A class action lawsuit was filed against Cassava Sciences Inc. (SAVA) by Levi & Korsinsky on December 12, 2024. The plaintiffs (shareholders) alleged that they bought SAVA stock at artificially inflated prices between February 7, 2024 and November 24, 2024 (Class Period) and are now seeking compensation for their financial losses. Investors who bought Cassava Sciences stock during that period can click here to learn about joining the lawsuit.

Cassava Sciences is a clinical-stage biopharmaceutical company that focuses on developing novel therapies for neurodegenerative conditions such as Alzheimer’s disease (AD).

The company’s tall claims about the potential efficacy of its lead drug candidate, simufilam, in the treatment of AD are at the heart of the current complaint.

Cassava Sciences’ Misleading Claims

According to the lawsuit, Cassava Sciences and two of its senior officers and/or directors (Individual Defendants) repeatedly made false and misleading public statements throughout the Class Period. Particularly, they are accused of omitting truthful information about the potential efficacy of simufilam from SEC filings and related material.

For instance, during the Class Period, the defendants consistently reiterated their belief in simufilam and its potential to fight Alzheimer’s disease. The company stated favorable top-line results from the Phase II study designed to investigate the safety of simulfilam as a treatment for Alzheimer’s disease dementia.

Additionally, the company said that several patients (over 655 patients out of the 735 completed participants) who had completed treatment in the Phase 3 study had opted to enter the open-label extension study.

Unfortunately, in June 2024, Cassava Science’s former science advisor Mr. Wang was handed a federal indictment, but the company stated that Mr. Wang was not involved in Phase 3 clinical trials of simufilam.

This was followed by the resignation of its then-president and CEO and the appointment of an Executive Chairman and principal executive officer in July 2024. The company was set on a mission to search a new permanent CEO who would help Cassava lead from a clinical-stage company to a commercial stage company.

However, subsequent events (discussed below) revealed that Cassava Sciences and the defendants wilfully misled investors about the potential efficiency of simufilam in treating Alzheimer’s disease.

Plaintiffs’ Arguments

The plaintiffs maintain that the Defendants deceived investors by lying and withholding critical information about the company’s business and prospects during the Class Period. Importantly, the Defendants are accused of misleading investors about the expected efficacy and commercial benefits of its lead drug candidate, simufilam.

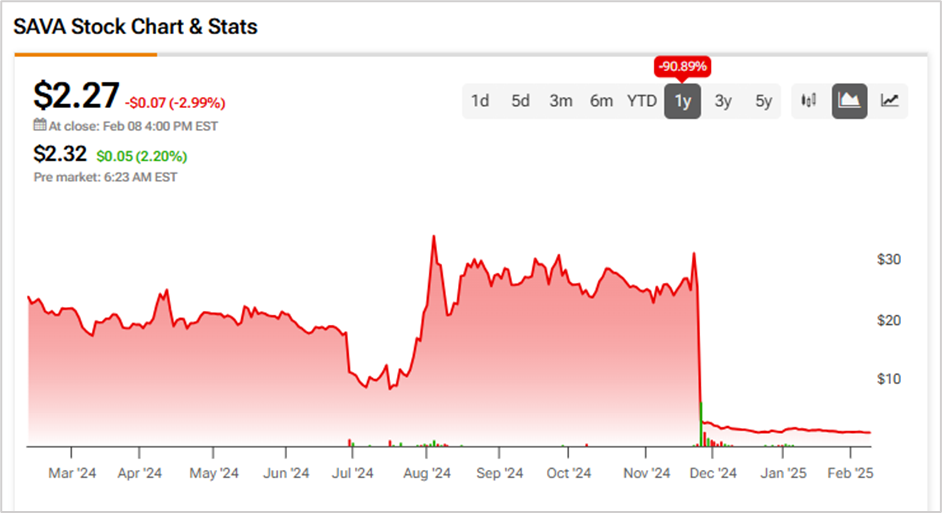

The information became clear on November 25, 2024, when the company released topline results for the first of its two ongoing Phase 3 studies on simufilam, called the ReThink-ALZ study. Unfortunately, the drug failed to meet the desired pre-specified primary, secondary, and exploratory endpoints of simufilam. In fact, simufilam failed to outperform the placebo during the studies, leading to huge investor disappointment. Following the news, SAVA stock collapsed by 83.8% on November 25.

To conclude, the defendants allegedly misled investors about the effectiveness of its simufilam drug in the treatment of Alzheimer’s disease. Owing to these issues, SAVA stock has plunged nearly 91% in the past year, causing significant damage to shareholder returns.