR), Best Buy Co. (BBY), Carter’s (CRI), Western Union (WU), and Ford Motor (F).

Revealingly, SCHD ETF’s Smart Score is seven, implying that this ETF will likely perform in line with the market.

Power up your ETF investing with TipRanks. Discover the Top Equity ETFs with High Upside Potential, carefully curated based on TipRanks’ analysis.