Investors looking for dividend-paying stocks can consider Star Bulk Carriers (NASDAQ:SBLK) and Ellington Financial (NYSE:EFC). Both of these stocks offer a consistent income stream along with the opportunity for long-term capital growth. These stocks offer a dividend yield of more than 5% and have received Strong Buy recommendations from Wall Street analysts. Further, their 12-month price targets reflect a solid upside potential of more than 15%.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Let’s take a closer look at these stocks.

Is SBLK a Good Dividend Stock?

Star Bulk Carriers is a dry bulk shipping company that transports essential commodities like iron ore, coal, and grain across international waterways. The stock has a dividend yield of 6.61%, far more than the industrial goods sector’s average of 1.64%.

Rising shipping rates due to several factors, like geopolitical tensions and a limited supply of new vessels, could result in higher revenue for SBLK. Furthermore, the company’s strong capital position keeps it well-positioned to pursue strategic expansion.

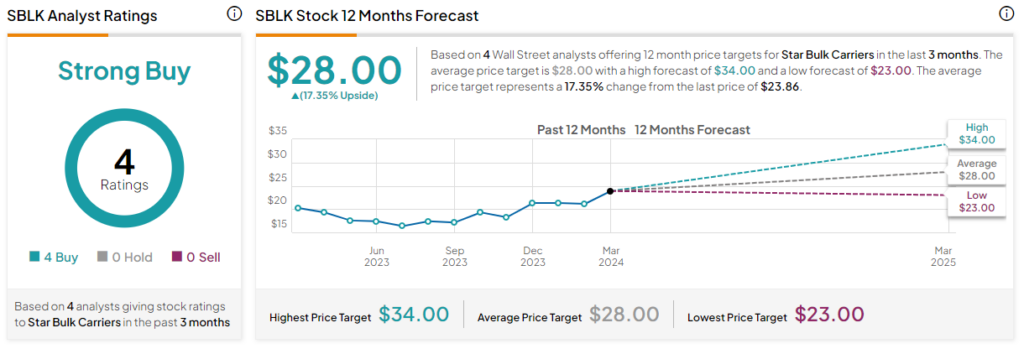

SBLK has received four Buy recommendations for a Strong Buy consensus rating. Further, analysts’ average price target on SBLK stock of $28 implies a 17.35% upside potential. The stock has gained 23.8% over the past six months.

On a positive note, Star Bulk stock has a maximum Smart Score of “Perfect 10” on TipRanks. Note that shares with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.

Is EFC a Good Stock to Buy?

Ellington is a specialty finance company that acquires and manages mortgage-related and other financial assets. Notably, the stock has a dividend yield of 15.36%, compared with 3.91% for the real estate sector.

EFC remains well poised to benefit from the improvement in the housing market, expected later this year. The company’s diversified platform and the presence of in-house origination capabilities position it well to drive growth.

Overall, Ellington’s Strong Buy consensus rating is backed up by five Buy ratings. The analysts’ average price target of $13.94 points to a 25.25% potential upside in the next 12 months. EFC stock is up 21.5% over the past year. Also, it boasts a Smart Score of “Perfect 10.”

Concluding Thoughts

SBLK and EFC are worth considering by income-focused investors because of their strong fundamentals and high dividend yields. Furthermore, the backing of analysts and the “Perfect 10” Smart Score point to their upside potential.